Please use a PC Browser to access Register-Tadawul

How MSC Industrial Direct's (MSM) Leadership Transition and Q4 Results May Shape Its Outlook

MSC Industrial Direct Co., Inc. Class A MSM | 86.74 | +0.16% |

- MSC Industrial Direct announced that CEO Erik Gershwind will step down at the end of 2025 as part of a planned succession, with President and COO Martina McIsaac set to become the new CEO, while Gershwind remains involved as Non-Executive Vice Chair after his resignation takes effect.

- Coinciding with the leadership transition, MSC Industrial Direct reported fourth-quarter results showing modest year-over-year growth in both sales and net income, reflecting continued operational stability during this period of management change.

- Given the internal promotion of Martina McIsaac to CEO, we'll examine what this means for continuity and near-term priorities within MSC's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MSC Industrial Direct Investment Narrative Recap

To be a shareholder in MSC Industrial Direct, you need to believe in the long-term growth potential of industrial supply distribution, particularly the value of MSC’s digital and in-plant initiatives to drive future sales, even if current demand remains subdued. The recent CEO transition appears to be well planned, with Martina McIsaac’s internal promotion ensuring leadership continuity; this is unlikely to materially affect the company’s most important short-term catalyst, which remains improved demand and margins, but persistent soft macro conditions still pose the biggest risk.

The company’s recent fourth-quarter results, which showed both sales and net income edging up year over year despite the management change, are especially relevant here. This performance reinforces MSC’s operational consistency and suggests that, for now, the leadership transition is not disrupting the business’s ability to address its core growth priorities.

By contrast, investors should be aware that soft demand conditions and a 4.7 percent decline in average daily sales year-over-year may still...

MSC Industrial Direct's narrative projects $4.3 billion revenue and $293.5 million earnings by 2028. This requires 4.5% yearly revenue growth and a $95 million earnings increase from $198.5 million today.

Uncover how MSC Industrial Direct's forecasts yield a $88.50 fair value, in line with its current price.

Exploring Other Perspectives

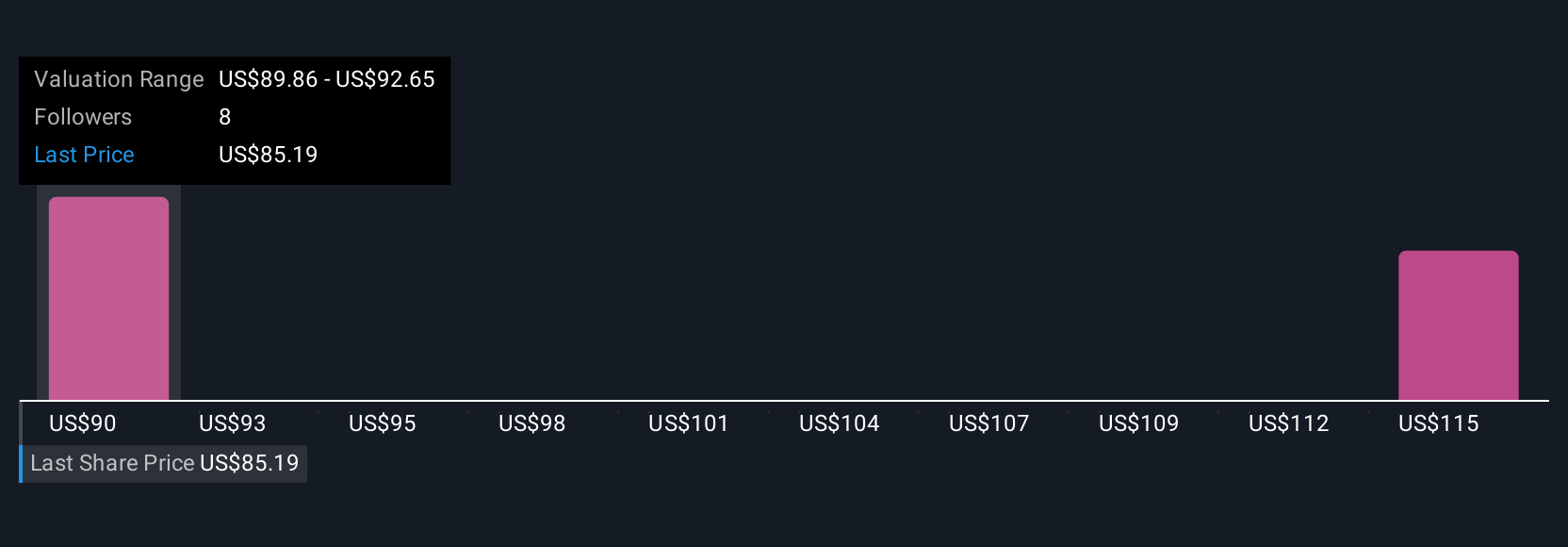

Two independent fair value estimates from the Simply Wall St Community range from US$88.50 to US$110.86 per share. With soft demand still a risk to near-term growth, exploring these varied perspectives can be valuable if you want a fuller view of MSC’s potential.

Explore 2 other fair value estimates on MSC Industrial Direct - why the stock might be worth just $88.50!

Build Your Own MSC Industrial Direct Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSC Industrial Direct research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MSC Industrial Direct research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSC Industrial Direct's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.