Please use a PC Browser to access Register-Tadawul

How N-able’s (NABL) Ransomware Defense Success Could Shape Its Long-Term Growth Outlook

N-able Inc Ordinary Shares NABL | 7.62 | +0.79% |

- On October 16, 2025, CRS Technology Consultants announced they had used N-able’s cyber resiliency solutions to stop a major ransomware attack on a regional CPA firm just days before critical federal tax deadlines, resulting in no ransom payout, no data loss, and preserved client trust.

- This incident highlighted how N-able’s combination of unified endpoint management, behavioral AI, and cloud backup can enable rapid response and business continuity even during potentially crippling cyberattacks.

- We’ll explore how this real-world validation of N-able’s cyber resilience platform could impact the company’s long-term growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

N-able Investment Narrative Recap

To own N-able stock, investors need to believe in the company's ability to position its cyber resilience platform as a mission-critical solution for managed service providers and IT partners. The recent successful defense against a ransomware attack could help reinforce N-able's value proposition and maintain strong customer retention, a short-term catalyst, but does not materially change key risks, such as industry consolidation and margin pressure from intensified competition and automation.

Of N-able’s recent announcements, the September launch of Anomaly Detection as a Service (ADaaS) is especially relevant: this technology aims to further protect client data from backup compromises, directly addressing the evolving threat environment that underpins both customer retention and product upsell opportunities. ADaaS also complements the company's focus on integrated cloud and security features, which remains a central catalyst for growth in a sector facing increased regulatory and competitive headwinds.

However, even as successful incident response strengthens N-able’s reputation, investors should be mindful that increasing vertical integration among large cloud providers can...

N-able's outlook anticipates $620.4 million in revenue and $15.9 million in earnings by 2028. This is based on an expected 8.7% annual revenue growth and a $13 million increase in earnings from the current $2.9 million.

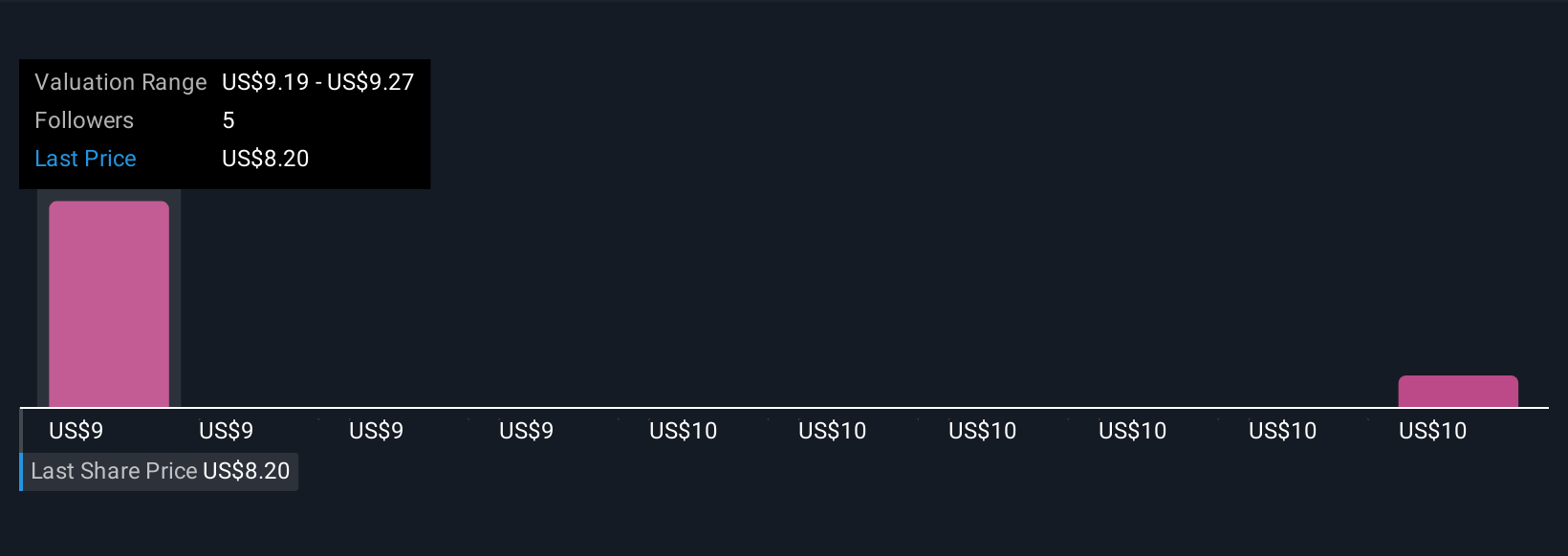

Uncover how N-able's forecasts yield a $9.19 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community have set N-able’s fair value between US$9.19 and US$9.76 per share, with two distinct analyses in this range. While many see the company as undervalued, industry consolidation and direct entry by large cloud providers may limit future growth, so consider the range of community perspectives before making up your mind.

Explore 2 other fair value estimates on N-able - why the stock might be worth as much as 28% more than the current price!

Build Your Own N-able Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your N-able research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free N-able research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate N-able's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.