Please use a PC Browser to access Register-Tadawul

How NOV’s Q4 Loss, Buybacks, and Tighter M&A Strategy May Reshape NOV (NOV) Investors

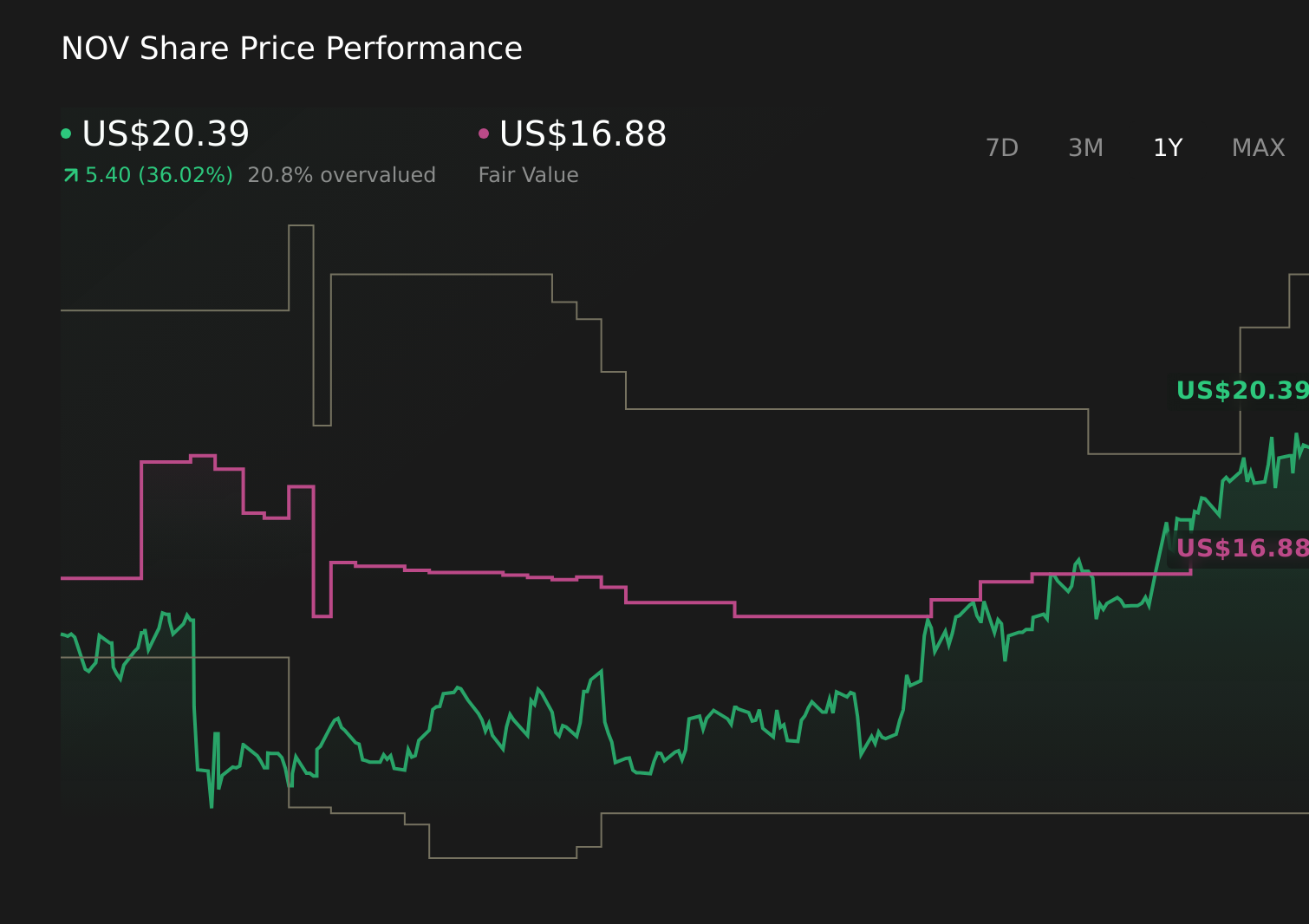

NOV Inc. NOV | 20.39 20.39 | +0.74% 0.00% Post |

- NOV Inc. recently reported fourth-quarter 2025 results showing revenue of US$2,277 million and a net loss of US$78 million, alongside guidance for a 1% to 3% year-over-year revenue decline in the first quarter of 2026.

- Despite weaker earnings, NOV has tightened its acquisition criteria, completed a share buyback of 36,959,834 shares for US$544.64 million, and signaled interest in targeted M&A aligned with its core businesses.

- Next, we’ll examine how NOV’s stricter acquisition approach and cautious revenue outlook shape the company’s broader investment narrative.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

What Is NOV's Investment Narrative?

For NOV, the core investment belief now hinges on the company’s ability to convert its large installed base, technology portfolio and global reach into steadier, higher quality earnings, even when end markets are soft. The latest quarter complicates that story: a US$78 million loss, weaker full year profitability and guidance for a 1% to 3% revenue decline in early 2026 put near term earnings momentum under pressure and amplify the risk around its already high price to earnings multiple and low returns on equity. At the same time, the completion of a roughly 10% share buyback and a much tighter M&A filter point to a more disciplined capital allocation playbook under the new CEO. Short term, the earnings miss and cautious outlook look material for sentiment, while the stricter acquisition criteria could reduce the risk of value destructive deals but may also slow any inorganic growth catalysts that some investors had been counting on.

However, investors should be aware that NOV’s high valuation multiples now sit against weaker earnings trends. NOV's shares have been on the rise but are still potentially undervalued by 44%. Find out what it's worth.Exploring Other Perspectives

Explore 6 other fair value estimates on NOV - why the stock might be worth 11% less than the current price!

Build Your Own NOV Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NOV research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NOV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NOV's overall financial health at a glance.

No Opportunity In NOV?

Our top stock finds are flying under the radar-for now. Get in early:

- The future of work is here. Discover the 28 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- Capitalize on the AI infrastructure supercycle with our selection of the 33 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.