Please use a PC Browser to access Register-Tadawul

How NVIDIA’s (NVDA) New AI Partnerships and Supercomputer Launch Could Shape Its Global Investment Profile

NVIDIA Corporation NVDA | 175.02 | -3.27% |

- In October 2025, NVIDIA announced a series of major product launches, industry collaborations, and client wins, including its compact DGX Spark AI supercomputer, new partnerships with MediaTek and Vertiv, and a landmark deal to supply infrastructure for the Dominican Republic's national AI initiatives. Oracle, Meta, and other global hyperscalers also revealed new deployments built on NVIDIA's GPU and networking platforms, reinforcing the company's role at the center of the ongoing AI infrastructure transformation.

- These announcements underscore NVIDIA's growing influence in enabling next-generation AI capabilities, not just in traditional tech hubs but also in emerging global markets and across diverse industries such as energy, healthcare, and finance.

- We’ll explore how NVIDIA’s deepening industrial and sovereign partnerships, highlighted by its Dominican Republic AI initiative, might reshape its investment fundamentals.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NVIDIA Investment Narrative Recap

For shareholders in NVIDIA, confidence hinges on continued explosive adoption of AI infrastructure, fueling surging data center demand and multiyear earnings expansion. The recent Dominican Republic partnership spotlights NVIDIA’s global reach but doesn’t materially shift the most important immediate catalyst, which remains hyperscaler investment cycles, nor does it address the single largest risk: intensifying US-China export controls that could block access to tens of billions in annual sales. The primary drivers and threats to the business remain fundamentally unchanged for now.

Of the latest announcements, the Memorandum of Understanding with the Dominican Republic stands out for illustrating NVIDIA’s efforts to embed its AI technology into new sovereign and emerging markets. While this advances broader adoption, the core catalyst for the next phase remains hyperscale demand and the ability to secure continued regulatory approval for sales in vital regions.

On the flip side, investors should also pay attention to risks from ongoing US-China trade restrictions, which could ...

NVIDIA's narrative projects $337.2 billion in revenue and $187.9 billion in earnings by 2028. This requires 26.8% yearly revenue growth and a $101.3 billion increase in earnings from $86.6 billion today.

Uncover how NVIDIA's forecasts yield a $218.51 fair value, a 17% upside to its current price.

Exploring Other Perspectives

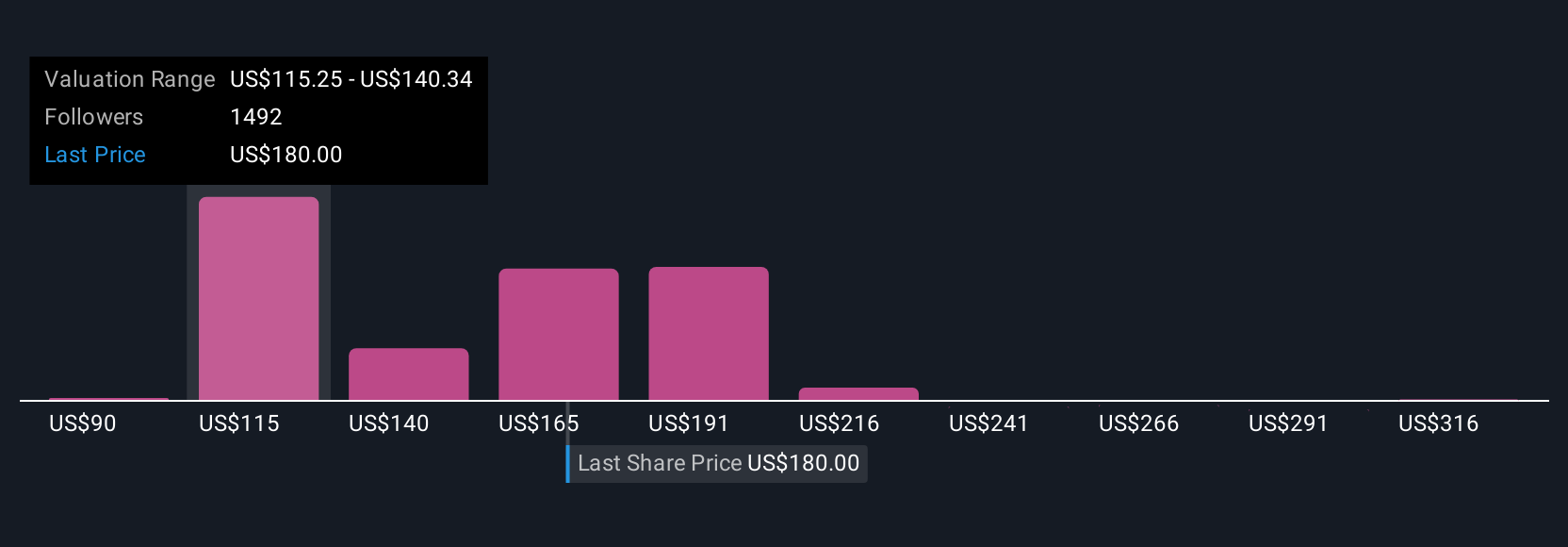

Across 429 fair value estimates by the Simply Wall St Community, opinions span from US$90.15 to US$341.12. While many focus on explosive AI-driven revenue, concern remains about access to critical growth regions and the possibility of regulatory setbacks affecting global prospects.

Explore 429 other fair value estimates on NVIDIA - why the stock might be worth less than half the current price!

Build Your Own NVIDIA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NVIDIA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NVIDIA's overall financial health at a glance.

No Opportunity In NVIDIA?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.