Please use a PC Browser to access Register-Tadawul

How Parsons’ (PSN) iNET Rollout for New Jersey DOT Reinforces Its Smart Mobility Leadership

Parsons PSN | 63.33 | -3.89% |

- On August 21, 2025, Parsons Corporation announced the successful launch of New Jersey Department of Transportation's first integrated Statewide Advanced Traffic Management System, powered by Parsons' iNET® smart mobility solution in partnership with HNTB Corporation.

- This deployment replaces multiple legacy systems with an innovative unified platform, enhancing statewide traffic management and earning the project the 2025 Excellence in Engineering Award.

- We'll explore how Parsons’ statewide implementation of iNET® for New Jersey marks its growing leadership in advanced smart mobility solutions.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Parsons Investment Narrative Recap

Parsons’ statewide deployment of its iNET® smart mobility platform in New Jersey highlights the company’s expanding presence in advanced infrastructure solutions, feeding into the bigger story of growing nationwide infrastructure demand. This milestone affirms Parsons’ ability to win complex, tech-enabled projects, but the news does not materially affect the most pressing near-term catalyst: sustaining top-line growth in a competitive contracting market. The business still faces exposure to shifts in U.S. government funding and increased competition for federal contracts.

Among recent announcements, Parsons’ $30 million contract from the U.S. Army DEVCOM for advanced radar systems engineering stands out, underlining demand for its high-tech defense and infrastructure offerings. Both the NJDOT contract win and the Army deal point to robust federal demand, but sustaining consistent growth amid bidding pressures remains an important focus for the company.

On the other hand, with exposure to U.S. federal budget cycles, investors should be mindful that sudden shifts in federal funding could...

Parsons' narrative projects $7.4 billion revenue and $350.2 million earnings by 2028. This requires 3.7% yearly revenue growth and a $102.6 million earnings increase from $247.6 million currently.

Uncover how Parsons' forecasts yield a $87.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

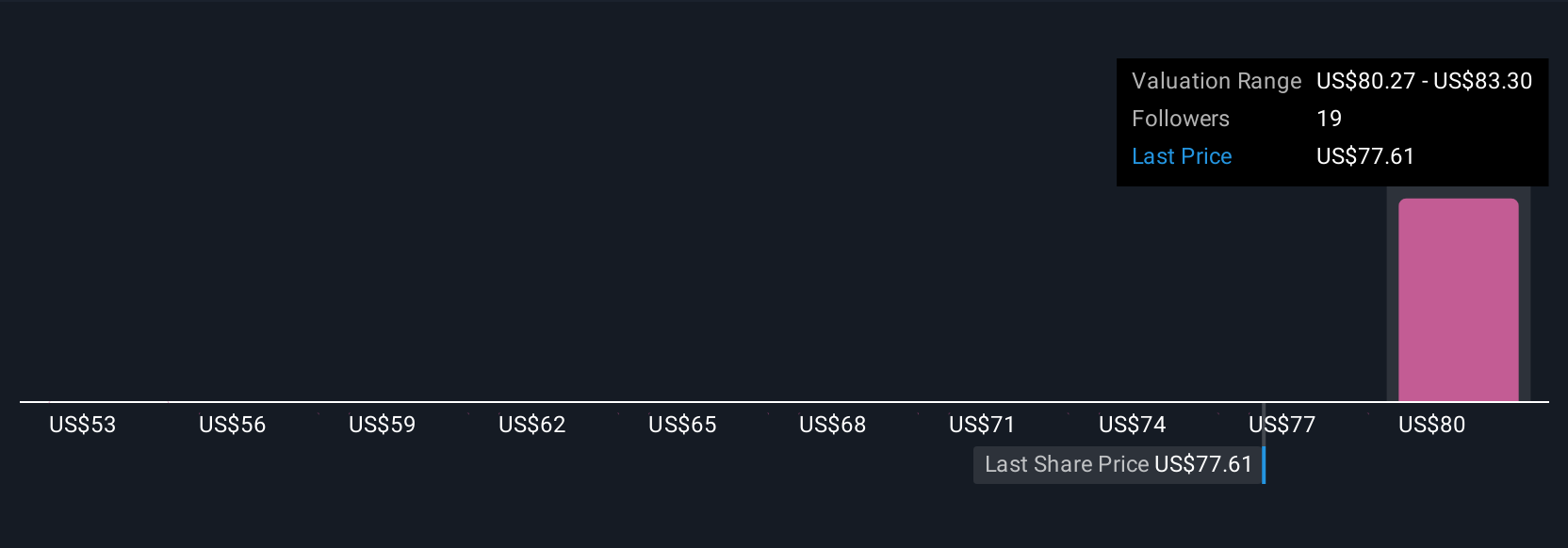

Four fair value estimates from the Simply Wall St Community range from US$53 to US$94.54, reflecting widely varied individual outlooks. While government infrastructure demand is a key driver, you should consider how swings in federal priorities could impact future project pipelines.

Explore 4 other fair value estimates on Parsons - why the stock might be worth 34% less than the current price!

Build Your Own Parsons Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Parsons research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Parsons research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Parsons' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.