Please use a PC Browser to access Register-Tadawul

How Perdoceo Education's (PRDO) 52-Week High and Strong Earnings May Shape Its Investment Case

PERDOCEO EDUCATION CORPORATION PRDO | 29.53 | +2.29% |

- Perdoceo Education recently reached a new 52-week high following a broad market rally after an in-line Consumer Price Index report, which heightened expectations for a potential Federal Reserve interest rate cut.

- An interesting development is Perdoceo's consistent outperformance on earnings, robust return on equity, and emphasis on reinvesting profits, all of which have reinforced investor confidence in the company's fundamentals.

- We'll examine how investor optimism around a Fed rate cut and Perdoceo's strong earnings record may influence its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Perdoceo Education Investment Narrative Recap

To be a shareholder in Perdoceo Education, you need conviction that its blend of consistent earnings, strong return on equity, and reinvestment in growth will translate into durable returns, even as the company faces persistent competition and regulatory uncertainty. The recent rally tied to interest rate optimism may provide short-term momentum, but does not substantially change the central risk: the company's heavy reliance on acquisitions like St. Augustine for enrollment and revenue gains.

Among recent announcements, Perdoceo's upward-trending financial performance stands out, particularly the Q2 2025 earnings, where revenue and net income meaningfully increased year over year. This is highly relevant in light of investor optimism fueled by the latest market rally, since it highlights the company's ability to deliver results even as it navigates a sector sensitive to broader economic and policy shifts.

By contrast, investors should be aware that integration challenges from its recent acquisitions could quickly...

Perdoceo Education's narrative projects $987.8 million revenue and $179.9 million earnings by 2028. This requires 8.7% yearly revenue growth and a $25.5 million earnings increase from $154.4 million today.

Uncover how Perdoceo Education's forecasts yield a $40.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

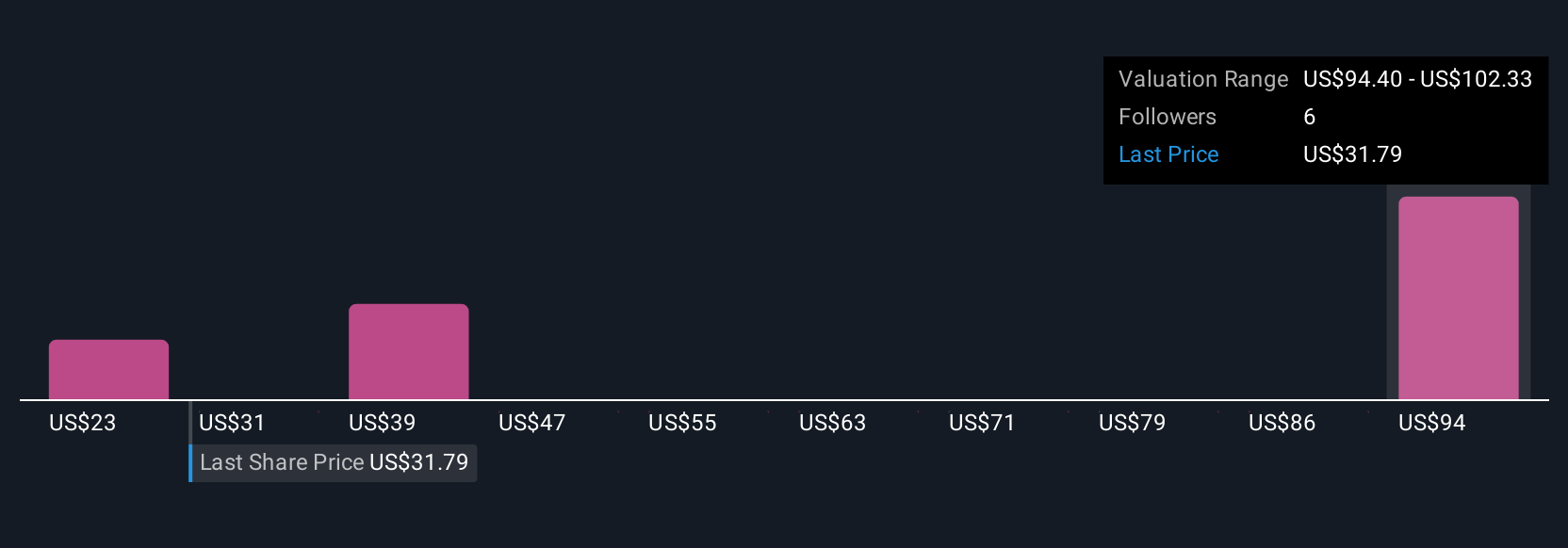

Five individual fair value estimates from the Simply Wall St Community range widely, from US$22.97 to US$106.95 per share. While investors debate these levels, the company's reliance on acquisitions for enrollment and earnings growth remains central to the bull and bear cases alike.

Explore 5 other fair value estimates on Perdoceo Education - why the stock might be worth over 3x more than the current price!

Build Your Own Perdoceo Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perdoceo Education research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Perdoceo Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perdoceo Education's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.