Please use a PC Browser to access Register-Tadawul

How Philip Morris International’s Smoke-Free Pivot and Strong 2025 Earnings Could Shape PM Investors’ Outlook

Philip Morris International Inc. PM | 183.40 | -0.05% |

- In early February 2026, Philip Morris International reported fourth-quarter 2025 sales of US$10,362 million and net income of US$2,141 million, reversing a prior-year net loss, alongside full-year 2025 sales of US$40.65 billion and net income of US$11.35 billion.

- The results underscored the growing weight of smoke-free products, which contributed roughly 42% of revenue in 2025, as the company also filed an omnibus shelf registration for potential future issuance of debt securities and warrants.

- Next, we’ll examine how the strong earnings and expanding smoke-free portfolio shape Philip Morris International’s investment narrative for investors.

The future of work is here. Discover the 28 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

What Is Philip Morris International's Investment Narrative?

To own Philip Morris International today, you need to believe the company can keep shifting its profit engine from traditional cigarettes toward its smoke free portfolio while managing high leverage and regulatory scrutiny. The latest results, with 2025 net income of US$11.35 billion and smoke free products contributing roughly 42% of revenue, reinforce that this transition is now central to the story rather than a side bet. The stock’s strong 3 month gain suggests the market had already been warming to that view, so the earnings beat and new 2026 guidance look more like confirmation than a reset of the thesis. The new omnibus shelf registration adds financial flexibility but also puts funding needs and balance sheet risk back in focus, especially if growth in smoke free volumes ever slows or tax headwinds bite harder than expected.

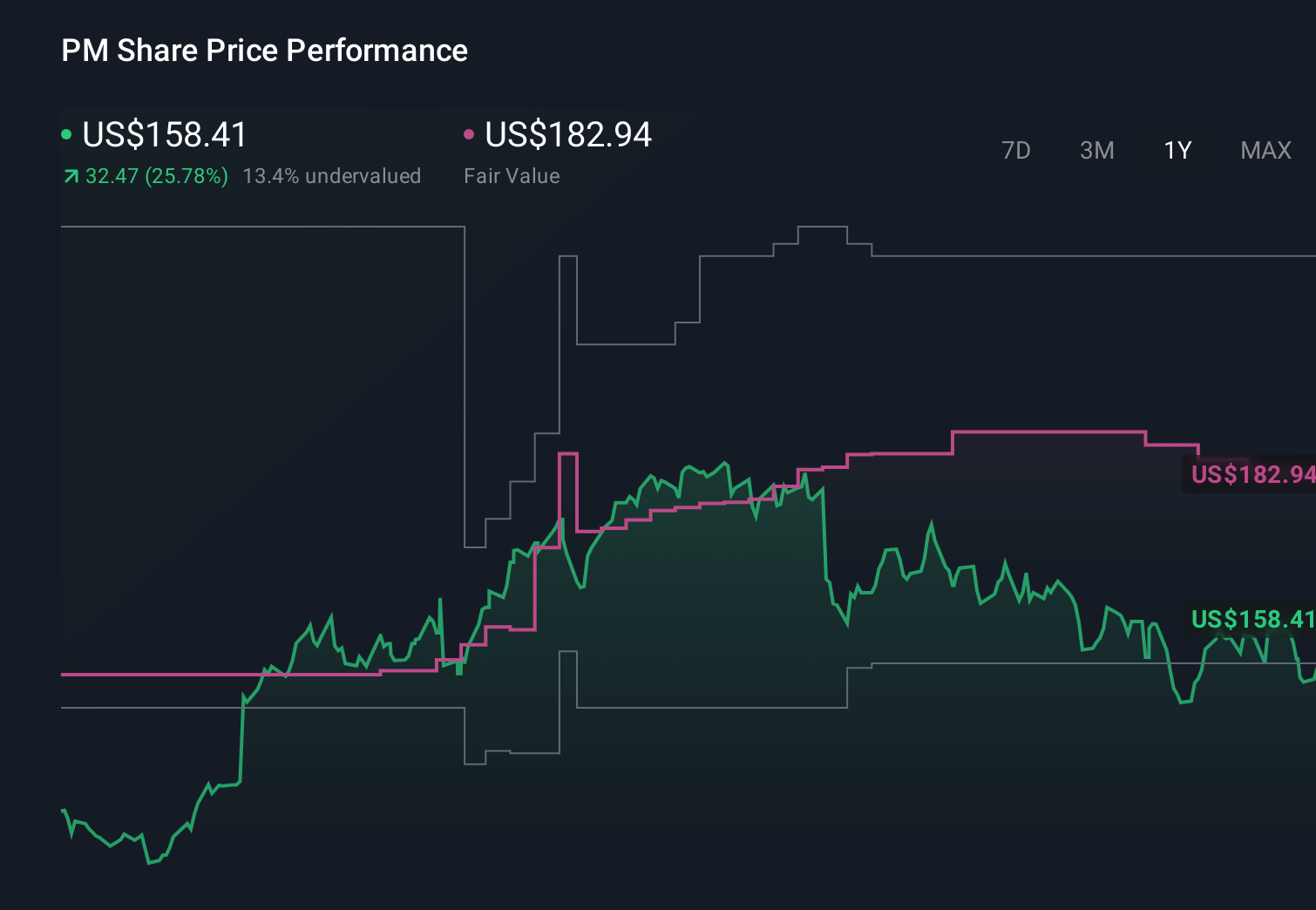

However, there is a key regulatory and balance sheet risk here that investors should not ignore. Philip Morris International's shares have been on the rise but are still potentially undervalued by 19%. Find out what it's worth.Exploring Other Perspectives

Eleven Simply Wall St Community fair values for PMI span roughly US$158 to just over US$225 per share, reflecting very different expectations for the business. Set that against a story now driven by smoke free growth, tax headwinds and a sizeable debt load, and you can see why it pays to weigh several viewpoints before deciding what these earnings really mean for future performance.

Explore 11 other fair value estimates on Philip Morris International - why the stock might be worth as much as 23% more than the current price!

Build Your Own Philip Morris International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Philip Morris International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Philip Morris International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Philip Morris International's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with 24 elite penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find 52 companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.