Please use a PC Browser to access Register-Tadawul

How Recent Regional Bank Sector Volatility Impacts BancFirst’s Market Valuation in 2025

BancFirst Corporation BANF | 119.63 | -0.63% |

- Thinking of investing in BancFirst and wondering if the stock is truly undervalued, or if there is more to the story? You are not alone. Many savvy investors are taking a closer look at its numbers.

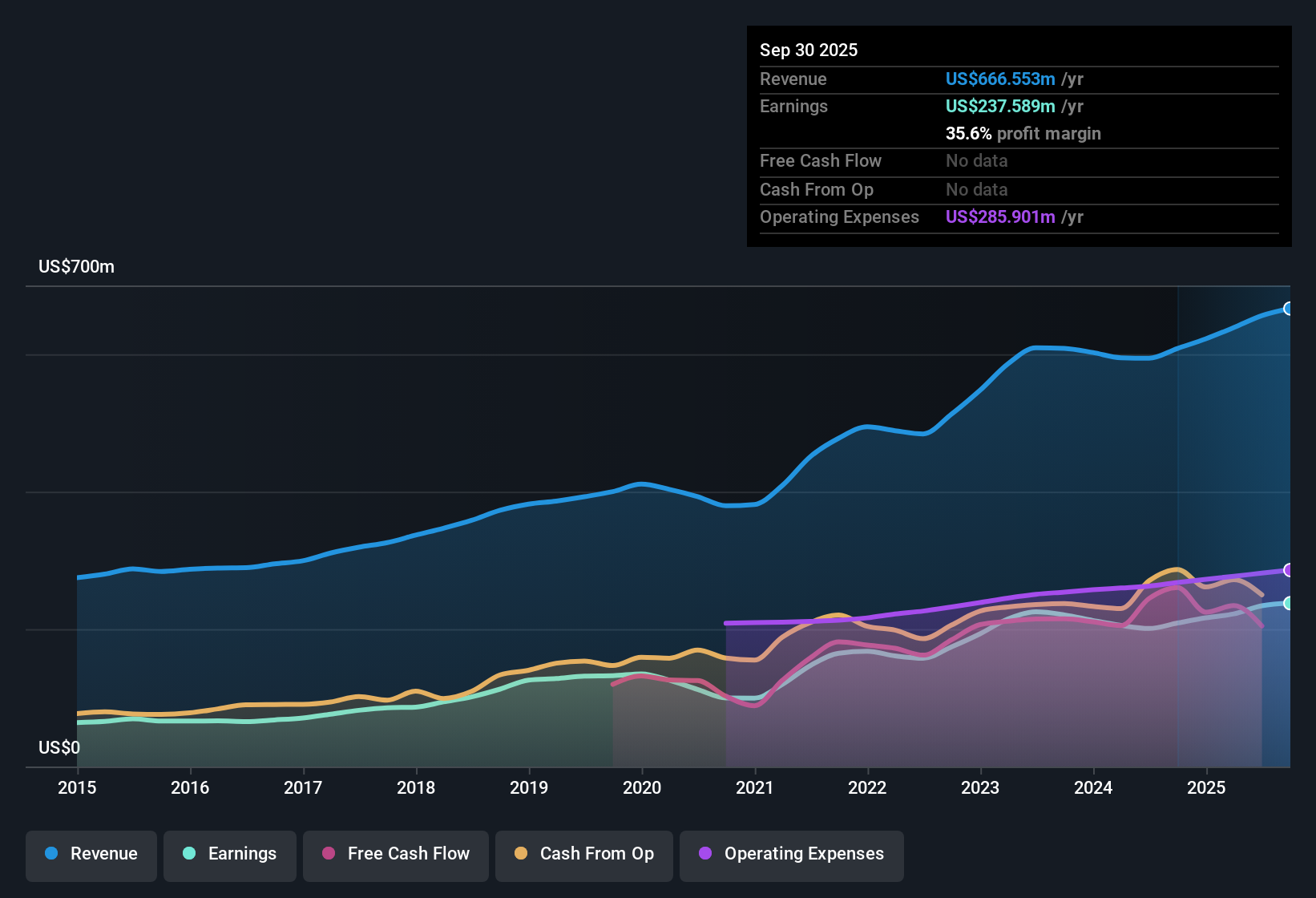

- BancFirst shares have been on a wild ride, rising 1.1% in the last week, despite dropping 13.0% over the past month and showing a year-to-date decline of 4.7%. However, if you zoom out, they are still up 130.4% over the past five years.

- Much of this recent volatility is linked to news around regional bank sector developments, including shifts in regulatory sentiment and headlines about interest rate uncertainty that are influencing investor confidence across the industry. These stories have prompted fresh debates about risk and opportunity in financials like BancFirst.

- For valuation, BancFirst currently scores a 3 out of 6, suggesting it is undervalued on about half the checks used. Next, we will unpack these valuation approaches, and at the end, reveal a way to move beyond the basics to judge the company's fair value with even greater insight.

Approach 1: BancFirst Excess Returns Analysis

The Excess Returns model estimates a company's fair value by focusing on the additional profits it generates beyond the required cost of equity. This approach looks at how effectively BancFirst turns its invested capital into shareholder returns, rather than just measuring assets or cash flows. It identifies what value the company creates above what investors could expect elsewhere for a similar level of risk.

For BancFirst, the latest analysis shows a Book Value of $51.94 per share and a Stable Earnings Per Share (EPS) of $8.56, based on the median return on equity from the past five years. The Cost of Equity is $3.97 per share, meaning the business is producing an Excess Return of $4.59 per share. The company's average Return on Equity stands at 14.61%, which is strong for its industry. Looking forward, analysts estimate a Stable Book Value of $58.58 per share, pooled from future projections by multiple analysts.

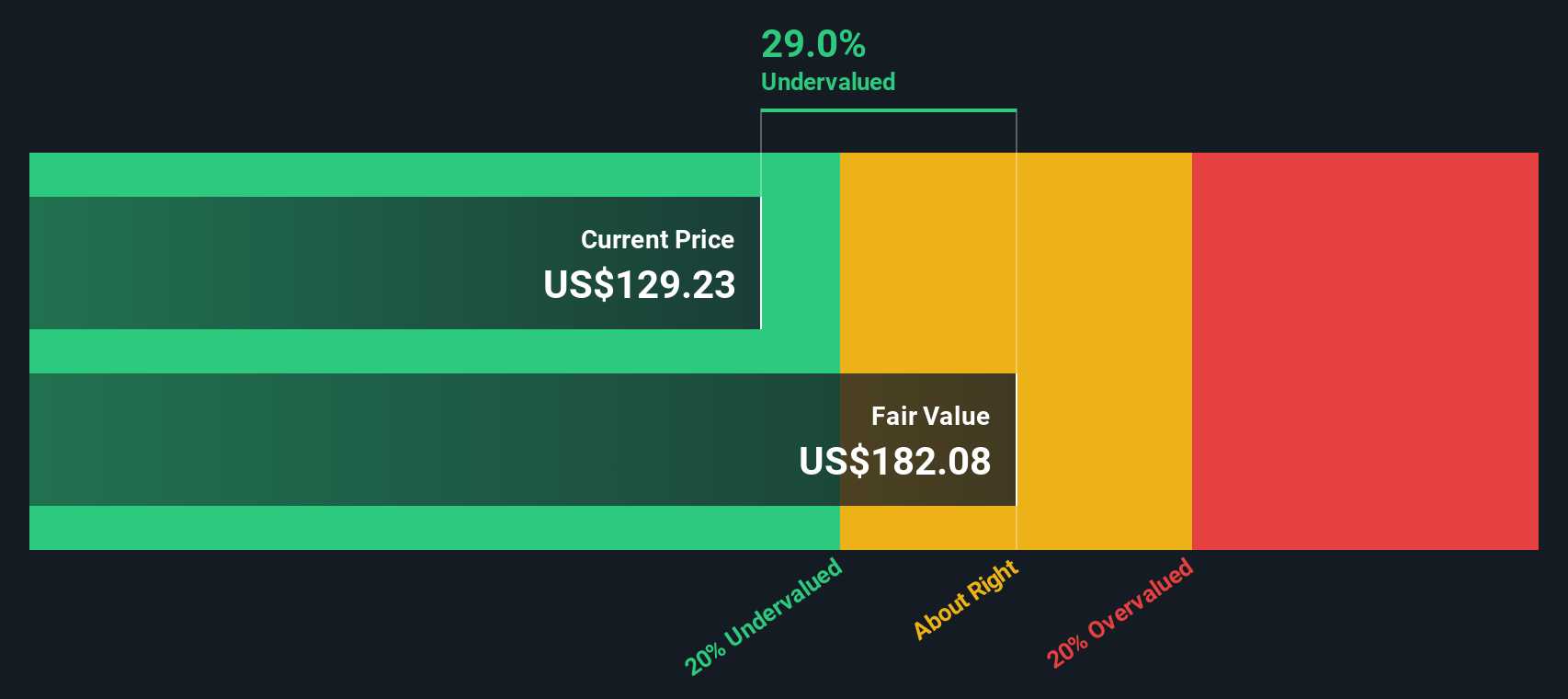

Based on these factors, the Excess Returns model suggests BancFirst's intrinsic value is $182.80 per share. With this value implying the stock is trading at a 39.5% discount to its fair price, the evidence points to BancFirst being meaningfully undervalued right now.

Result: UNDERVALUED

Our Excess Returns analysis suggests BancFirst is undervalued by 39.5%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: BancFirst Price vs Earnings

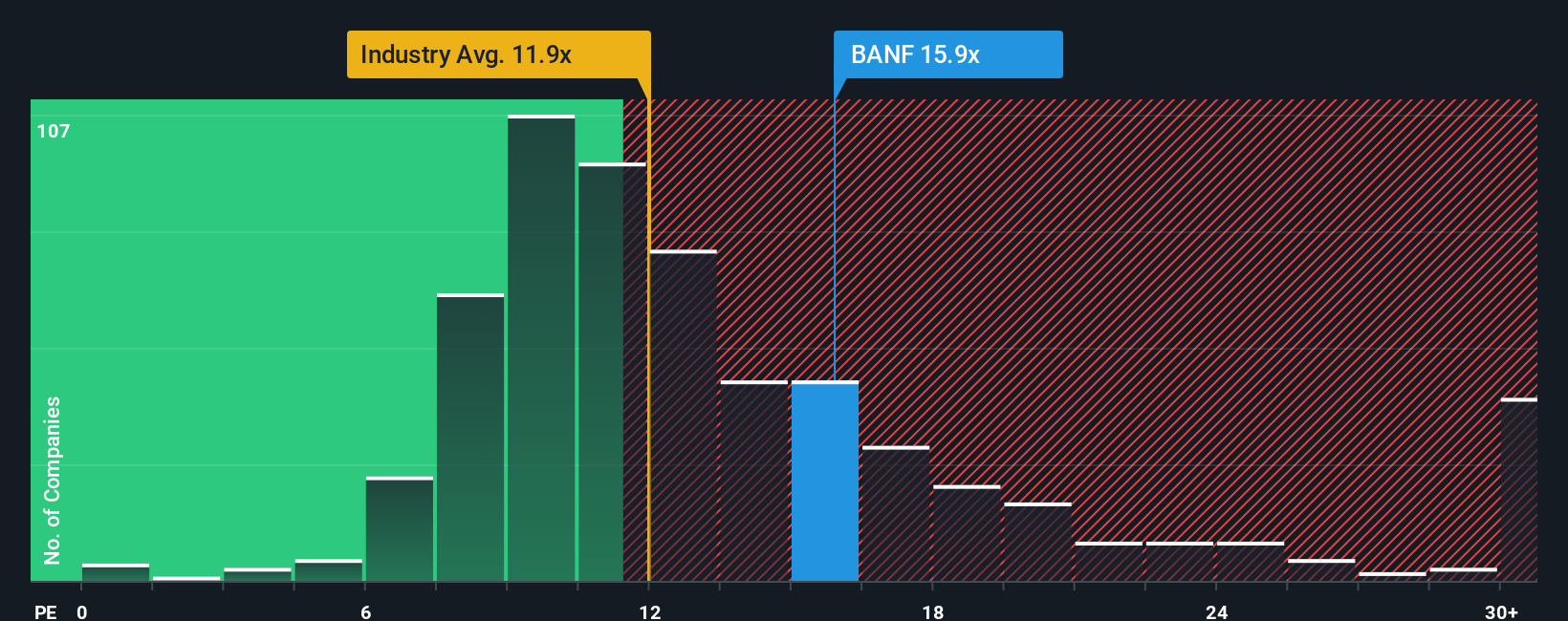

For consistently profitable companies like BancFirst, the Price-to-Earnings (PE) ratio is a reliable metric to assess valuation. The PE ratio helps investors understand how much the market is willing to pay for each dollar of earnings, which makes it particularly relevant when a business has a solid track record of profitability.

The “fair” PE ratio for any company depends on factors like its expected earnings growth, risk profile, and the stability of its income. Higher growth and more stable earnings typically justify a higher PE, while higher risk or volatile performance would warrant a lower ratio. It is standard to compare BancFirst’s PE to benchmarks such as the industry average (11.0x) and the average of similar peers (26.5x). BancFirst currently trades at 15.5x, which puts it above the industry average but below peers.

Simply Wall St offers an extra layer with its proprietary Fair Ratio, which in this case is 10.0x for BancFirst. Unlike simple industry or peer comparisons, the Fair Ratio reflects not just the company’s sector but also its specific earnings growth, profitability, risk, and market cap. This makes it a more tailored and insightful guide for what BancFirst’s multiple should be. Comparing the Fair Ratio (10.0x) to the actual PE (15.5x), the stock appears modestly expensive on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BancFirst Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your unique investment story, bringing together your own assumptions about BancFirst’s future earnings, growth, and profitability, and connecting these to a financial forecast and a calculated fair value.

Narratives are easy to use and accessible on Simply Wall St’s Community page, where millions of investors share their perspectives. By building a Narrative, you can see how your view of BancFirst’s prospects compares to the current market price, making it much clearer when to buy, hold, or sell.

What makes Narratives powerful is their dynamic nature. Whenever new earnings, industry news, or forecasts are released, your Narrative automatically updates, ensuring your valuation always reflects the latest information. For example, one investor might believe BancFirst deserves a much higher fair value because of expected loan growth, while another values it less due to concerns over interest rate risk.

With Narratives, you link your perspective directly to the numbers, giving you a truly personalized and up-to-date investment decision tool.

Do you think there's more to the story for BancFirst? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.