Please use a PC Browser to access Register-Tadawul

How Record Sales and New Leadership May Shape Mueller Water Products' (MWA) Investment Outlook

Mueller Water Products, Inc. Class A MWA | 24.99 24.99 | +0.93% 0.00% Pre |

- In recent days, Mueller Water Products reported record net sales growth for Q3 2025, matched analyst earnings expectations, and introduced new leadership in operations and accounting, while confirming that recent executive departures were not tied to financial reporting issues.

- Additionally, Director Brian Healy's purchase of 1,070 shares under a pre-arranged trading plan stands out as an individual show of internal confidence against a backdrop of more frequent insider selling over the last year.

- We'll examine how the company’s strong quarterly results and leadership appointments may shape Mueller Water Products' investment outlook moving forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Mueller Water Products Investment Narrative Recap

To be a shareholder in Mueller Water Products, you need to believe that long-term demand for water infrastructure upgrades and municipal replacement cycles will offset ongoing industry risks such as funding delays and rising costs. While the company’s record Q3 net sales and steady earnings offer reassurance for near-term momentum, these results do not fundamentally change the immediate reliance on public infrastructure funding, the key catalyst, as well as the persistent headwind from potential government spending slowdowns. The latest numbers, while strong, may not materially alter those short-term swings.

Among recent announcements, the appointment of Darin Harvey as Senior Vice President of Operations and Supply Chain closely aligns with current business catalysts, as his background is expected to support the company’s margin improvement initiatives and supply chain optimization. The ability to execute on operational efficiency, especially when input costs and tariffs remain volatile, can play a significant role in translating robust order activity into sustained profitability.

In contrast, local government budget pressures remain a factor that investors should be aware of, as they can quickly shift demand forecasts...

Mueller Water Products' outlook anticipates $1.6 billion in revenue and $320.8 million in earnings by 2028. This is based on a 4.1% annual revenue growth rate and an increase in earnings of $171.7 million from the current $149.1 million.

Uncover how Mueller Water Products' forecasts yield a $28.67 fair value, a 11% upside to its current price.

Exploring Other Perspectives

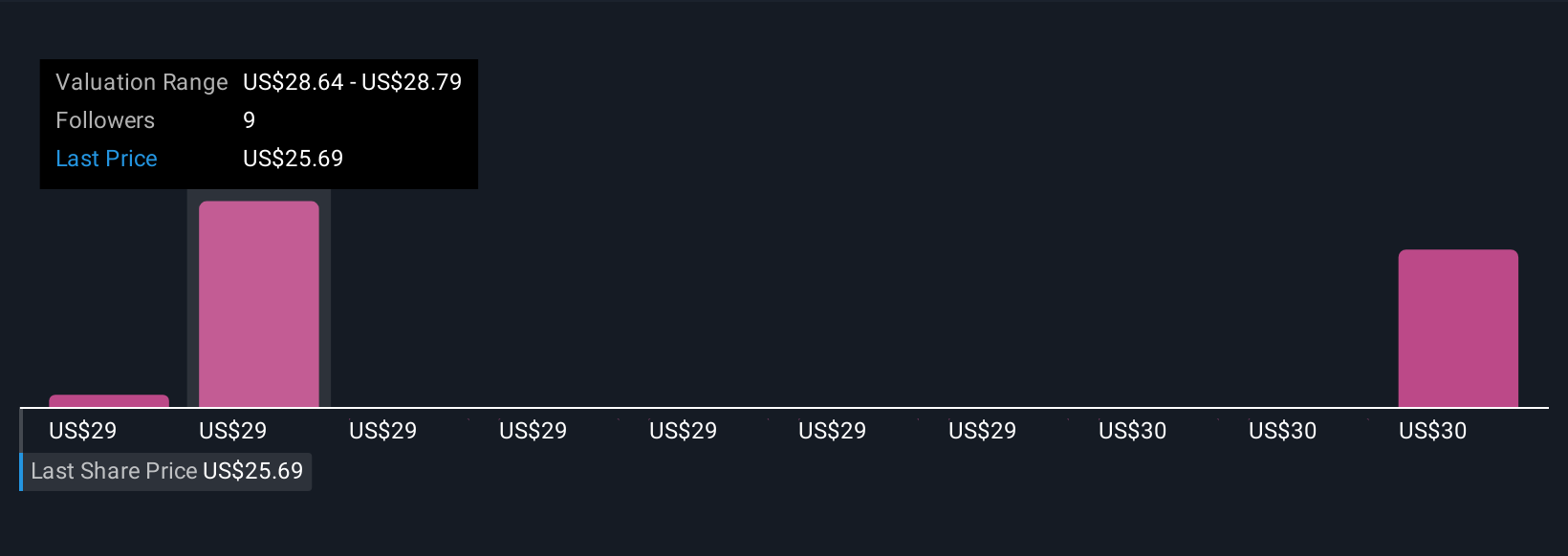

Simply Wall St Community members see fair value for Mueller Water Products between US$28.67 and US$30.02 across 2 recent estimates. These diverse views come as operational execution and reliance on infrastructure funding create a mix of optimism and caution, putting a spotlight on how your expectations for demand growth stack up against others in the market.

Explore 2 other fair value estimates on Mueller Water Products - why the stock might be worth as much as 17% more than the current price!

Build Your Own Mueller Water Products Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mueller Water Products research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mueller Water Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mueller Water Products' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.