Please use a PC Browser to access Register-Tadawul

How Record US$143 Billion AUM and Precious Metals Inflows At WisdomTree (WT) Has Changed Its Investment Story

WisdomTree Investments Inc WT | 15.16 | +6.61% |

- In December 2025, WisdomTree, Inc. reported record global exchange traded product and tokenized assets under management of about US$143 billion, with US$1.10 billion of net inflows for the month and US$8.50 billion for 2025, largely driven by gold and other precious metals.

- This strong organic growth in assets and flows highlights how investor demand for WisdomTree’s ETFs and tokenized products is reinforcing its broader expansion across both traditional and digital investment platforms.

- Next, we’ll examine how December’s record US$143 billion in assets under management might influence WisdomTree’s existing investment narrative and outlook.

This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

WisdomTree Investment Narrative Recap

To own WisdomTree, you generally need to believe that its ETF franchise and early move into tokenized products can keep attracting assets despite fee pressure and competition. December’s record US$143 billion in AUM and 8% organic growth support that thesis near term, but do not remove the key risk that digital asset and tokenization investments may face regulatory or adoption hurdles that weigh on returns.

The December AUM update ties closely to WisdomTree’s December 2025 launch of the Equity Premium Income Digital Fund, which extends its tokenized, blockchain-based product suite. Together, strong recent inflows and new tokenized offerings show how the traditional ETF engine and digital initiatives are increasingly connected to the main growth story, even as the economics and long term contribution of these digital products remain uncertain.

Yet behind these record flows, investors still need to consider the risk that WisdomTree’s sizable bet on digital assets and tokenization could...

WisdomTree's narrative projects $600.8 million revenue and $227.8 million earnings by 2028. This requires 10.6% yearly revenue growth and about a $168.2 million earnings increase from $59.6 million today.

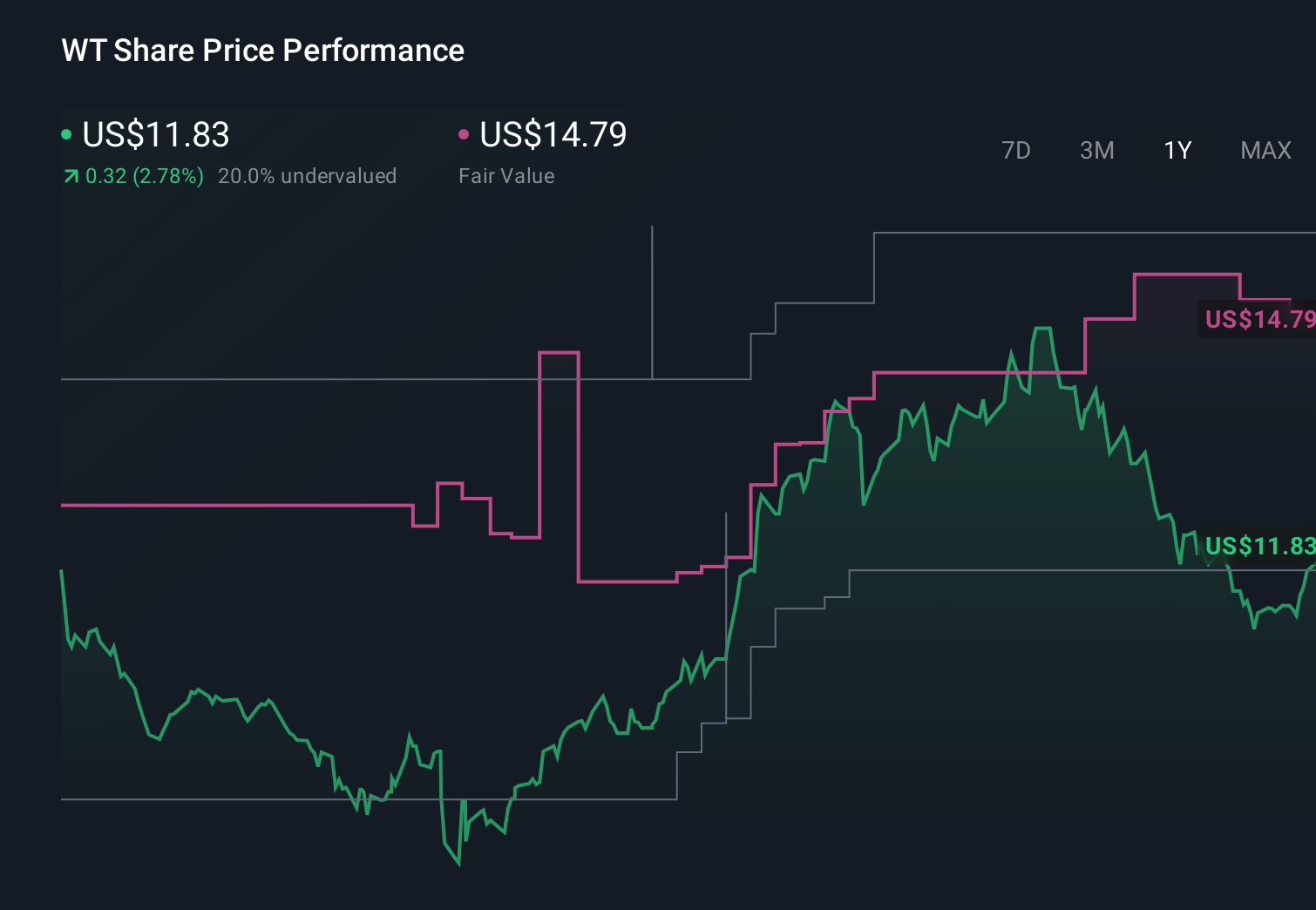

Uncover how WisdomTree's forecasts yield a $14.79 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members place fair value for WisdomTree between US$6.28 and US$14.79, underscoring how far opinions can differ. You should weigh those views against the recent AUM driven catalyst from strong ETF and tokenized product inflows, and explore how each perspective treats the potential execution and regulatory risks in digital assets.

Explore 2 other fair value estimates on WisdomTree - why the stock might be worth as much as 11% more than the current price!

Build Your Own WisdomTree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WisdomTree research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free WisdomTree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WisdomTree's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.