Please use a PC Browser to access Register-Tadawul

How Salesforce's (CRM) AI Security Alliances Could Influence Its Position in Enterprise Automation

Salesforce.com, inc. CRM | 262.23 | -0.05% |

- Over the past week, CrowdStrike and Salesforce jointly announced a partnership to integrate Falcon Shield and Charlotte AI with Salesforce Security Center and Slack, aiming to elevate security for AI agents and applications, while RightRev revealed a deepened collaboration with Salesforce to enhance Revenue Cloud’s advanced billing and revenue recognition capabilities.

- These developments highlight Salesforce’s focus on unifying security and automation, addressing the increasing complexity of enterprise monetization models and AI-driven workflows in today’s digital landscape.

- We'll now explore how Salesforce’s new partnership with CrowdStrike to secure AI-powered business could shape its forward-looking investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Salesforce Investment Narrative Recap

To own Salesforce stock, an investor needs to believe that the company can stay ahead in enterprise software by integrating advanced AI, maintaining product differentiation, and monetizing a growing suite of workflow solutions. The recent CrowdStrike partnership underscores Salesforce’s commitment to security and automation alignment, but its effect on the most important short-term catalyst, adoption of AI-driven agentic workflows, appears positive though not immediately transformative. The largest risk remains the threat of commoditization from deeper AI/automation integration by competitors and the potential impact on pricing power.

The new integration with CrowdStrike, making Charlotte AI available in Slack and automating threat response within Salesforce Security Center, is a compelling response to customer demand for secure, plug-and-play automation. This collaboration may help reinforce Salesforce’s efforts to raise switching costs and anchor customers within its ecosystem, tying directly to the catalyst of expanding high-margin agentic revenues.

Yet, in contrast, investors should be alert to the risk of Salesforce’s solutions losing differentiation as rivals ramp up their own embedded AI platforms and ...

Salesforce's narrative projects $51.9 billion in revenue and $10.3 billion in earnings by 2028. This requires 9.6% yearly revenue growth and a $3.6 billion earnings increase from the current $6.7 billion.

Uncover how Salesforce's forecasts yield a $334.68 fair value, a 35% upside to its current price.

Exploring Other Perspectives

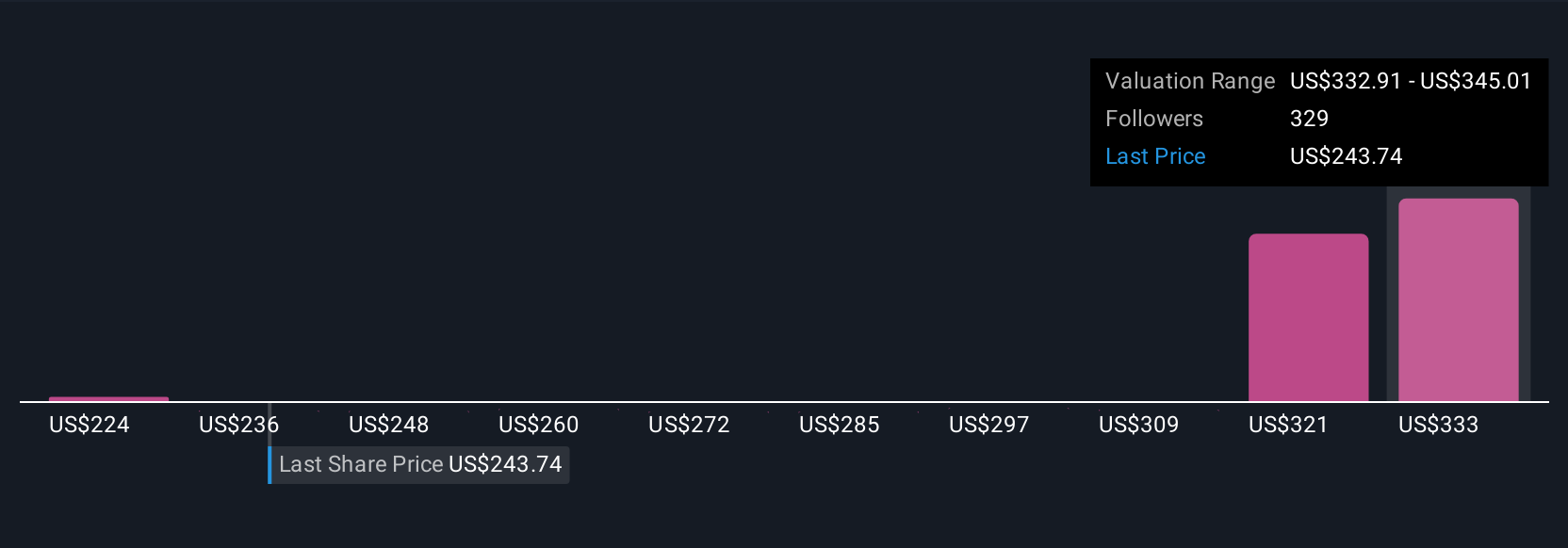

Fair value estimates from the Simply Wall St Community range from US$223.99 to US$341.14 across 42 viewpoints. While Salesforce’s push into secure AI-powered automation is a promising catalyst, these varied perspectives show that opinions on future performance often differ, consider reviewing several angles before deciding for yourself.

Explore 42 other fair value estimates on Salesforce - why the stock might be worth as much as 38% more than the current price!

Build Your Own Salesforce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Salesforce research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Salesforce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Salesforce's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.