Please use a PC Browser to access Register-Tadawul

How Saudi Approval of PYRUKYND Has Changed the Investment Story at Agios Pharmaceuticals (AGIO)

Agios Pharmaceuticals, Inc. AGIO | 26.09 | -2.83% |

- Agios Pharmaceuticals recently announced that the Saudi Food and Drug Authority approved PYRUKYND® (mitapivat) for treating adult patients with both non-transfusion-dependent and transfusion-dependent alpha- or beta-thalassemia, based on robust Phase 3 clinical data.

- This regulatory win not only expands Agios’ access in the Gulf region but also underscores the global momentum for PYRUKYND, as regulatory reviews continue in the U.S., EU, and other key markets.

- With this Gulf region approval serving as a catalyst, we'll examine how Agios' evolving product footprint may shape its outlook going forward.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Agios Pharmaceuticals Investment Narrative Recap

To be a shareholder in Agios Pharmaceuticals, you need to believe in the company’s success with PYRUKYND in rare blood disorders and continued progress in regulatory approvals, particularly with thalassemia and sickle cell disease. The Saudi FDA approval strengthens Agios’ global push, but the most critical short-term catalyst remains the anticipated FDA decision on PYRUKYND for thalassemia in the U.S.; this Gulf region win supports the company’s expansion, though its overall impact on near-term U.S. progress is not material. The biggest risk continues to be revenue volatility tied to PYRUKYND’s uptake and possible regulatory headwinds, especially if safety concerns emerge or launches face delays.

Among recent announcements, Agios reported Q2 2025 revenues of US$12.46 million, up from a year ago, but operating losses also widened to US$112.02 million. This underscores how, despite global regulatory progress and partnership agreements, elevated R&D and commercialization costs remain an issue and highlight the importance of future product launches and regulatory milestones as essential growth drivers.

Yet, investors should also be aware that if ever-increasing safety or label restrictions arise for PYRUKYND’s use in thalassemia, then...

Agios Pharmaceuticals' outlook projects $416.9 million in revenue and $58.9 million in earnings by 2028. This scenario assumes a robust 116.9% annual revenue growth rate but a significant decrease in earnings, dropping by $591.2 million from current earnings of $650.1 million.

Uncover how Agios Pharmaceuticals' forecasts yield a $50.14 fair value, a 42% upside to its current price.

Exploring Other Perspectives

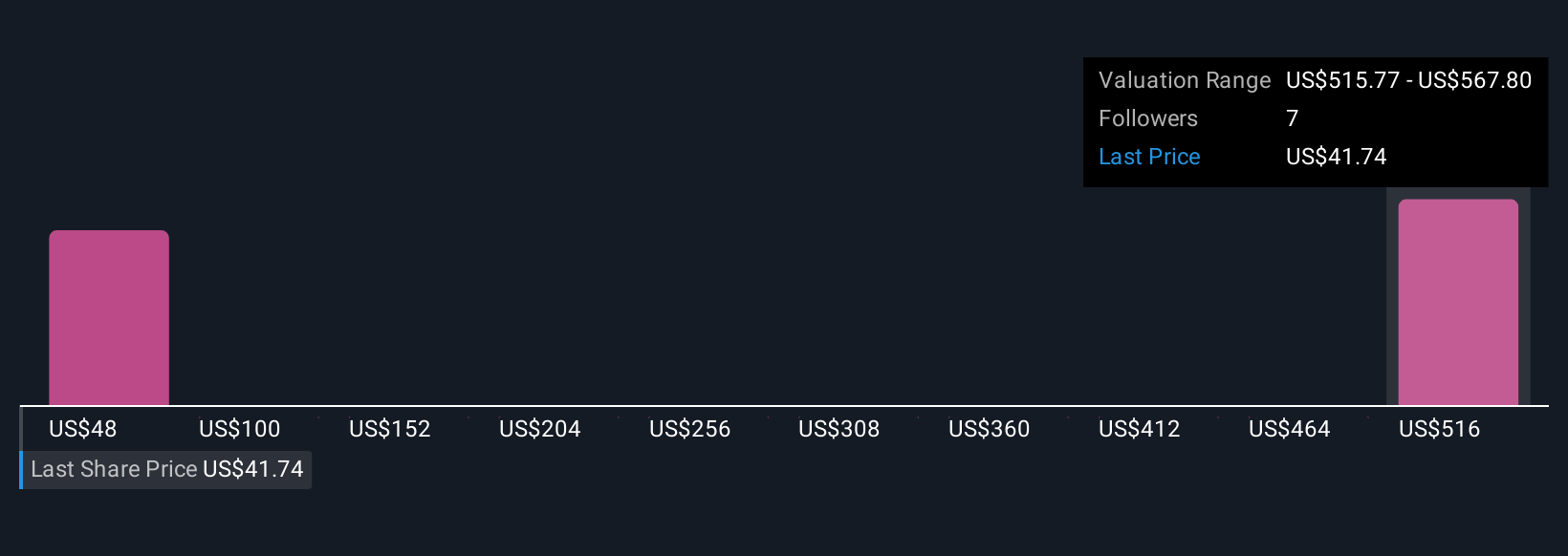

Two Simply Wall St Community contributors valued Agios Pharmaceuticals between US$50 and US$583 per share. With such wide spreads, it is clear opinions differ sharply as approval pace and market uptake remain central themes for future company performance.

Explore 2 other fair value estimates on Agios Pharmaceuticals - why the stock might be worth just $50.14!

Build Your Own Agios Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agios Pharmaceuticals research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Agios Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agios Pharmaceuticals' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.