Please use a PC Browser to access Register-Tadawul

How Securities Lawsuits Over Internal Controls Could Shape the Lockheed Martin (LMT) Investment Story

Lockheed Martin Corporation LMT | 623.58 | +2.36% |

- In late August 2025, multiple law firms announced securities class action lawsuits against Lockheed Martin, alleging that the company made false or misleading statements about internal controls and its ability to meet contract commitments, after reporting significant pre-tax losses on classified programs across its Aeronautics and Rotary and Mission Systems segments.

- These legal developments have brought renewed attention to corporate governance and financial risk management practices at one of the world’s largest defense contractors, with potential longer-term implications for investor confidence and contract execution.

- We’ll look at how these legal risks and internal control questions may impact Lockheed Martin’s future earnings expectations and investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Lockheed Martin Investment Narrative Recap

To own Lockheed Martin shares, you need to believe in sustained growth of global defense spending, the company’s technological leadership, and its ability to capture large, multi-year contracts despite persistent execution and budget risks. The wave of class action lawsuits alleging internal control lapses and misstated contract risk could weigh on confidence, but for now, the main near-term catalyst, ongoing demand for advanced defense platforms, remains unchanged. The most significant risk right now is further contract losses that could erode earnings visibility.

One of the most interesting recent announcements is Lockheed Martin’s memorandum of understanding with Korea Zinc to secure a non-China supply of critical minerals, particularly germanium, for defense systems. While unrelated to the legal challenges, this move is potentially significant for long-term supply resilience, supporting future contract execution and technological development, key themes for investors focused on catalysts.

By contrast, some legal risks behind these lawsuits could expose issues that investors should be aware of if more details emerge...

Lockheed Martin's narrative projects $81.0 billion revenue and $7.1 billion earnings by 2028. This requires 4.1% yearly revenue growth and a $2.9 billion earnings increase from $4.2 billion today.

Uncover how Lockheed Martin's forecasts yield a $476.67 fair value, a 3% upside to its current price.

Exploring Other Perspectives

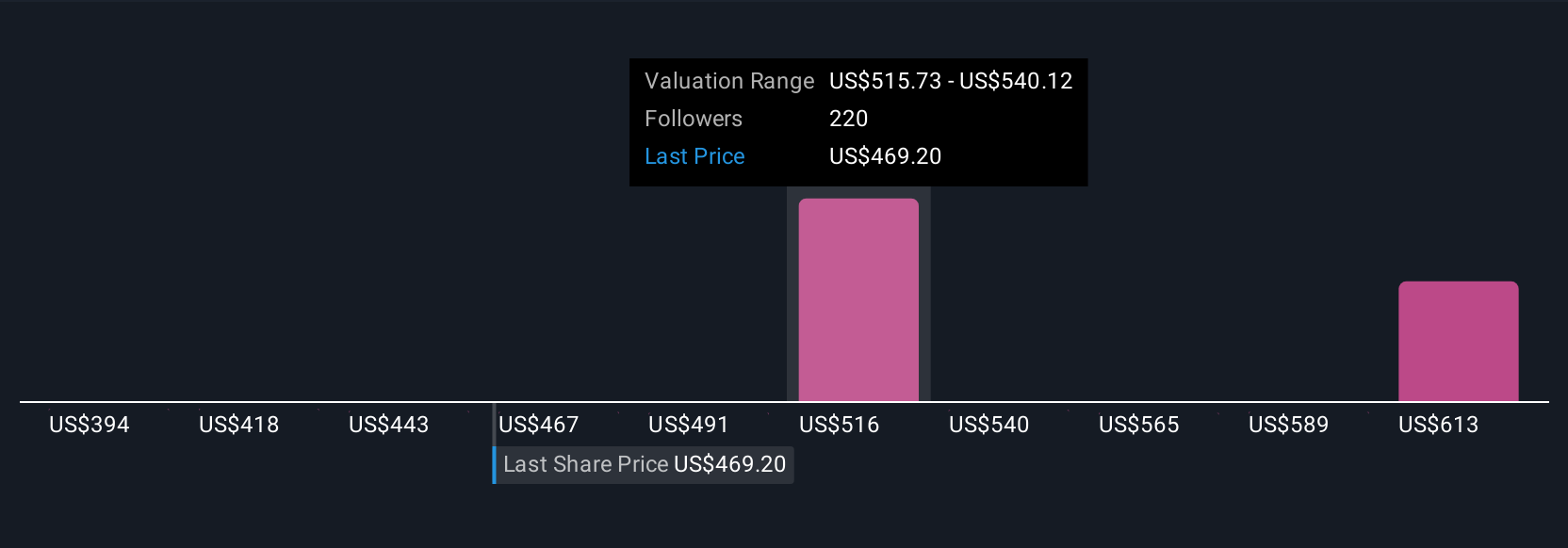

Twenty-seven fair value estimates from the Simply Wall St Community for Lockheed Martin range from US$374 to US$574 per share. With such a broad spread of views, consider how concerns about program charges and profit compression could continue to influence company performance and market sentiment.

Explore 27 other fair value estimates on Lockheed Martin - why the stock might be worth 19% less than the current price!

Build Your Own Lockheed Martin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lockheed Martin research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lockheed Martin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lockheed Martin's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.