Please use a PC Browser to access Register-Tadawul

How Should Investors Value MMC as Shares Fall 11% Ahead of 2025?

Marsh & McLennan Companies, Inc. MMC | 182.70 | 0.00% |

Thinking about what to do with your Marsh & McLennan Companies stock? You are definitely not alone. Over the past year, MMC has given investors plenty to consider, with its stock price retreating by 10.9% over twelve months and slipping 6.8% year-to-date. Short-term moves have been more muted, with a slight dip of 0.5% in the last week and a 6.4% decline over the past month. However, here is where it gets interesting, especially for the patient investor: zoom out just a little and Marsh & McLennan's shares have climbed 38.0% in the past three years and increased an impressive 85.1% over five years.

What explains these moves? Much of the recent short-term pressure seems tied to broader market shifts, including ongoing debates around interest rates and a more cautious tone in the financial sector after several headline-grabbing developments in insurance and risk management. While nothing specific has affected MMC itself lately, the market seems to be adjusting its risk expectations for stocks like this one.

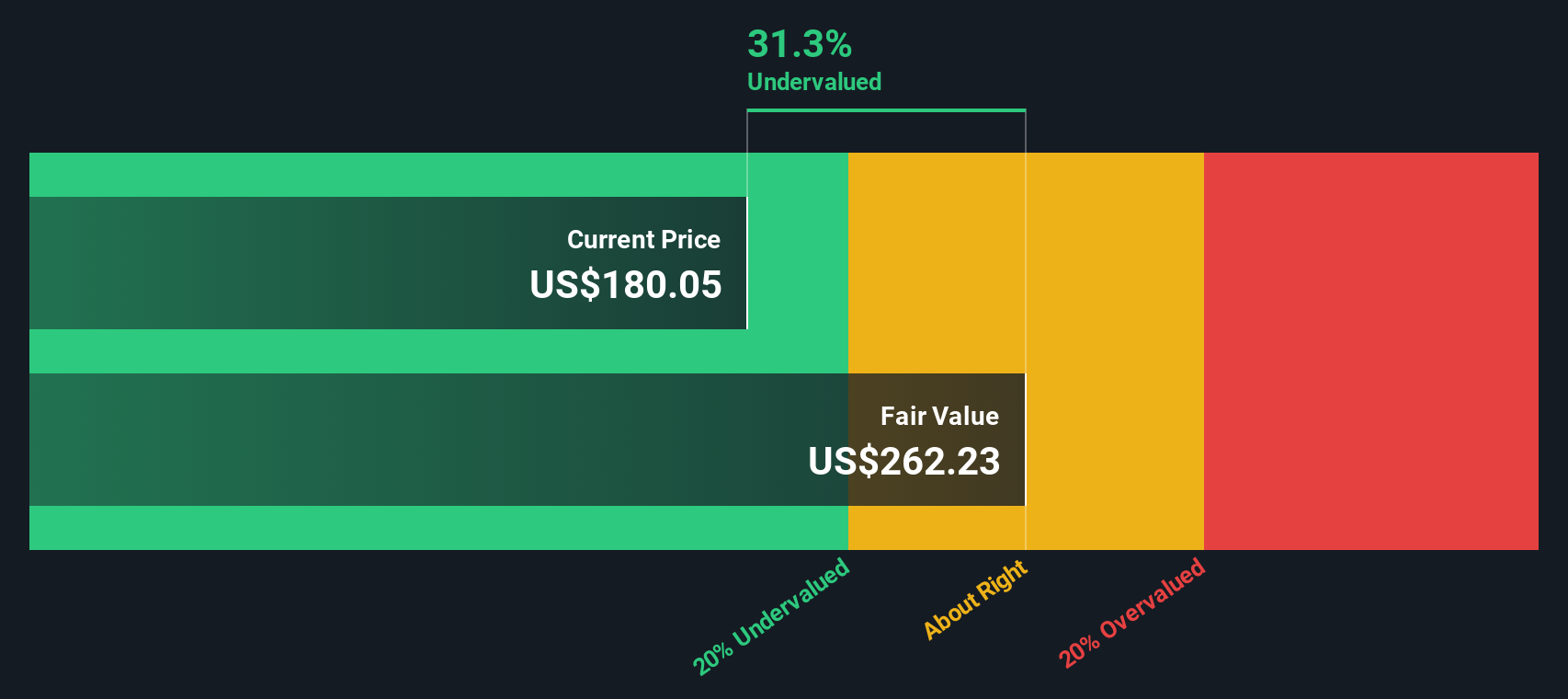

But what really matters for most of us is valuation. Is Marsh & McLennan a bargain, fairly priced, or getting a little ahead of itself? According to our multi-factor valuation score, MMC rates a 3 out of 6, meaning it looks undervalued on half of the checks we use. That is not a decisive signal, but it is certainly not a red flag either. Next, we will break down which valuation methods stack up in MMC's favor, and which do not, plus why old-school metrics might not tell the full story when it comes to this company.

Why Marsh & McLennan Companies is lagging behind its peersApproach 1: Marsh & McLennan Companies Excess Returns Analysis

The Excess Returns valuation model focuses on how efficiently a company generates profits above its cost of capital, rather than simply looking at future cash flows. Essentially, it asks whether Marsh & McLennan is creating value for shareholders by earning high returns on its investments compared to what it costs to raise those funds.

Based on the most recent analysis, Marsh & McLennan boasts a strong Average Return on Equity of 29.57%. With a Book Value of $32.07 per share and a projected Stable Book Value of $36.27 per share (using consensus from four analysts), the company’s ability to consistently grow shareholder equity is clear. Its Stable EPS is projected at $10.73 per share, while the Cost of Equity stands at $2.46 per share. This means the company is generating an Excess Return of $8.27 per share, which is a strong signal that profits are meaningfully above its cost of capital.

Given these inputs, the Excess Returns model estimates an intrinsic value per share that is 24.2% above the current trading price. This suggests Marsh & McLennan is undervalued right now, with a sizable margin of safety for long-term investors.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Marsh & McLennan Companies.

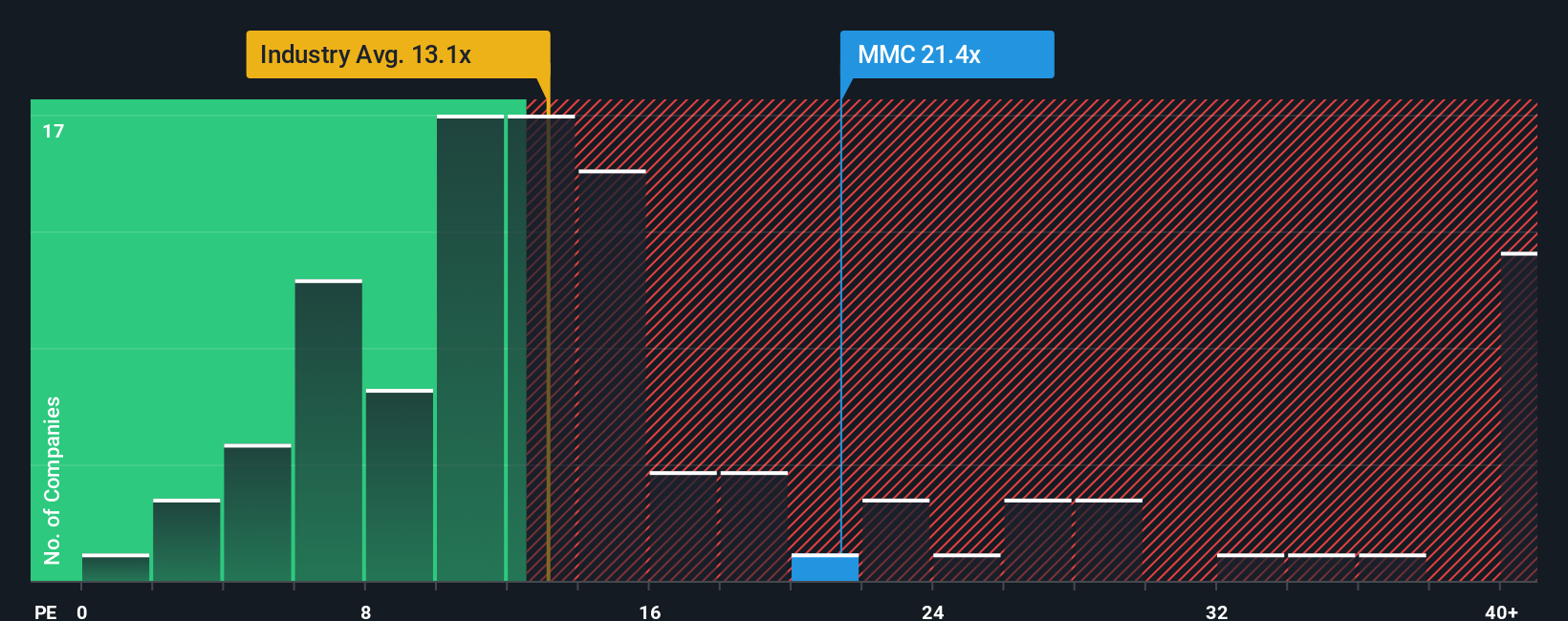

Approach 2: Marsh & McLennan Companies Price vs Earnings

For highly profitable companies like Marsh & McLennan, the price-to-earnings (PE) ratio is often the go-to valuation tool. It tells investors how much they are paying for each dollar of earnings, making it especially effective for businesses with stable profit streams. A lower PE can sometimes indicate a bargain, while a higher PE might reflect strong growth prospects or less perceived risk.

However, interpreting the PE ratio is not always straightforward. Growth expectations and risk play major roles in determining where a "normal" PE should sit. Fast-growing companies or those with more predictable earnings streams typically attract higher PEs. Sectors under pressure or with greater uncertainty generally trade closer to the lower end of the scale.

Currently, Marsh & McLennan trades on a PE of 23.5x. That is well above the insurance industry average of 13.8x, and noticeably below the broader peer group average of 56.6x. The key reference here is Simply Wall St's "Fair Ratio," which is 16.1x for MMC. The "Fair Ratio" is a proprietary measure that considers the company’s earnings growth, margin profile, risk factors, market size, and industry characteristics. This more nuanced benchmark offers a better yardstick than simply comparing to peers or industry averages, which may not fully reflect MMC's strengths or potential vulnerabilities.

With Marsh & McLennan’s current PE of 23.5x coming in higher than the Fair Ratio of 16.1x, it suggests the shares are running a bit hot compared to fundamentals and risk profile.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Marsh & McLennan Companies Narrative

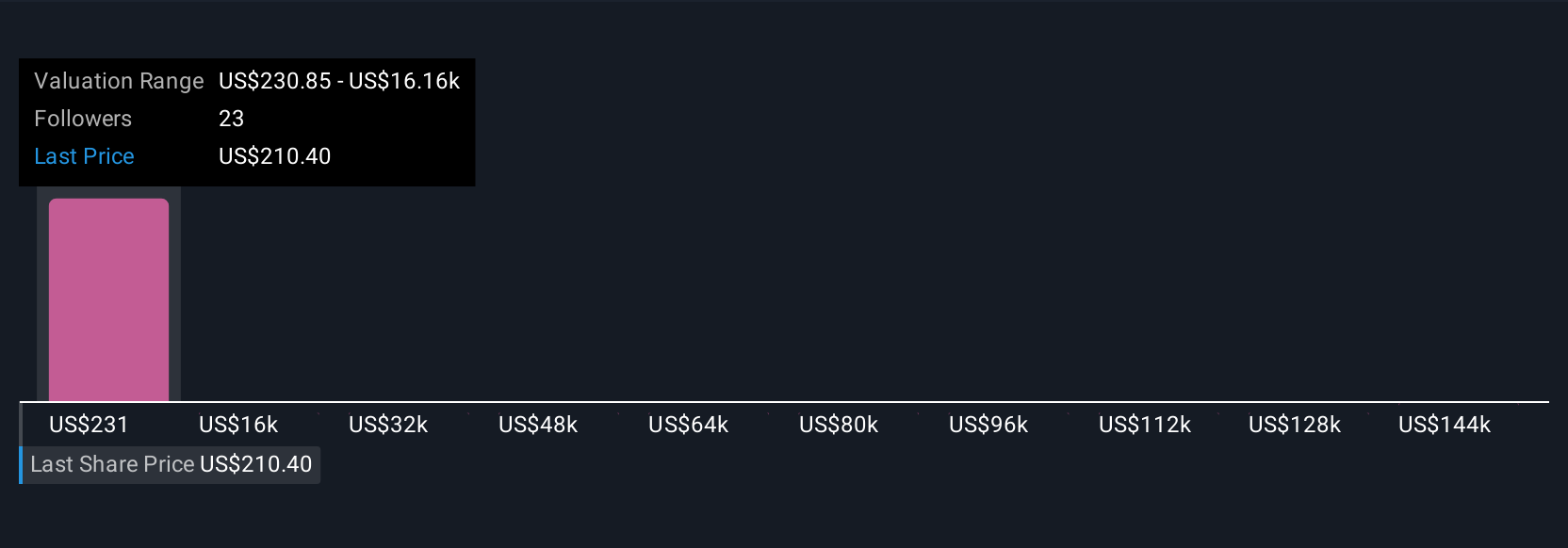

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is an investor’s personalized story about a company. It is how you connect all the facts, forecasts, and assumptions into a clear picture of where a business is headed, with numbers that back up your beliefs.

Narratives link together what is happening in the real world, such as industry trends or company initiatives, with financial forecasts and ultimately a fair value for the stock. On Simply Wall St's Community page, millions of investors are already using Narratives to easily document their outlooks and see how their story stacks up against others in the market.

What makes Narratives powerful is that they help clarify when to buy or sell by letting you compare your calculated Fair Value to the current Price. This makes your investment decisions much more transparent and structured. Plus, as new information emerges, like breaking news or fresh earnings reports, Narratives update automatically so your conclusions always stay relevant.

For example, when it comes to Marsh & McLennan Companies, some investors see strong long-term demand for its risk advisory and insurance services driving a fair value as high as $258 per share, while others factor in industry risks and come up with a fair value as low as $197.

Do you think there's more to the story for Marsh & McLennan Companies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.