Please use a PC Browser to access Register-Tadawul

How Signs of Lower Demand at Tri Pointe Homes (TPH) Has Changed Its Investment Story

TRI Pointe Group Inc TPH | 33.56 | -0.36% |

- Recent reports indicate that Tri Pointe Homes is contending with declining demand and expectations for lower future sales, raising concerns among industry observers.

- This shift in outlook highlights how sensitive homebuilders like Tri Pointe Homes can be to even modest potential slowdowns in buyer activity or appetite.

- We'll explore how the anticipated decrease in demand might reshape the investment narrative presented by analysts for Tri Pointe Homes.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Tri Pointe Homes Investment Narrative Recap

To be a shareholder in Tri Pointe Homes, you’d need to believe that the U.S. housing supply shortage and favorable demographic trends will ultimately outweigh current headwinds like softer buyer demand. The sharp drop in demand highlighted by recent reports could pose a risk to near-term earnings momentum, and may also affect Tri Pointe’s position in its key regions, but it does not appear to change the company’s primary long-term growth opportunity or its main risk, which remains market share loss amid declining orders.

Among recent news, the Q2 2025 earnings report offered new guidance for home deliveries and pricing, projecting fewer sales than previously expected. This update is closely tied to concerns about shrinking demand, as slower absorption rates and lower volumes can increase pressure on profit margins, points that analysts are watching closely as short-term catalysts shift and risks become more prominent.

By contrast, investors should be aware of how continued prioritization of price over sales pace might...

Tri Pointe Homes is projected to have $3.2 billion in revenue and $193.6 million in earnings by 2028. This outlook assumes an annual revenue decline rate of 7.5% and a decrease in earnings of $172.2 million from the current level of $365.8 million.

Uncover how Tri Pointe Homes' forecasts yield a $38.60 fair value, a 20% upside to its current price.

Exploring Other Perspectives

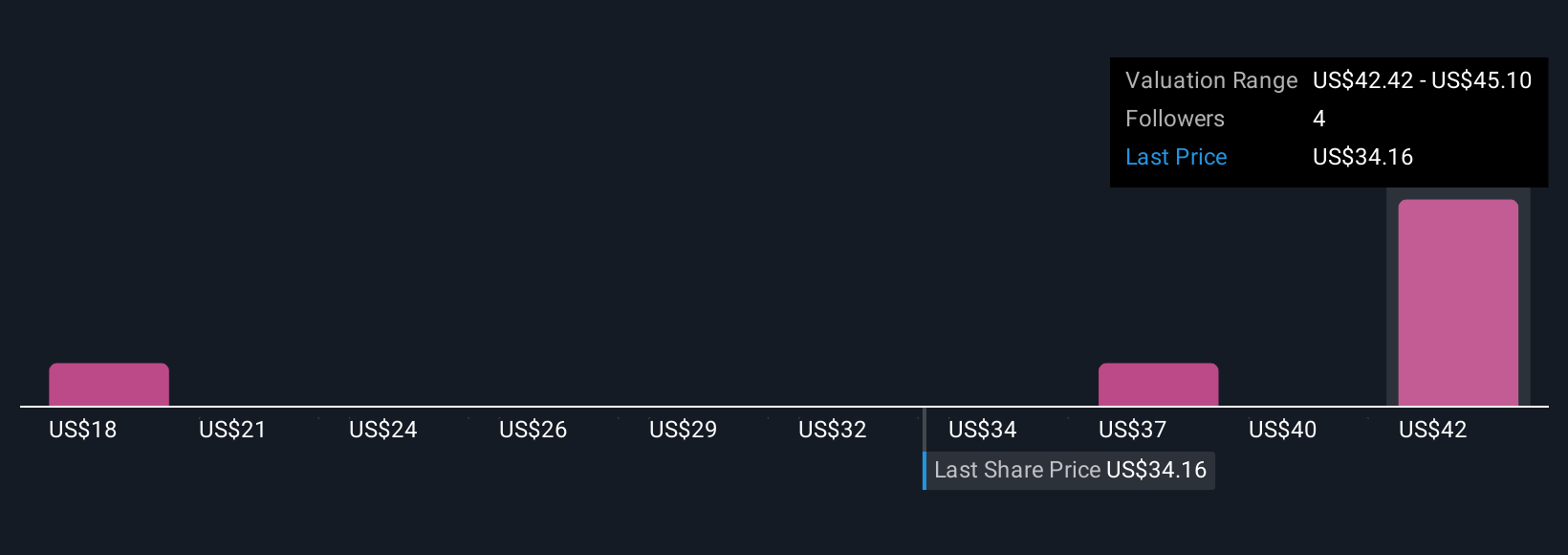

Three private investor fair value estimates from the Simply Wall St Community for Tri Pointe Homes ranged from US$18.35 to US$44.54 per share. While market participants reach different conclusions, analysts note that declining home orders versus peers could have broader implications for future market share and earnings potential.

Explore 3 other fair value estimates on Tri Pointe Homes - why the stock might be worth 43% less than the current price!

Build Your Own Tri Pointe Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tri Pointe Homes research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tri Pointe Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tri Pointe Homes' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.