Please use a PC Browser to access Register-Tadawul

How Softer Timeshare Demand and Higher Leverage Could Impact Hilton Grand Vacations (HGV) Investors

Hilton Grand Vacations, Inc. HGV | 48.54 | +0.77% |

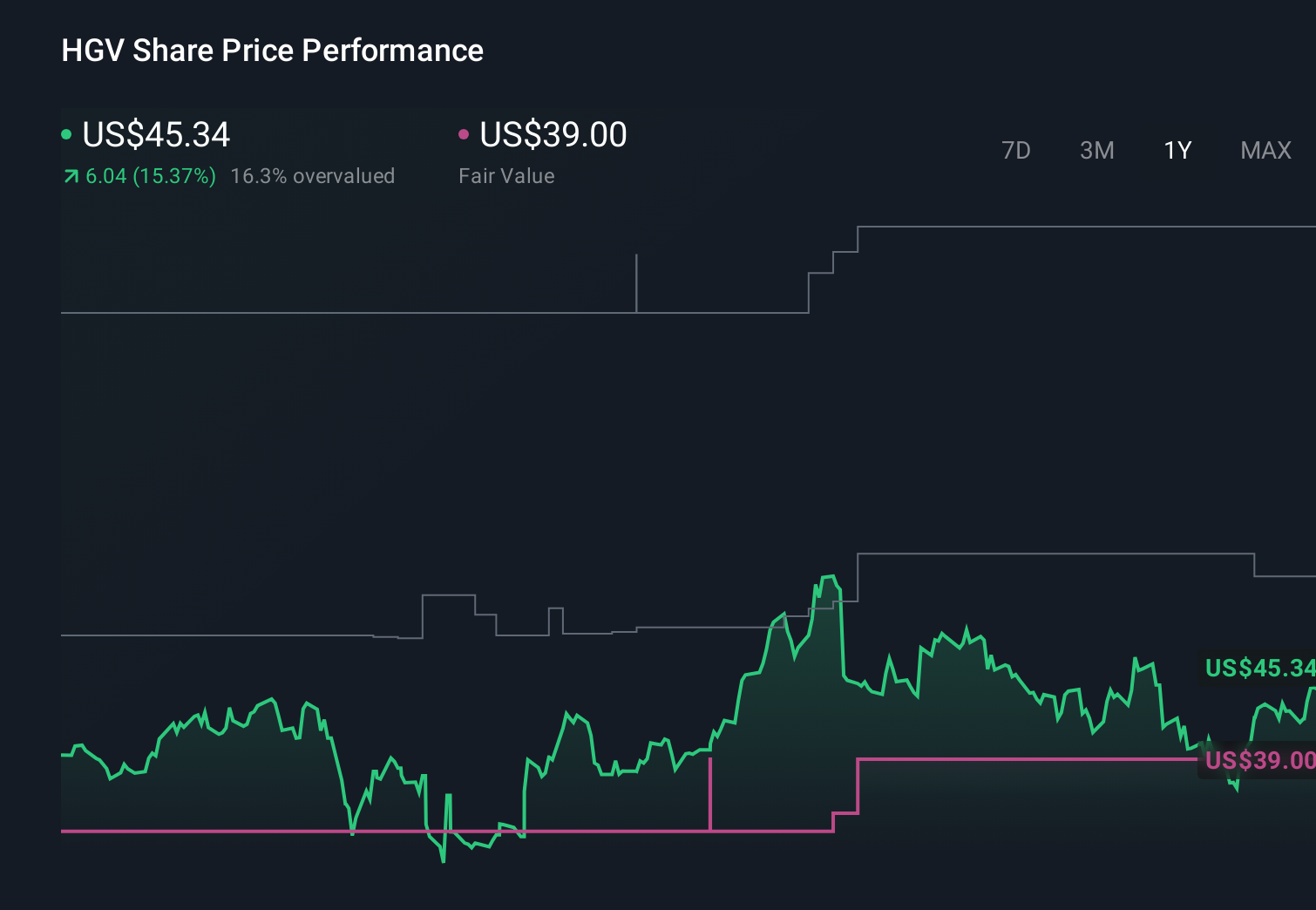

- In recent months, Hilton Grand Vacations has reported softer timeshare demand, reflected in slower growth in member points and fewer tours, alongside declining returns on invested capital and elevated net debt relative to EBITDA.

- This combination of weaker demand signals and higher leverage has sharpened concerns about the company’s ability to protect profitability while managing its financial obligations and credit risk.

- We’ll now examine how weaker member-point growth and associated profitability pressures may influence Hilton Grand Vacations’ existing investment narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Hilton Grand Vacations Investment Narrative Recap

To own Hilton Grand Vacations, you need to believe in the resilience of its timeshare and membership model despite softer tour volumes, slower member-point growth and high leverage. The key near term catalyst remains the company’s ability to stabilize demand without eroding margins, while the most immediate risk is that weaker profitability meets an already elevated net-debt-to-EBITDA position. Recent data on softer demand and declining returns on invested capital directly heighten this balance sheet and credit risk.

Among recent announcements, the company’s US$375 million securitization of timeshare loans in May 2024 stands out in this context. While it improved liquidity and helped pay down other debt, it also reinforces how dependent the business is on capital markets access at reasonable rates, especially when cash generation is pressured by weaker member-point growth and softer tour activity.

Yet behind the brand strength and membership appeal, investors should also be aware of the rising tension between elevated debt and...

Hilton Grand Vacations' narrative projects $6.4 billion revenue and $785.5 million earnings by 2028. This requires 12.6% yearly revenue growth and an earnings increase of about $728.5 million from $57.0 million today.

Uncover how Hilton Grand Vacations' forecasts yield a $51.70 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span from about US$51.70 to over US$54,000, showing just how far apart investor opinions can be. Against this backdrop, recent signs of slowing demand and high leverage give you clear reasons to compare several viewpoints before deciding how Hilton Grand Vacations might fit into your portfolio.

Explore 4 other fair value estimates on Hilton Grand Vacations - why the stock might be worth just $51.70!

Build Your Own Hilton Grand Vacations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hilton Grand Vacations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Grand Vacations' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 108 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.