Please use a PC Browser to access Register-Tadawul

How S&P Global BMI Index Inclusion at Sunrise Communications (SNRE.Y) Has Changed Its Investment Story

- On September 21, 2025, Sunrise Communications AG (SWX:SUNN) was added to the S&P Global BMI Index, marking its inclusion among major global equities.

- Such index additions can attract passive investment flows and elevate the company's visibility to a broader range of institutional investors.

- We’ll explore how joining a widely tracked index could reshape Sunrise Communications' investment narrative by amplifying demand from index-linked funds.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Sunrise Communications' Investment Narrative?

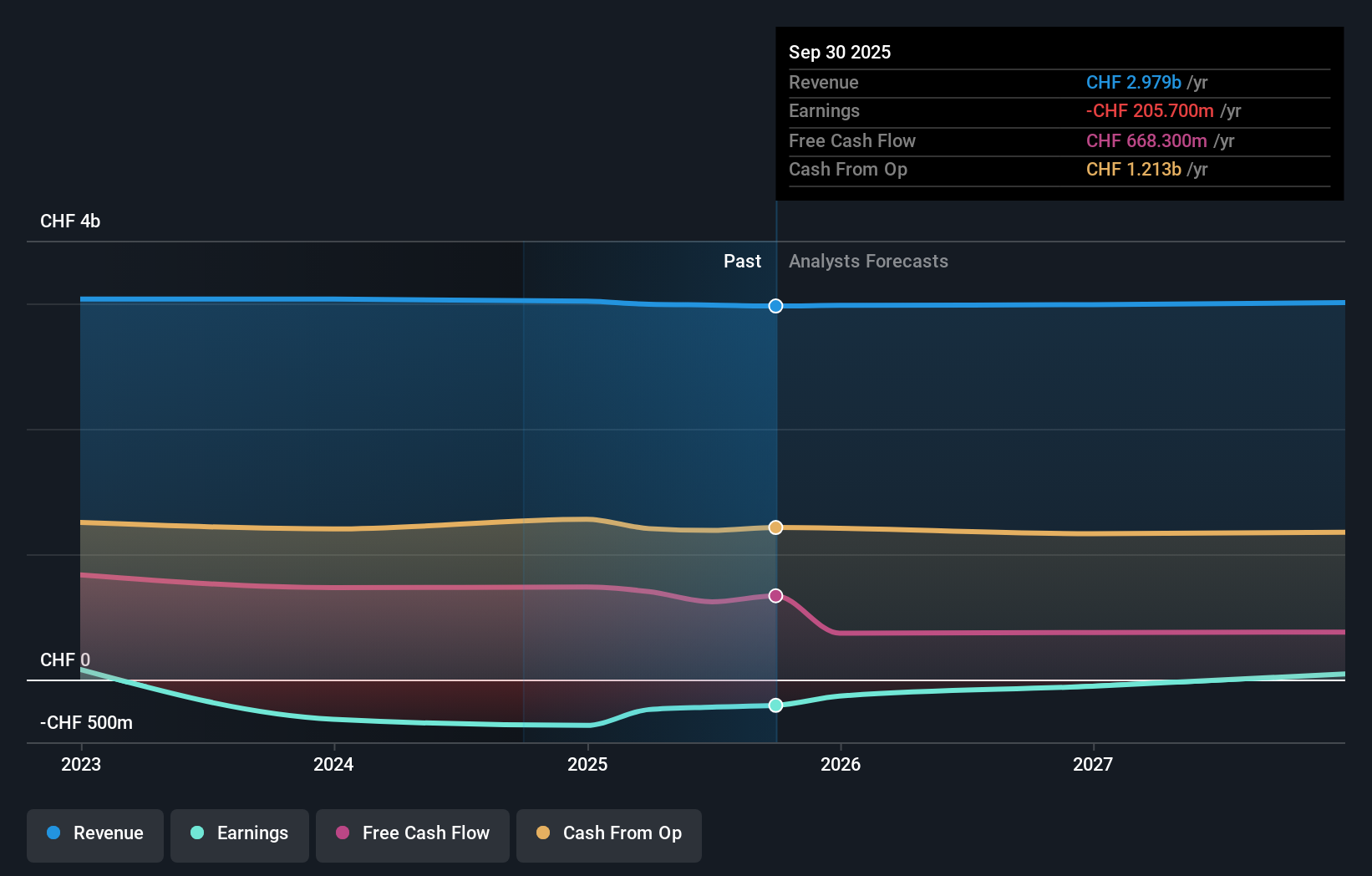

To believe in Sunrise Communications as a shareholder right now, you’d need to have confidence in its ability to turn the corner on profitability while managing sluggish revenue growth. The new inclusion in the S&P Global BMI Index could serve as a short-term catalyst, potentially drawing more passive inflows and profile for the stock at a point when its fundamentals are in a rebuilding phase after last year’s spin-off from Liberty Global. That said, the underlying business is still posting losses despite modest improvements and a stable dividend policy. Prior to this index change, the main risks were margin pressure, slow top-line growth, and whether the turnaround on profits would stick. With visibility from index inclusion, some risk shifts to whether the broader investor interest translates into real, sustained buying, or simply heightened expectations without material fundamental change. The catalyst is real, but the heavy lifting comes down to delivering core operational progress.

But investors need to be mindful of margin pressure that may not be fully offset by index flows. Sunrise Communications' shares have been on the rise but are still potentially undervalued by 23%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Sunrise Communications - why the stock might be worth as much as 19% more than the current price!

Build Your Own Sunrise Communications Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrise Communications research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Sunrise Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrise Communications' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.