Please use a PC Browser to access Register-Tadawul

How Strong Q3 Results and Cost Reductions at Permian Resources (PR) Have Changed Its Investment Story

Permian Resources Corporation (New) Class A PR | 13.50 13.50 | -0.88% 0.00% Pre |

- Earlier this month, Permian Resources attracted positive attention from major analysts following its strong Q3 results, which featured robust free cash flow and significant reductions in both cash and drilling costs due to operational improvements.

- This analyst support highlights both the impact of Permian Resources' operational efficiencies and renewed confidence in its production outlook after surpassing earlier guidance expectations.

- We’ll look at how these operational cost reductions and outperformance might shape Permian Resources' investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Permian Resources Investment Narrative Recap

To own Permian Resources, an investor needs to see continued operational efficiency gains as the core engine for value, while keeping a close eye on commodity prices as the biggest short-term risk. The recent analyst upgrades driven by Q3’s strong free cash flow and cost reductions may support optimism around the company delivering on its most important near-term catalyst, consistent production outperformance, though the impact on commodity price risk is not material in the short run.

One of the most relevant recent announcements is the updated production guidance, which saw management raise its oil and total production targets. This directly ties into analyst confidence, as increased production targets and delivery above expectations offer a tangible catalyst to drive sentiment and could influence Permian Resources’ ability to sustain stronger results amid volatile commodity pricing.

However, investors should also be aware that despite robust operational progress, ongoing uncertainty in oil and gas markets means that if energy prices turn lower...

Permian Resources' outlook projects $6.1 billion in revenue and $1.4 billion in earnings by 2028. This requires 6.1% annual revenue growth and a $0.3 billion increase in earnings from the current $1.1 billion.

Uncover how Permian Resources' forecasts yield a $18.05 fair value, a 26% upside to its current price.

Exploring Other Perspectives

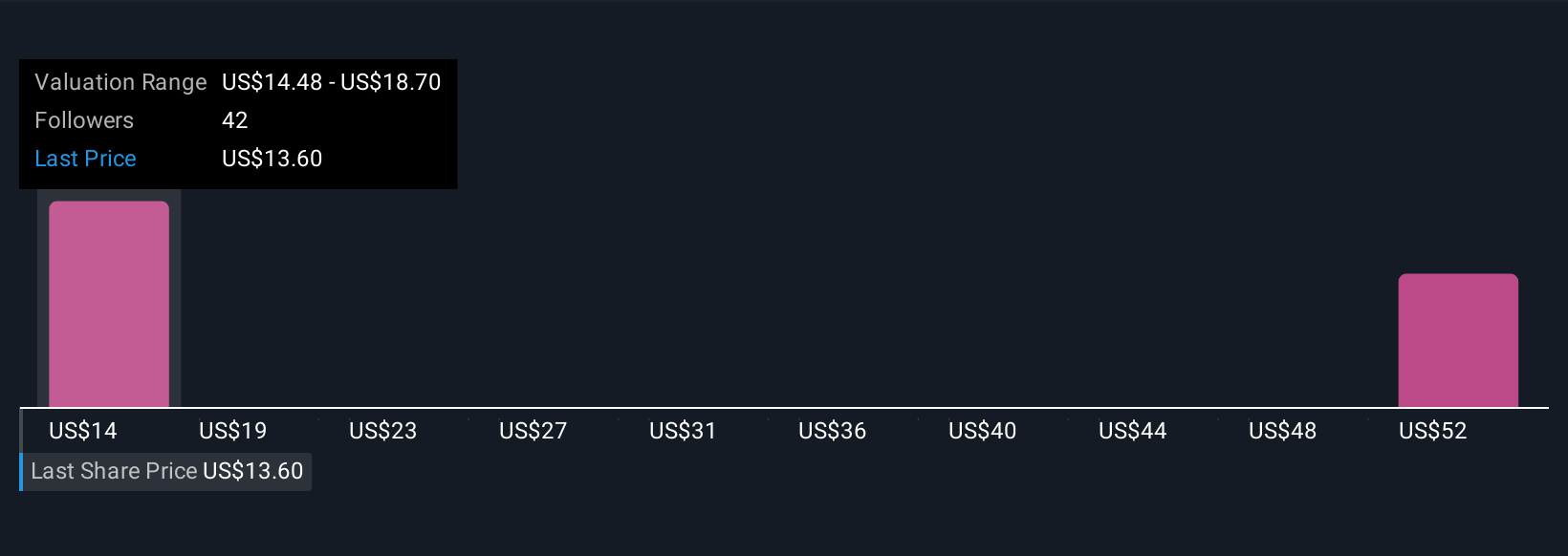

Simply Wall St Community members supplied five different fair value estimates for Permian Resources, ranging from US$11.70 to US$67.05 per share. With this diversity set against analyst focus on cost control and production growth, you get a fuller picture of how expectations around cash flow can influence sentiment and company performance, see how other investors view the same data.

Explore 5 other fair value estimates on Permian Resources - why the stock might be worth over 4x more than the current price!

Build Your Own Permian Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Permian Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Permian Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Permian Resources' overall financial health at a glance.

No Opportunity In Permian Resources?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.