Please use a PC Browser to access Register-Tadawul

How Strong Q3 Results and Higher Dividend Will Impact CVR Partners (UAN) Investors

CVR Partners, LP UAN | 102.50 | +4.30% |

- CVR Partners, LP reported much stronger third quarter 2025 financial results on October 29, with sales rising to US$163.55 million and net income reaching US$43.07 million compared to a year earlier.

- The company also announced a significant increase in its quarterly cash distribution to US$4.02 per common unit, highlighting increased returns for shareholders.

- We'll explore how the impressive growth in earnings and higher dividend shapes CVR Partners' investment narrative going forward.

We've found 23 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is CVR Partners' Investment Narrative?

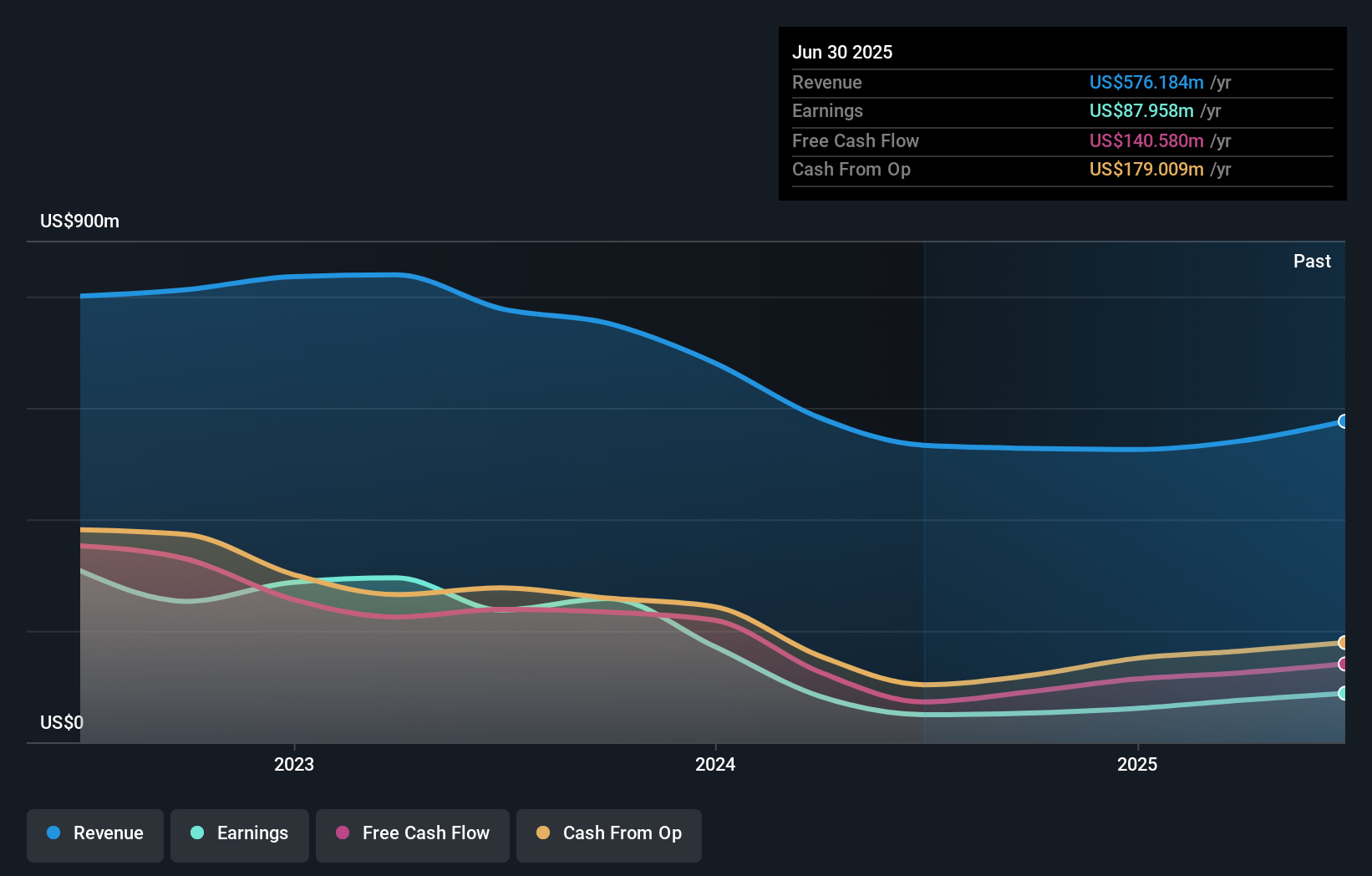

For investors to see the appeal in CVR Partners, belief in the company's ability to deliver strong cash returns even in the notoriously cyclical fertilizer sector is essential. The latest quarterly results, with sales climbing to US$163.55 million and net income surging over tenfold year on year, put near-term profitability in focus and support the board's decision to lift the distribution per unit once again. After this report, the big story shifts to whether this stronger earnings profile, even if market pricing or production rates ease, can be sustained. The major short-term catalyst now is continued distribution growth, which will be tested by commodity price swings and the company’s elevated debt levels. While the business has a seasoned management team and a history of high returns, higher payouts add pressure to maintain earnings through market cycles, amplifying the ongoing risk around dividend coverage.

Yet, not all that glitters is secure, dividend coverage remains a crucial factor to monitor. CVR Partners' shares have been on the rise but are still potentially undervalued by 29%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on CVR Partners - why the stock might be worth as much as 41% more than the current price!

Build Your Own CVR Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CVR Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CVR Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CVR Partners' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.