Please use a PC Browser to access Register-Tadawul

How the Appointment of Former Intel CTO Greg Lavender to Nutanix’s (NTNX) Board Has Changed Its Investment Story

Nutanix, Inc. Class A NTNX | 47.58 | +0.38% |

- On September 17, 2025, Nutanix appointed former Intel CTO Greg Lavender to its board of directors and its Security and Privacy Committee, highlighting his four decades of leadership in software, cloud, AI, and enterprise infrastructure.

- Lavender's extensive background across major technology firms is seen as bolstering Nutanix's expertise in driving innovation for cloud-native applications and artificial intelligence.

- We'll examine how Greg Lavender's addition to the Nutanix board could influence the company's direction and future investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Nutanix Investment Narrative Recap

To be a Nutanix shareholder today, you need confidence in the continued rise of hybrid and multi-cloud adoption, as well as the company's ability to drive innovation and expand its software-defined data platform. The recent addition of Greg Lavender to the board is a positive signal for technical leadership, yet it is not likely to significantly affect the near-term catalyst of expanding large enterprise customer relationships, nor does it materially change the biggest risk posed by ongoing competitive pressure from the public cloud sector.

Recent client announcements highlight new integrations with Nutanix and NVIDIA, particularly Omnissa's efforts to unify server management and endpoint integration. These moves support current catalysts around broadening addressable market and deepening enterprise IT modernization partnerships, indirectly underscoring the relevance of board expertise in areas like cloud-native architectures and AI-driven solutions.

Yet, in contrast to management's growth ambitions, investors should remain aware of persistent risks tied to...

Nutanix's narrative projects $3.9 billion revenue and $513.0 million earnings by 2028. This requires 15.3% yearly revenue growth and a $324.6 million earnings increase from $188.4 million today.

Uncover how Nutanix's forecasts yield a $87.03 fair value, a 13% upside to its current price.

Exploring Other Perspectives

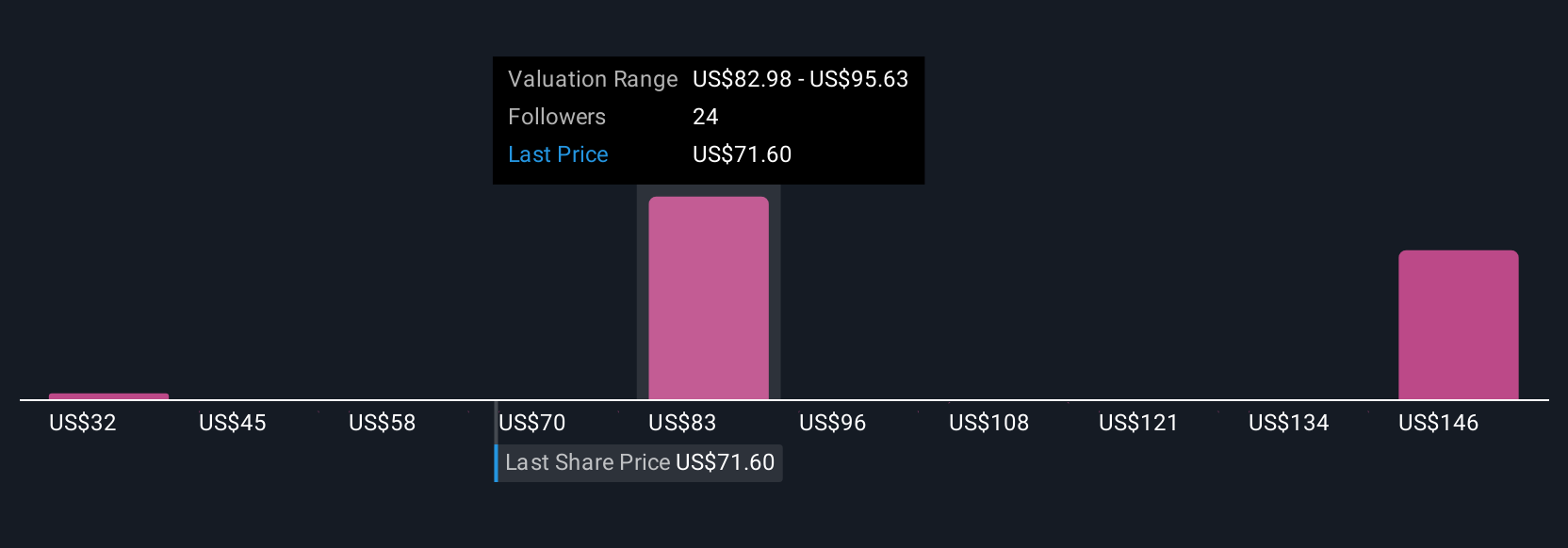

Seven members of the Simply Wall St Community estimate Nutanix's fair value between US$32.34 and US$118.13. While opinions differ widely, growing competition from hyperscale public cloud vendors may influence future outcomes in ways not all perspectives address.

Explore 7 other fair value estimates on Nutanix - why the stock might be worth less than half the current price!

Build Your Own Nutanix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nutanix research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nutanix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nutanix's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.