Please use a PC Browser to access Register-Tadawul

How the Blackstone Partnership is Shaping Tempus AI’s Current Stock Value Debate

Tempus AI TEM | 70.61 71.29 | -4.40% +0.96% Pre |

Thinking about what to do with Tempus AI stock right now? You are definitely not alone. After a string of headline-grabbing moves, this healthcare technology player is catching the attention of both seasoned investors and new entrants alike. Over the past year, shares have gained a solid 24%, surging more than 25% in the last three months alone. That type of momentum gets people talking, especially when you consider that the stock recently pulled back around 6.8% in a single day before bouncing back for a 10% gain over the past week. Clearly, both volatility and growth potential are present as Wall Street evaluates Tempus AI’s story.

Much of this price action is happening against the backdrop of optimism around Tempus AI’s tech-driven approach to healthcare and recent buzz about its partnerships and product launches. While some investors see the rally as a vote of confidence in the company’s ability to change the game, others wonder whether current levels are sustainable or if the market is reassessing the risks involved.

On paper, though, the typical undervalued stock screeners are not signaling green flags here. Tempus AI scores a 0 out of 6 on our valuation checklist for undervalued companies, suggesting the market is not missing any easy bargains at first glance. But valuation is tricky, and in the sections ahead, we are going to break down the main methods analysts use to value a company like Tempus AI, then wrap up with a smarter way to think about what these numbers really mean for your next move.

Tempus AI delivered 24.5% returns over the last year. See how this stacks up to the rest of the Life Sciences industry.Approach 1: Tempus AI Cash Flows

A Discounted Cash Flow (DCF) model takes Tempus AI’s future expected cash flows, projects them out over time, and then discounts them back to today’s dollars. The aim is to estimate what the business is truly worth as of now. Essentially, it tries to answer the question: if you owned all of Tempus AI, what would those future cash flows be worth to you today?

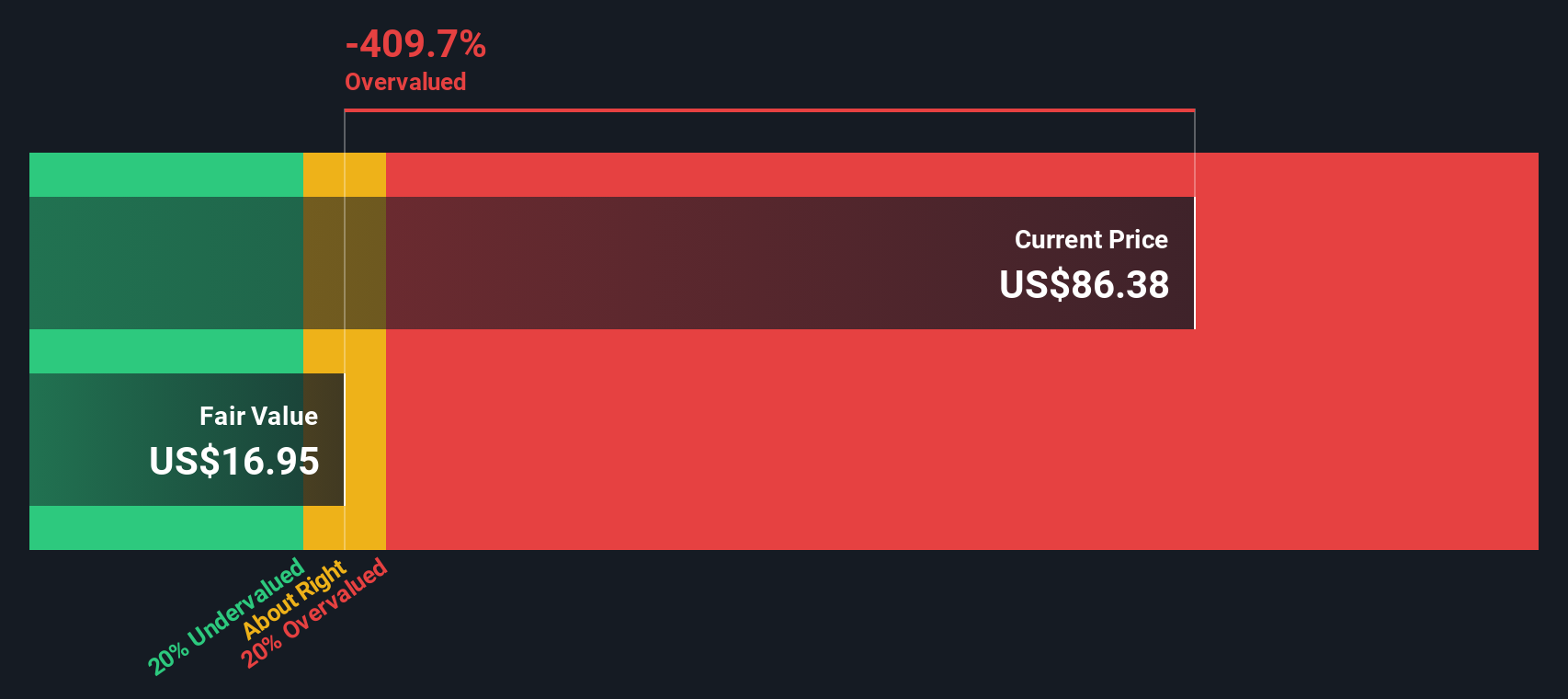

Looking at the latest numbers, Tempus AI is currently generating negative Free Cash Flow (FCF), with a reported -$90.1 million over the last twelve months. Projections indicate, however, a rapid improvement, with annual FCF forecast to rise steadily in the coming years and reach $168.3 million in 2035. That growth expectation is incorporated into a two-stage model, which produces an estimated intrinsic value for the company of $17.10 per share using these cash flows and discount rates.

Comparing this intrinsic value to Tempus AI’s current trading price, the analysis finds the stock is 327.3% overvalued. This suggests today’s price is considerably higher than what is justified by expected future cash generation.

Result: OVERVALUED

Approach 2: Tempus AI Price vs Sales

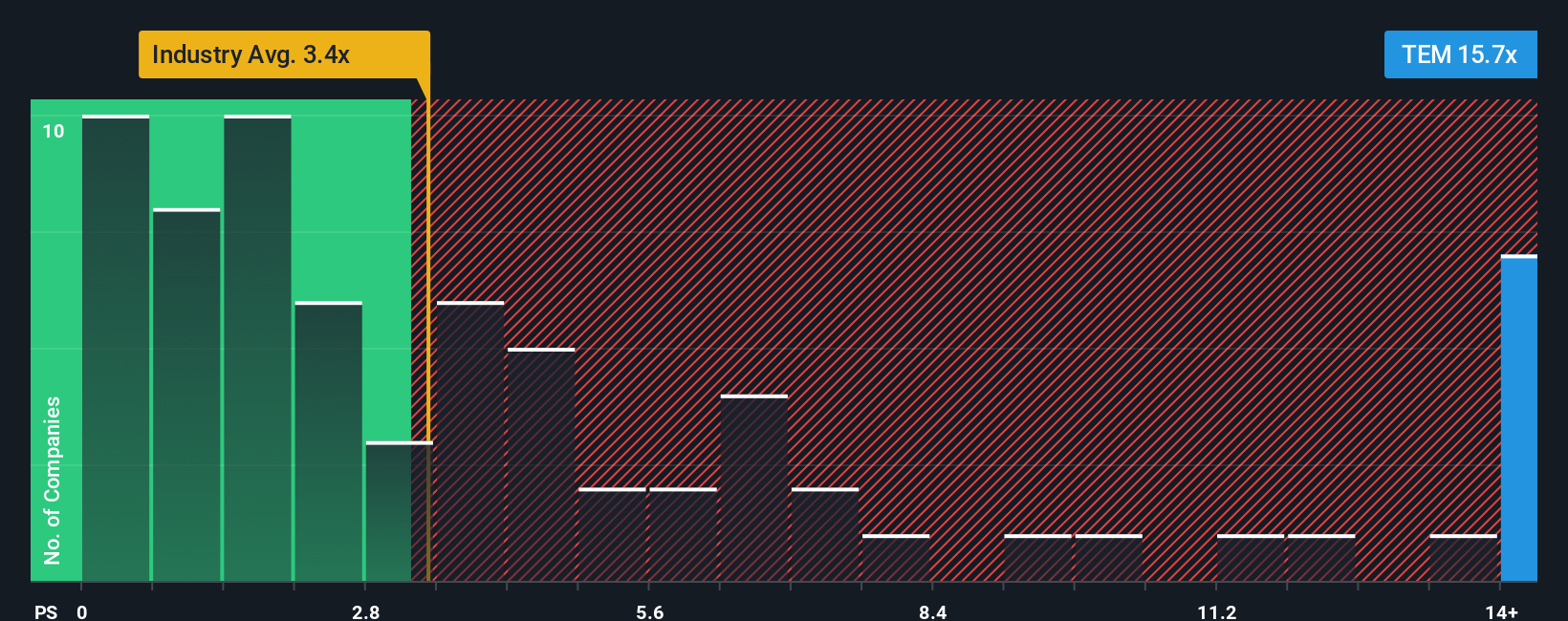

The Price-to-Sales (P/S) ratio is often a practical way to value rapidly growing companies like Tempus AI, especially when profits are not yet positive. The P/S ratio provides a straightforward comparison, showing how much investors are paying for each dollar of current sales. It is particularly relevant for early-stage or tech-heavy companies still investing heavily in growth.

Growth expectations and perceived risk play a big part in determining what counts as a normal or “fair” P/S ratio. Higher growth potential, expanding market opportunities, and unique advantages can justify paying a higher multiple. However, if sales growth slows or risks increase, investors may expect a lower multiple as a tradeoff.

Currently, Tempus AI is trading on a P/S ratio of 13.34x. That is well above the Life Sciences industry average of 3.36x and also higher than its peer group, which averages around 4.10x. To factor in Tempus AI’s unique characteristics, the proprietary Fair Ratio from Simply Wall St considers its growth outlook, industry dynamics, profit margin, market cap, and risk profile. The Fair Ratio for Tempus AI comes out to 9.41x, indicating the current P/S is significantly higher than what these fundamentals support.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Tempus AI Narrative

Rather than focusing only on valuation ratios or forecasts, building a "Narrative" means connecting the story you believe about Tempus AI, from its competitive advantages or challenges to how quickly it attracts new customers and partners, directly to your assumptions for future revenue, earnings, and margins.

Narratives are a simple, accessible tool within Simply Wall St that let you define your perspective on where Tempus AI is headed, link it to concrete financial forecasts, and instantly see an estimated fair value tailored to your view rather than just the market consensus.

This approach helps you decide whether to buy, hold, or sell by clearly showing how your fair value compares with the current share price. Because Narratives update dynamically as news or results emerge, your decision framework always reflects the latest developments.

For example, looking at recent analyst Narratives on Tempus AI, some investors see expansion in genomic testing and AI as supporting a high $75 per share fair value, while others point to industry risks, giving a more cautious $60. This allows you to easily explore both the bullish and bearish perspectives before making your own call.

Do you think there's more to the story for Tempus AI? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.