Please use a PC Browser to access Register-Tadawul

How United Airlines Stock Stacks Up After Announcing Record Summer Flight Schedule

United Airlines Holdings UAL | 106.84 | -1.43% |

If you have been following United Airlines Holdings or considering it for your next investment, the timing could not feel more interesting. The stock has had a dramatic journey over the past several years, surging 183.8% over three years and 166.8% in the last five years. Even over a one-year window, there has been a robust 64% return. However, most recently, there has been a pause. Shares have contracted 1.6% over the past week and nearly 9% in the last month. You might be wondering whether these short-term slips are red flags or simply new opportunities as market sentiment adapts to shifting expectations in travel demand, fuel trends, and broader economic signals.

As United’s price hovers near $97 per share and the market takes a breath, investors are naturally asking, “Is United Airlines Holdings undervalued, fairly priced, or getting stretched?” Breaking it down by valuation checklist, United currently scores a 2 out of 6. This means it passes two key undervaluation tests, but there is still room for scrutiny and debate. It is this kind of mixed picture that demands a closer look, especially since valuation is not always as straightforward as checking boxes.

Next, we will look into the traditional methods behind that valuation score, showing where United stands on the standard metrics. If you stick with me to the end, there is an even more nuanced way to size up the company’s worth, which could offer added perspective.

United Airlines Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: United Airlines Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This method focuses on what United Airlines Holdings is expected to generate for shareholders in the years to come.

Currently, United’s last twelve months’ Free Cash Flow stands at approximately $2.89 billion. Analyst estimates are available through 2028, when Free Cash Flow is expected to be $1.31 billion. For the following years, projections are extrapolated, with numbers gradually tapering off. These progressive declines are part of Simply Wall St’s two-stage Free Cash Flow to Equity estimate, which aims to capture both immediate analyst expectations and longer-term trends.

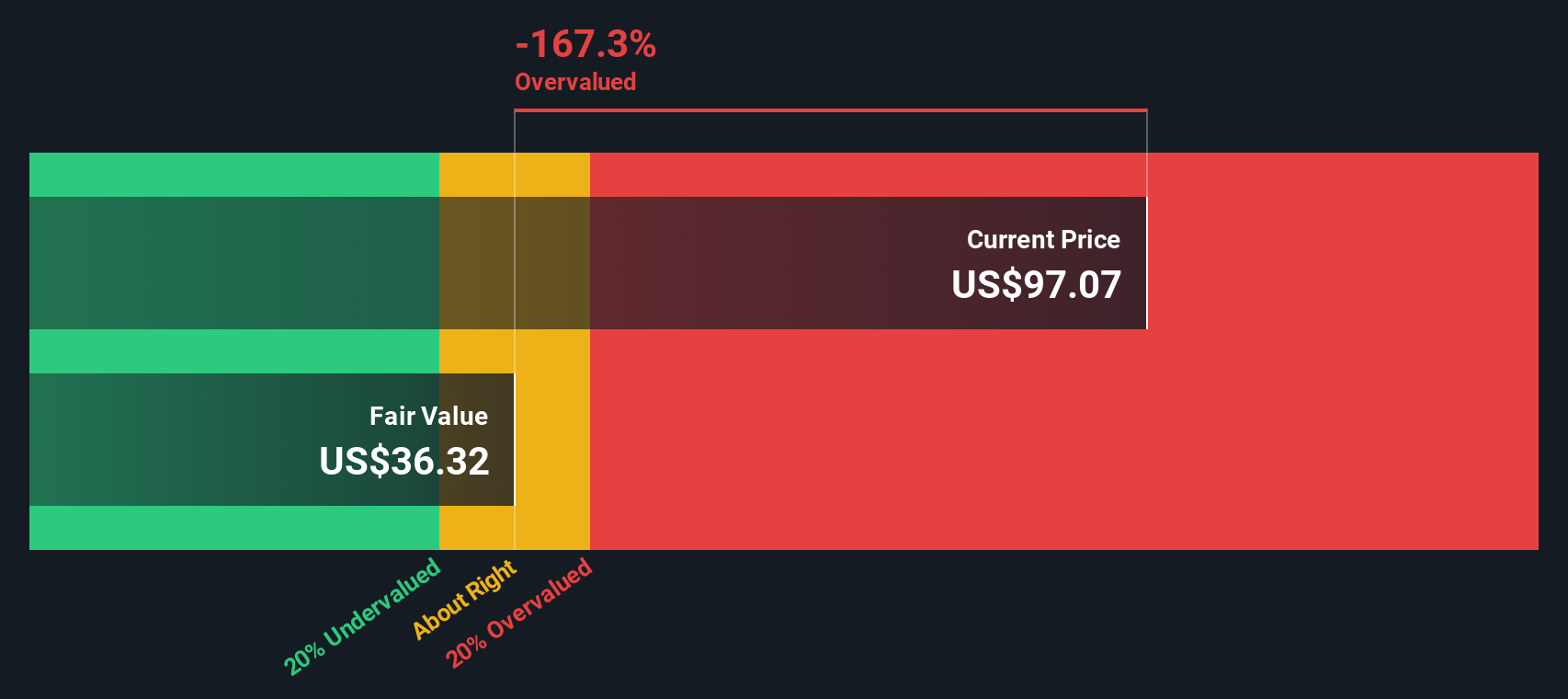

Taking all these cash flows together and discounting them appropriately, the DCF model arrives at an intrinsic value of $36.32 per share. With United’s current share price around $97, this suggests the stock is trading at a 167.3% premium to its estimated fair value using this approach. In DCF terms, United Airlines Holdings appears substantially overvalued at this moment.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Airlines Holdings may be overvalued by 167.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: United Airlines Holdings Price vs Earnings

When it comes to profitable companies like United Airlines Holdings, the Price-to-Earnings (PE) ratio is a go-to tool for investors. This metric helps you see how much investors are willing to pay today for a dollar of United's earnings. Generally, if the company is expected to grow quickly or carries lower risk, investors will accept a higher PE ratio. Conversely, lower growth prospects or higher risks mean a lower "fair" PE is justified.

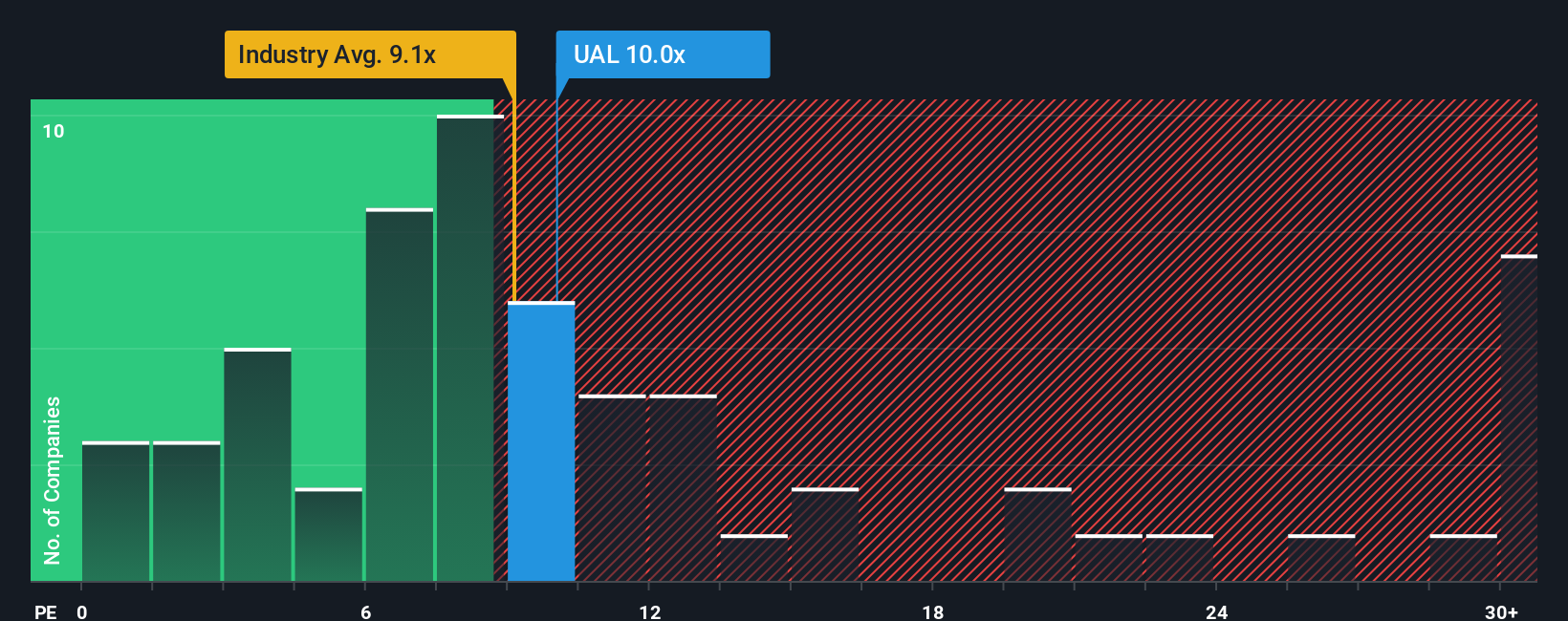

United’s current PE ratio stands at 9.5x. Compared to the airline industry average, which is about 9.3x, and a peer group average of 20.9x, United appears valued in line with the broader industry but quite a bit below its peers. However, rather than stopping here, it is helpful to check what Simply Wall St calls the "Fair Ratio." For United, this proprietary fair PE is calculated at 13.7x, which reflects not just the airline's earnings growth, but also its profit margin, market cap, industry specifics, and underlying risks.

Why is the Fair Ratio preferable to just using the industry or peer group averages? Because it tailors the expected multiple to United's unique characteristics. It recognizes, for example, that a company with stronger growth or safer fundamentals might warrant a premium, while riskier or slower-growing peers merit a discount. Simply Wall St’s Fair Ratio brings those subtle but critical distinctions into focus.

Comparing United’s actual PE ratio (9.5x) to its Fair Ratio of 13.7x, the stock currently trades noticeably below what would be expected. This suggests that by this measure, United Airlines Holdings looks undervalued relative to its growth outlook and risks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

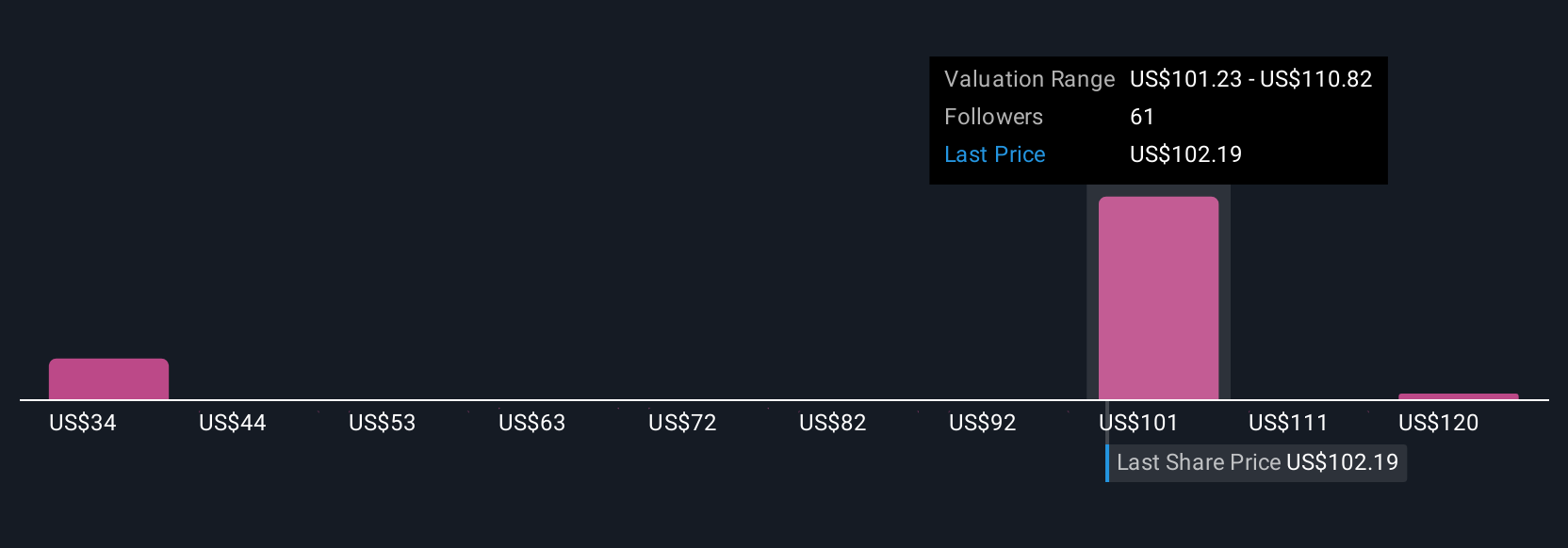

Upgrade Your Decision Making: Choose your United Airlines Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are Simply Wall St's unique approach that lets you build a story for a company like United Airlines Holdings, connecting your expectations for its business drivers and performance directly to a financial forecast and fair value estimate.

This means you can interpret the numbers not just in isolation, but in the context of your own take on the company's future, whether that’s optimism about expanding premium cabins driving higher yields and margins, or concern over complex risks such as debt levels and industry competition.

Narratives link your thesis about how United will perform to a tangible valuation that helps you decide whether the stock is a buy, hold, or sell at today's price. They are automatically updated as new news or earnings are released. The best part is, Narratives are built-in and simple to use within the Simply Wall St Community page, making this dynamic and transparent decision-making tool available for millions of investors.

For example, in United's case, bullish Narratives might highlight international expansion and premium upgrades, while bearish Narratives could focus on debt risks and market headwinds. Each presents a different fair value benchmark to act on as new data emerges.

Do you think there's more to the story for United Airlines Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.