Please use a PC Browser to access Register-Tadawul

How Vertex’s (VRTX) Return to Profitability and Pain Drug Setback May Shape Its Future Pipeline

Vertex Pharmaceuticals Incorporated VRTX | 477.92 | +4.17% |

- In the past week, Vertex Pharmaceuticals reported its second quarter 2025 results, returning to profitability with revenue of US$2.96 billion and net income of US$1.03 billion, while simultaneously announcing that its investigational pain drug VX-993 failed to meet efficacy endpoints in a Phase 2 trial and will not be further developed as monotherapy for acute pain.

- This mixed announcement highlights both the recovery in Vertex's financial performance and an unexpected setback to the company's pipeline diversification strategy outside its core cystic fibrosis business.

- We’ll now explore how the halted VX-993 pain program development could affect Vertex’s projected pipeline growth and earnings quality.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

Vertex Pharmaceuticals Investment Narrative Recap

To be a shareholder in Vertex Pharmaceuticals, you need confidence in its ability to extend beyond its dominant cystic fibrosis (CF) business and successfully launch and scale new therapies. The recent failure of the VX-993 pain program, while disappointing for pipeline diversification, does not materially impact near-term results, as the CF franchise and emerging launches like ALYFTREK remain the primary performance drivers. Near-term, the greatest catalyst is broader commercialization of new approvals, while the largest risk remains overdependence on mature CF assets amidst evolving competitive pressures.

Among recent company developments, Vertex’s reaffirmed 2025 revenue guidance of US$11.85 billion to US$12 billion stands out. This is critical in light of the VX-993 news: maintaining guidance suggests management still sees robust sales momentum from its current portfolio, particularly CF therapies and newer launches, cushioning the impact from the halted pain program on projected growth.

On the other hand, what investors should pay close attention to is the risk that even with strong current cash flows, setbacks outside CF spotlight how long-term growth could stall if...

Vertex Pharmaceuticals' outlook projects $15.1 billion in revenue and $5.6 billion in earnings by 2028. This scenario relies on a 9.7% annual revenue growth rate and a $2.0 billion increase in earnings from the current $3.6 billion level.

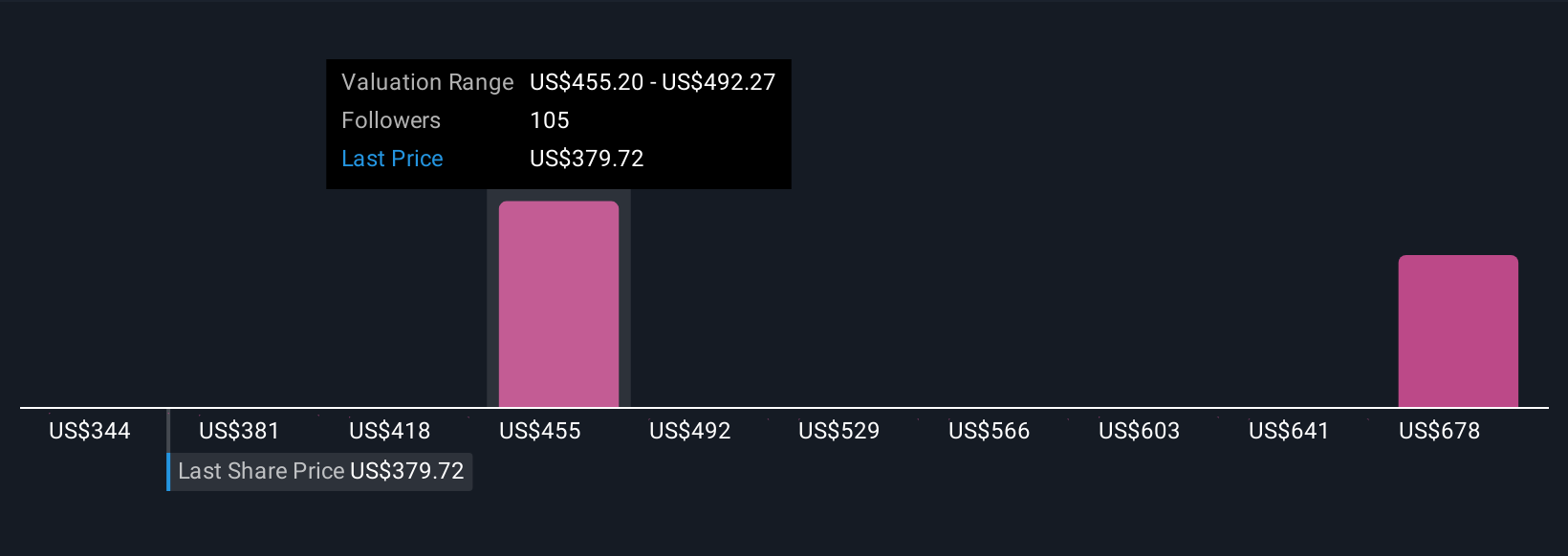

Uncover how Vertex Pharmaceuticals' forecasts yield a $487.74 fair value, a 26% upside to its current price.

Exploring Other Perspectives

While the consensus view highlights Vertex’s ability to weather setbacks, the most optimistic analysts expected revenue to reach US$16.9 billion by 2028 and assume pipeline therapies would rapidly offset any program failures, seeing opportunities like ALYFTREK as accelerating CF expansion. Whether this latest pain program news will meaningfully change those forecasts reveals just how much opinions can differ, so it is worth considering several perspectives before deciding what matters most to you as a shareholder.

Explore 7 other fair value estimates on Vertex Pharmaceuticals - why the stock might be worth 6% less than the current price!

Build Your Own Vertex Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertex Pharmaceuticals research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Vertex Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertex Pharmaceuticals' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.