Please use a PC Browser to access Register-Tadawul

How Viasat’s (VSAT) Q3 Return To Profitability Has Changed Its Investment Story

ViaSat, Inc. VSAT | 46.50 | +1.44% |

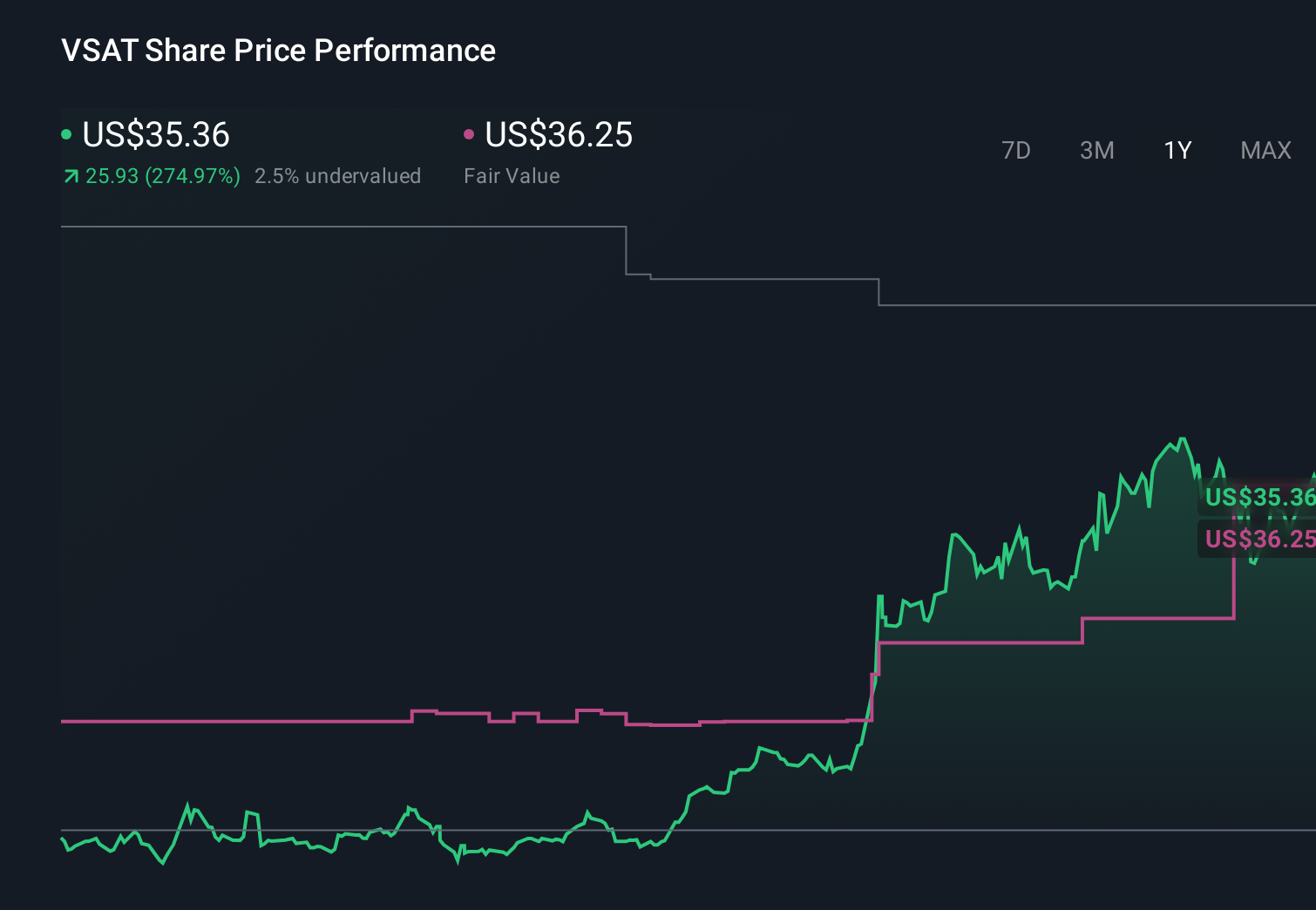

- On February 5, 2026, Viasat, Inc. reported third‑quarter 2026 results showing revenue of US$1,157.05 million and net income of US$24.97 million, compared with revenue of US$1,123.77 million and a net loss of US$158.41 million a year earlier.

- The return to profitability, with diluted earnings per share from continuing operations improving to US$0.18 from a US$1.23 loss, signals meaningful progress in lifting earnings quality while nine‑month results still reflect a US$92.91 million net loss.

- Now we’ll examine how Viasat’s return to profitability this quarter reshapes its existing investment narrative and future earnings assumptions.

The future of work is here. Discover the 30 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

Viasat Investment Narrative Recap

To own Viasat, you need to believe its heavy satellite and network investments can translate into durable cash generation despite high leverage, intense competition, and regulatory complexity. The third quarter return to profitability supports that thesis at the margin, but the key near term catalyst remains execution on ViaSat‑3 and Inmarsat integration, while the biggest risk is still that ongoing capital spending and debt servicing keep straining free cash flow and limit earnings quality.

The most relevant recent announcement here is the November 14, 2025 confirmation that ViaSat‑3 Flight 2 successfully launched, with service entry targeted for early 2026. The Q3 profit print sits against this backdrop of expanding capacity, making it easier to see how new satellites, government contracts, and maritime and aviation products could support future revenue, while also underscoring how any missteps with ViaSat‑3 could quickly reintroduce margin pressure.

Yet against this progress, investors should also be aware of the risk that mounting capital needs and debt costs could still...

Viasat's narrative projects $5.0 billion revenue and $534.2 million earnings by 2028.

Uncover how Viasat's forecasts yield a $41.12 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Some of the most pessimistic analysts were assuming only about 2.8 percent annual revenue growth and no profitability in the next three years, so this quarter’s profit and the risks from rising LEO and terrestrial competition may prompt you to reassess which narrative you find more convincing.

Explore 7 other fair value estimates on Viasat - why the stock might be worth as much as 63% more than the current price!

Build Your Own Viasat Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viasat research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Viasat research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viasat's overall financial health at a glance.

No Opportunity In Viasat?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with 27 elite penny stocks that balance risk and reward.

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.