Please use a PC Browser to access Register-Tadawul

How Will Leadership Transition and Profit Dip Shape Berkshire Hathaway’s (BRK.A) Investment Story?

Berkshire Hathaway Inc. Class A BRK.A | 762569.63 | +0.74% |

- Berkshire Hathaway reported second-quarter 2025 earnings, revealing sales of US$5,118 million and net income of US$12,370 million, both up slightly in revenue but down significantly in profit compared to a year earlier.

- As the company prepares for Warren Buffett’s announced retirement and Greg Abel’s succession, investors are closely watching how leadership transition impacts the company’s direction and steady performance.

- We’ll examine how Berkshire Hathaway’s unexpectedly lower profit and upcoming leadership change may influence its long-held investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Berkshire Hathaway's Investment Narrative?

Being a Berkshire Hathaway shareholder has always been about trusting in the long game and believing in the company’s ability to compound capital through diversified, quality assets under a disciplined management team. The recent quarterly update, flat revenue and a sharp drop in net income, doesn’t fundamentally change the big picture, though it puts a spotlight back on earnings volatility and the importance of the upcoming leadership transition. With Warren Buffett set to retire and Greg Abel confirmed as his successor, most immediate catalysts now revolve around whether the new leadership can maintain operational stability, prudent capital allocation, and investor confidence. Given the company’s long-term focus, the dip in quarterly profit feels more like a headline than a signal of any major, lasting business risk for now. The share price’s moderate pullback since the announcement underscores that sentiment: the perceived catalyst is Abel’s leadership, while the biggest near-term risk is market confidence during the management transition.

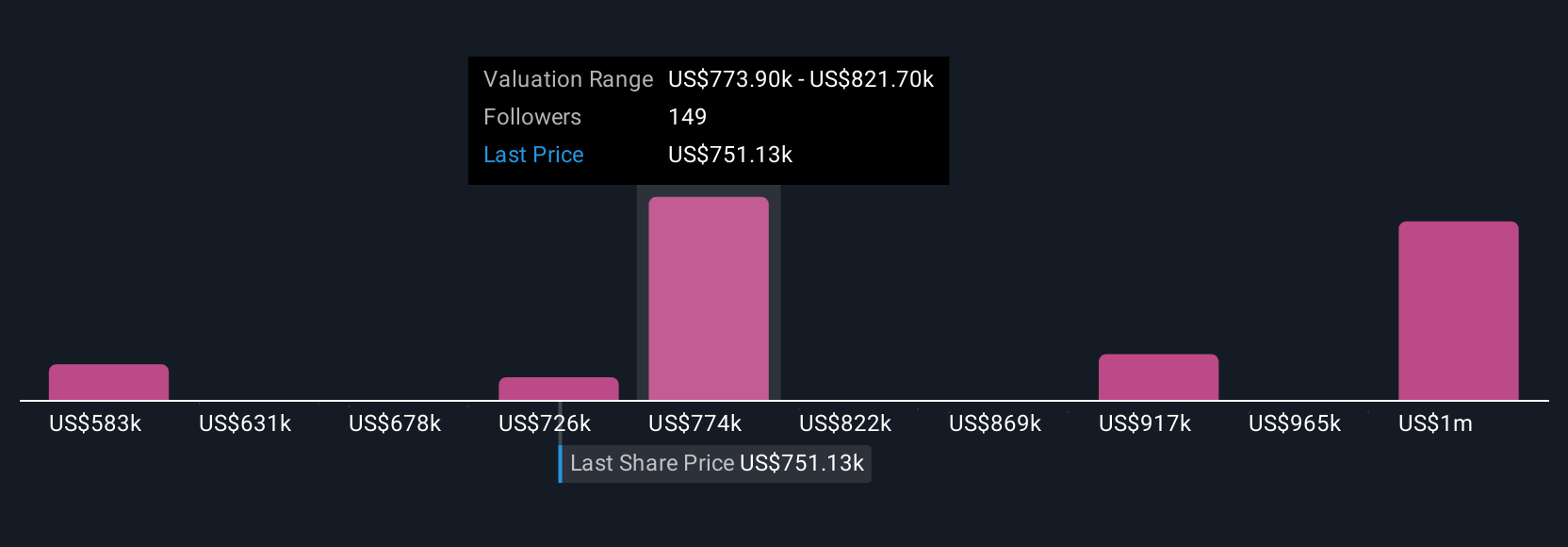

But with leadership in flux, will confidence hold through this handover? Berkshire Hathaway's shares have been on the rise but are still potentially undervalued by 33%. Find out what it's worth.Exploring Other Perspectives

Explore 27 other fair value estimates on Berkshire Hathaway - why the stock might be worth 18% less than the current price!

Build Your Own Berkshire Hathaway Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Berkshire Hathaway research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Berkshire Hathaway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Berkshire Hathaway's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.