Please use a PC Browser to access Register-Tadawul

How Will TriNet’s New AI HR Tools Shape Technology-Driven Growth for TNET Investors?

TriNet Group, Inc. TNET | 59.29 | +1.68% |

- TriNet recently announced a suite of AI-powered HR capabilities aimed at providing intelligent, responsive support for small and medium-sized businesses, including a virtual Personal Health Assistant, a TriNet Assistant for HR inquiries, and a customizable dashboard for platform access.

- This launch highlights TriNet's adoption of a human-in-the-loop AI model, where technology automates routine HR tasks while expert professionals continue to offer personalized guidance and insight.

- We'll examine how TriNet's integration of AI-powered HR tools influences its investment narrative and the outlook for technology-driven growth.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

TriNet Group Investment Narrative Recap

To be a TriNet shareholder, you need confidence in the company’s ability to sharpen its long-term earnings growth by effectively marrying proprietary technology with HR expertise, particularly as client retention and recurring revenue become more vital amid workforce and fee-related pressures. TriNet’s latest AI-powered HR tools demonstrate a commitment to improved customer efficiency, but the current announcement is unlikely to materially shift what remains the biggest short-term catalyst, gaining traction among new and existing SMB clients, as well as the headwind of persistent healthcare cost inflation.

Among the product innovations, the Personal Health Assistant, a 24/7 AI-enabled virtual health resource, stands out as highly relevant. By streamlining healthcare queries and reducing administrative complexity, this tool could strengthen TriNet's client value proposition, which ties directly into customer acquisition and retention, a key earnings driver as SMBs weigh PEO options in a tough market. But while technology investments help address some frictions, questions remain about how much they can offset the ongoing risks rooted in fee increases and competition.

In contrast, investors should pay careful attention to how fee hikes might...

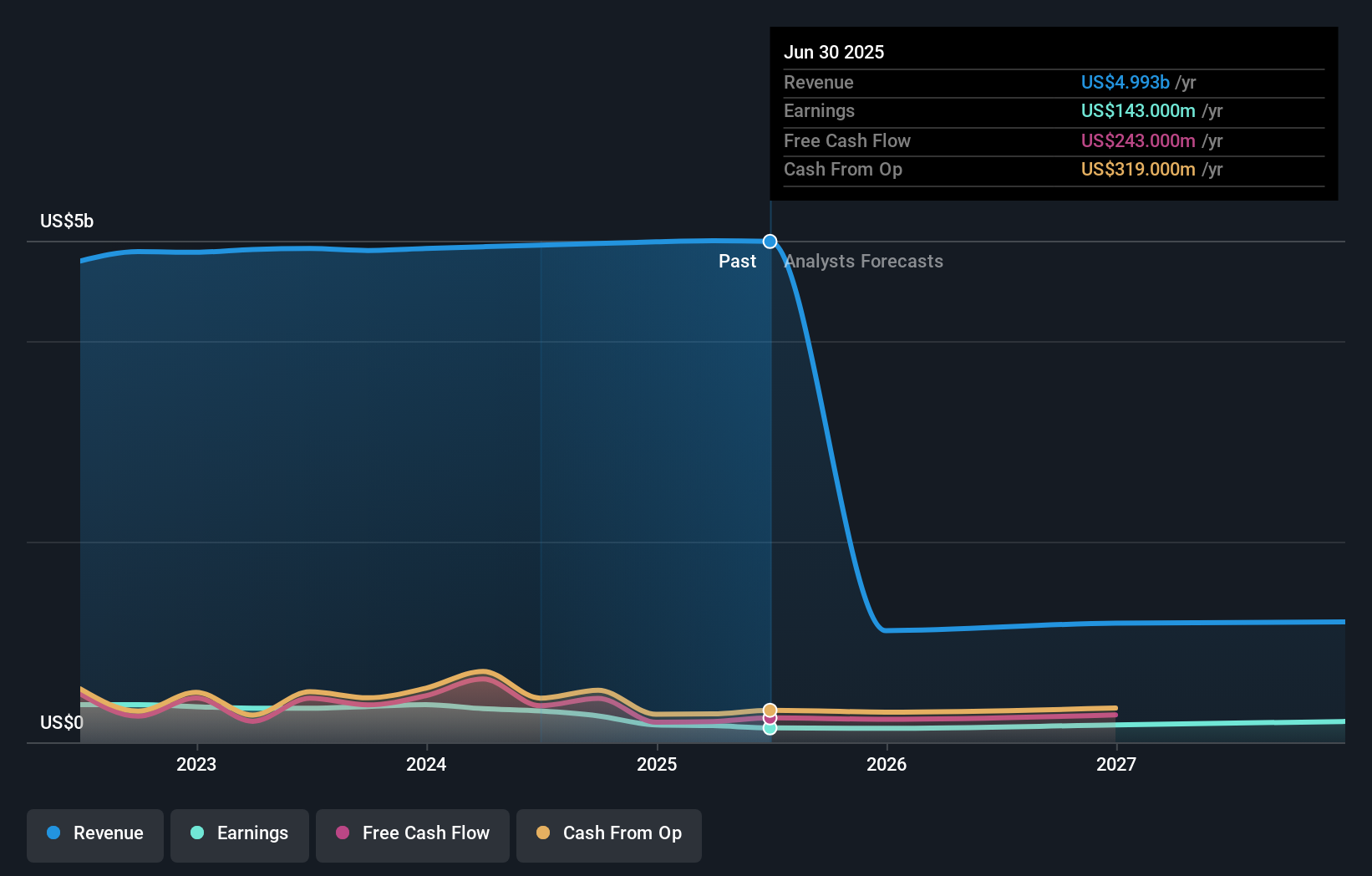

TriNet Group's outlook forecasts $408.0 million in revenue and $220.2 million in earnings by 2028. This scenario assumes a 56.6% annual revenue decline and an earnings increase of $77.2 million from current earnings of $143.0 million.

Uncover how TriNet Group's forecasts yield a $77.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members place TriNet's fair value between US$62.22 and US$77, with two distinct opinions published. Consider how client retention risk and pressure from health plan fee hikes may challenge future recovery potential; investor viewpoints can vary widely so review several perspectives.

Explore 2 other fair value estimates on TriNet Group - why the stock might be worth as much as 25% more than the current price!

Build Your Own TriNet Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TriNet Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TriNet Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TriNet Group's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.