Please use a PC Browser to access Register-Tadawul

ICON (ICLR): Evaluating Valuation After Jefferies Downgrade on Client Cancellation Concerns

ICON Plc ICLR | 186.58 | -1.76% |

If you have been tracking ICON (NasdaqGS:ICLR), the recent analyst downgrade may have landed right on your radar. Jefferies has issued a cautionary outlook, pointing to client cancellations approaching $1 billion in the third quarter and warning that this trend could continue into the next quarter. While the company has secured some partnership wins lately, this call has moved risk perception to the forefront for everyone considering what to do next with ICON stock.

This story comes against a backdrop of persistent pressure on shares. ICON has seen its price fall around 41% over the past year, slipping further year-to-date, while a gain of 21% in the past three months hints at short-term momentum returning. Executive changes have also come into play with long-time CEO Steve Cutler announcing retirement and COO Barry Balfe stepping in to take the top job. Even with revenue and net income showing some annual growth, the mood is more cautious than optimistic right now.

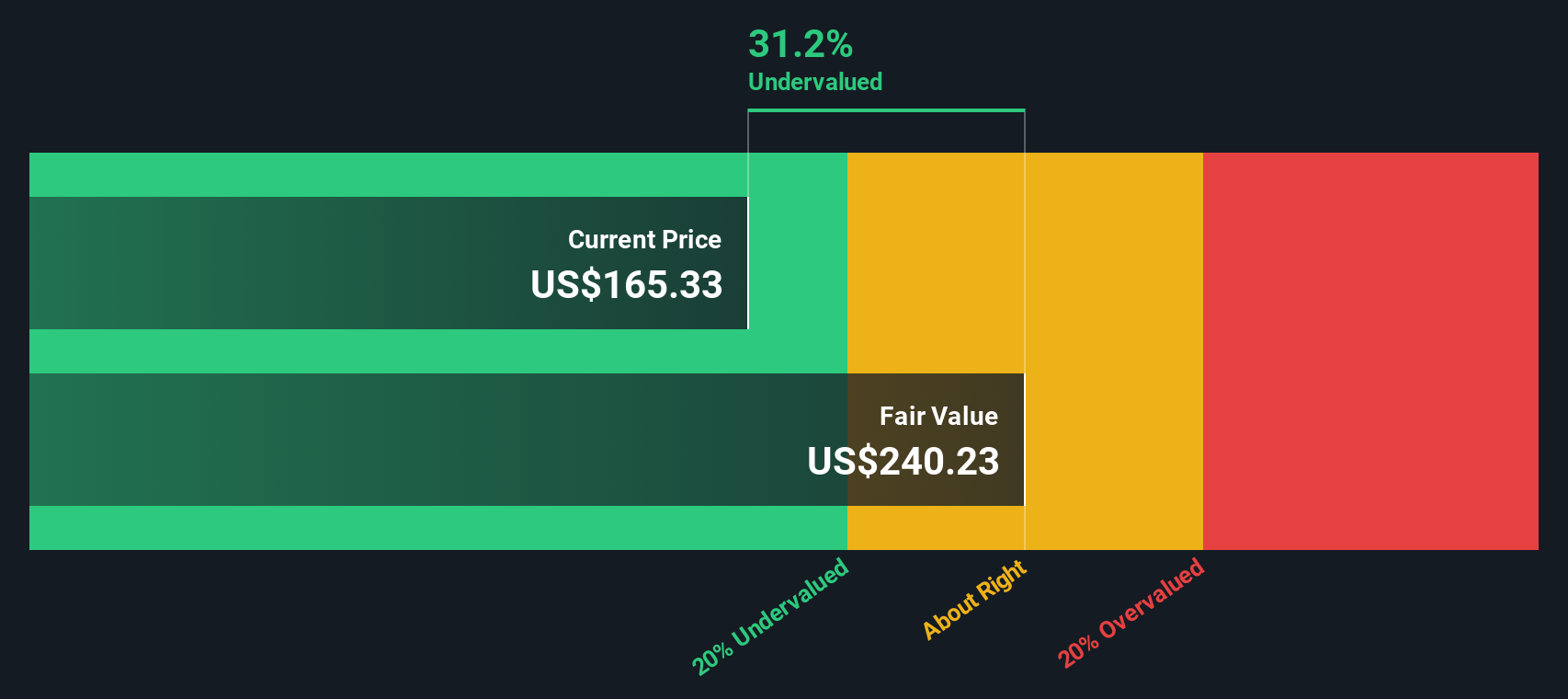

With all eyes on management’s next steps and concerns over client spend still swirling, the big question is whether the current price reflects the real risks or if value is hiding in plain sight for patient investors.

Most Popular Narrative: 19.7% Undervalued

The leading narrative views ICON stock as significantly undervalued, based on forward-looking earnings growth, improving profitability, and continued operational enhancements.

Operational standardization and streamlining processes are expected to enhance ICON's study cycle times and operational efficiencies. This could potentially improve net margins and profitability. Strategic investments in AI-enabled tools like iSubmit and SmartDraft are set to accelerate trials and enhance data management, which could lead to improved earnings through increased operational efficiency.

Ready to discover how this narrative envisions so much upside? The secret sauce includes bold operational moves and ambitious forecasts. What are the projections that build this undervaluation case? Find out how analysts believe margin transformation and increased tech adoption could push future earnings to new heights.

Result: Fair Value of $215.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent clinical trial cancellations and ongoing macroeconomic uncertainty remain possible catalysts that could challenge this optimistic outlook for ICON.

Find out about the key risks to this ICON narrative.Another Perspective: SWS DCF Model Challenges the Narrative

While analysts highlight attractive valuation based on industry ratios, our SWS DCF model offers a different take. This approach weighs future cash flows and can tell a story that sometimes challenges consensus. Could this method be seeing a risk others are missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ICON Narrative

If you think there’s more to the story, or want to form your own conclusions based on the data, you can create a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding ICON.

Looking for more investment ideas?

Smart investors never settle for one opportunity. Make your next move by checking out powerful stock selections targeting breakthrough technologies, strong yields, and value-packed companies.

- Capitalize on fast-growing, undervalued opportunities by using our undervalued stocks based on cash flows to find stocks outpacing their price tags with robust cash flows.

- Target the future of medicine and innovation by starting with healthcare AI stocks, highlighting companies harnessing artificial intelligence for healthcare breakthroughs.

- Elevate your income potential and consistency by seeking out dividend stocks with yields > 3%, spotlighting stocks delivering yields above 3% for savvy, income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.