Please use a PC Browser to access Register-Tadawul

IDT (IDT): Assessing Valuation Following Record Same-Store Sales Growth and NRS Expansion

IDT Corporation Class B IDT | 50.81 | -2.42% |

If you’ve been following IDT (IDT), the latest numbers from its NRS subsidiary probably caught your eye. In August, same-store sales jumped 8.3% compared to a year ago, the kind of surge we haven’t seen at IDT in more than two years. Behind that boost? More shoppers visiting more frequently and walking out with fuller baskets, especially across categories like Cigarettes, Prepared Cocktails, and Beer. For shareholders and fence-sitters alike, these results feel like a genuine signal of strong consumer demand, not just the afterglow of inflation adjustments.

This momentum lines up with a bigger story for the stock itself. Over the past year, IDT has climbed 77%, and year to date, it’s up 41%. The company’s retail solutions arm, the NRS platform, continues to scale rapidly through new terminal placements and deeper ties with independent retailers. While quarters can be lumpy, long-term holders have enjoyed gains, with share price growth far outpacing that of many industry peers in the past three and even five years.

Now that the business is firing on multiple cylinders, investors are left to wonder: is the current price still underestimating future earnings power, or has the recent growth story already been baked into the market?

Most Popular Narrative: 22.5% Undervalued

Based on the most popular narrative among analysts, IDT is trading well below what is seen as its fair value, hinting at potential upside.

“The introduction of net2phone's virtual AI agent is projected to enhance customer interactions while reducing costs, potentially increasing net margins and driving growth in earnings.”

Curious how this big fair value target was set? The narrative teases a bold financial forecast, with improved profitability and margin expansion expected to push this valuation higher than most would expect. Wondering what aggressive growth assumptions are priced in? Unpack the full narrative to see exactly which bullish expectations power this 22.5% discount.

Result: Fair Value of $85.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges remain, including dependence on BOSS Money’s working capital needs and currency volatility. Either of these factors could jeopardize the bullish outlook for IDT.

Find out about the key risks to this IDT narrative.Another View: What About the Market Multiple?

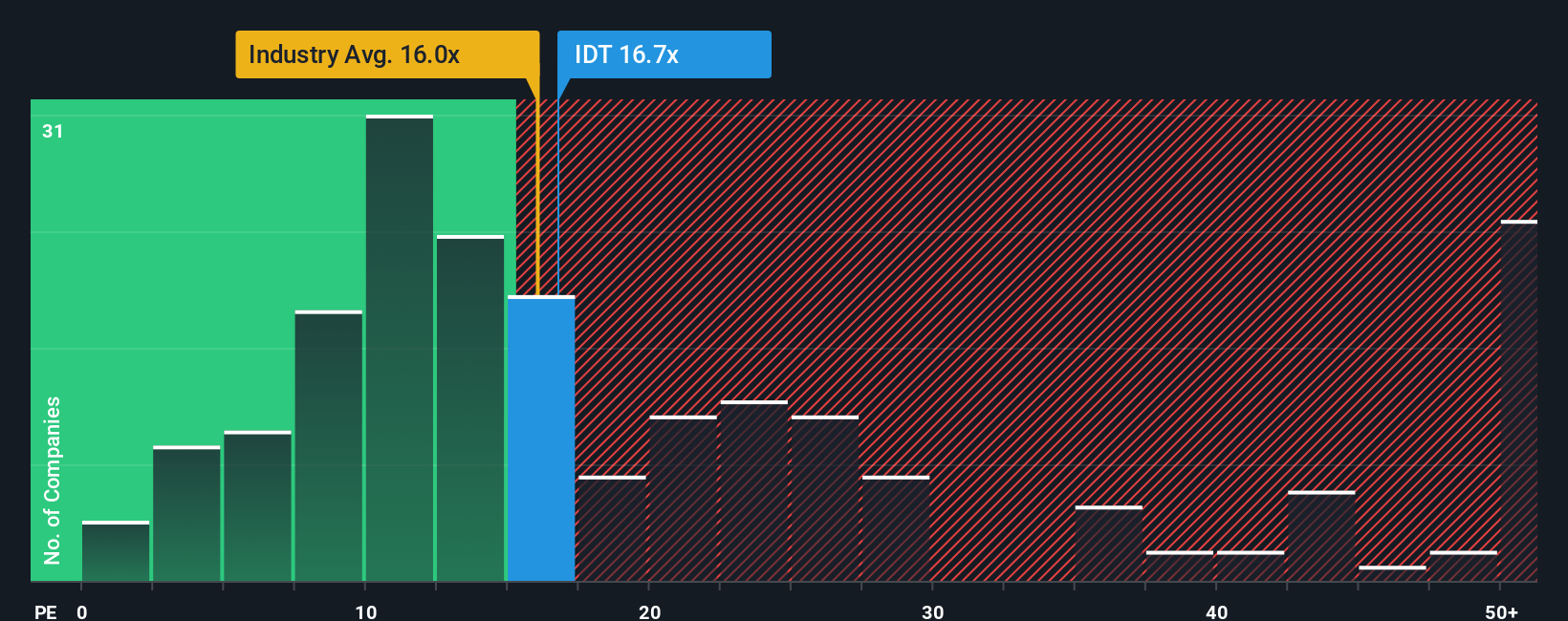

Instead of forecasting future cash flows, looking at current market pricing tells a different story. Compared to others in its space, IDT is actually trading at a higher valuation, which suggests that the upbeat outlook may already be reflected in the price. So, which side of the value debate will prove right over the long run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IDT Narrative

If these perspectives do not quite match your own, or if you like to dig into the numbers yourself, you can put together your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding IDT.

Looking for More Winning Opportunities?

Smart investors never limit their view to just one stock. Set yourself up for success by branching into sectors where untapped potential could boost your portfolio’s returns. The Simply Wall Street Screener offers you a running start. Check out these ideas before the next wave of investors gets in.

- Unlock ultra-high yield with cash-generating companies by scanning for attractive dividend stocks with yields > 3% opportunities that keep your money working harder for you.

- Find tomorrow’s breakthroughs first when you track AI penny stocks, the pioneers reshaping industries with artificial intelligence and bold innovation.

- Jump ahead of the crowd and pinpoint deeply discounted shares with our smart hunt for undervalued stocks based on cash flows that top value investors are already watching.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.