Please use a PC Browser to access Register-Tadawul

IFF (IFF) Returns To Quarterly Profit But Trailing Losses Test Turnaround Narrative

International Flavors & Fragrances Inc. IFF | 81.39 | -0.28% |

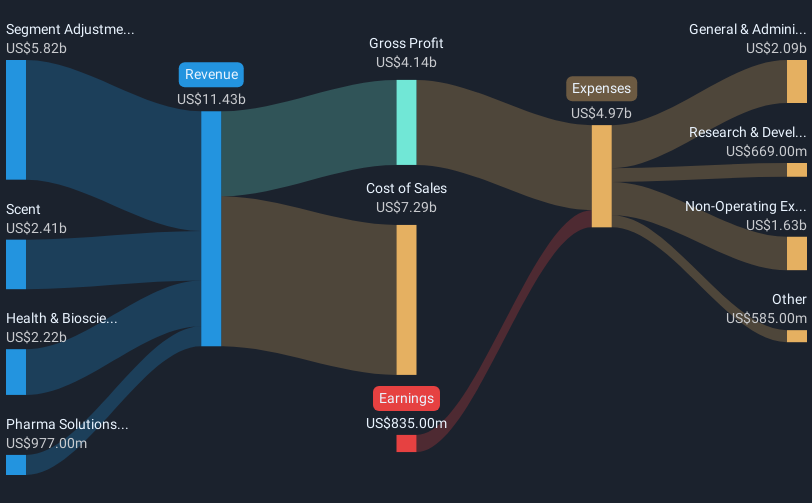

International Flavors & Fragrances FY 2025 earnings snapshot

International Flavors & Fragrances (IFF) closed FY 2025 with fourth quarter revenue of US$2,589 million and basic EPS of US$0.07, while trailing twelve month figures show total revenue of US$10.9 billion and a net loss of US$374 million, equal to basic EPS of US$1.46 in losses. Over the past two reported quarters, quarterly revenue moved from US$2,764 million with EPS of US$2.29 in Q2 2025 to US$2,694 million and EPS of US$0.16 in Q3 2025, giving investors a recent view of how sales and earnings have tracked through the year. The focus now is on whether margins can steadily rebuild from here and support a clearer profitability story.

See our full analysis for International Flavors & Fragrances.With the headline numbers on the table, the next step is to see how this earnings print lines up against the widely followed narratives around IFF's growth potential, profitability path and risk profile, and where those stories might need updating.

TTM loss of US$374 million despite Q4 profit

- Across the last twelve months, IFF generated US$10.9b of revenue but recorded a net loss of US$374 million, even though Q4 alone showed a small profit of US$18 million and basic EPS of just over US$0.07.

- Bulls focus on the earnings recovery story, yet these numbers show the turnaround is still in early days:

- The bullish narrative talks about earnings reaching US$1.2b and margins of 10.0% in a few years. However, the latest trailing data still show a loss and margins that are not yet close to that level.

- At the same time, Q1 2025 net loss of US$1,018 million and Q2 profit of US$586 million highlight how lumpy the path has been. This makes the bullish glide path to steadier earnings something investors may want to treat with caution until results settle down.

Investors who want to see how the optimistic case lines up with these mixed results can go deeper into the bullish arguments in the full narrative: 🐂 International Flavors & Fragrances Bull Case

Revenue near US$2.6b as growth stays modest

- Q4 2025 revenue of US$2,589 million sits within a tight range versus earlier quarters in the table. The dataset shows revenue forecast at about 1.1% per year compared with a 10.4% US market forecast, which frames IFF as a relatively low growth story on the top line.

- Consensus commentary leans on product mix and new categories to support future growth, but the current figures underline the challenge:

- The balanced narrative points to future revenue of around US$11.4b, which is close to the current trailing US$10.9b. Expectations therefore rely more on margin improvement than big volume expansion.

- Segments like Health & Biosciences and Food Ingredients are expected, in the consensus view, to help earnings quality over time. Yet the recent modest revenue profile suggests those efforts may need time before they meaningfully shift the overall growth picture.

Unprofitable today while paying a 1.96% dividend

- The risk summary flags that IFF is unprofitable over the last twelve months and that its 1.96% dividend is not well covered by either earnings or free cash flow, which means investors are currently being paid income out of a business that is still loss making.

- Bears argue that high leverage and weak coverage limit flexibility, and the trailing numbers back up parts of that concern:

- Losses have grown at about 25.9% per year over five years according to the analysis, which sits awkwardly alongside ongoing cash commitments for dividends.

- With a P/S of 1.9x versus 1.2x for the US Chemicals industry, critics may question paying a higher multiple for a company that is still loss making and facing questions about how securely its dividend is funded.

If you are weighing those dividend and leverage worries against the turnaround story, it can help to read the cautious take in full: 🐻 International Flavors & Fragrances Bear Case

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for International Flavors & Fragrances on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this update sparks a different angle, shape it into your own clear, data backed view in minutes with Do it your way

A great starting point for your International Flavors & Fragrances research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

IFF is still loss making on US$10.9b of revenue, with uneven quarterly earnings and a dividend that current profits and cash flows do not comfortably cover.

If that mix of losses, leverage concerns and dividend pressure feels uncomfortable, you may want to look at 85 resilient stocks with low risk scores, which aims to prioritise stronger financial resilience and fewer red flags.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.