Please use a PC Browser to access Register-Tadawul

ImmunityBio Glioblastoma Data Add Fuel To Rapidly Moving IBRX Story

ImmunityBio Inc IBRX | 8.70 | +1.05% |

- ImmunityBio reported updated Phase 2 data from its QUILT-3.078 trial of ANKTIVA plus CAR-NK therapy in recurrent glioblastoma.

- The combination showed a median overall survival that has not yet been reached, with most patients still alive and maintaining immune function.

- The regimen was reported to have a manageable safety profile and did not require chemotherapy.

For ImmunityBio (NasdaqGS:IBRX), this new glioblastoma update lands at a time when the stock has already logged sharp moves. The share price stands at $6.21, with returns of 190.2% over the past 30 days and 207.4% year to date. One-year and three-year returns of 98.4% and 64.3% indicate that the market has been reacting strongly to the company story, including its pipeline progress.

These glioblastoma data add another piece to that story, particularly since the outcomes have not yet been widely discussed. Investors watching IBRX may focus on how this program fits with the rest of the pipeline and any future regulatory or partnering steps the company chooses to pursue.

Stay updated on the most important news stories for ImmunityBio by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on ImmunityBio.

The glioblastoma data extend ImmunityBio’s broader push to use ANKTIVA and CAR-NK platforms to treat hard-to-manage cancers while reducing reliance on high-dose chemotherapy. For investors, this trial sits alongside recent progress in bladder cancer, lung cancer and hematologic indications, and points to a company thesis built around reusing a common immunotherapy backbone across several tumor types.

ImmunityBio narrative, where this glioblastoma update fits

There are no active community narratives provided here, but this news may feed into existing debates among investors about how much value to place on ImmunityBio’s pipeline beyond its already approved ANKTIVA use in non muscle invasive bladder cancer CIS and recent approvals and filings in Saudi Arabia and the US.

Risks and rewards to keep in mind

- ⚠️ Highly volatile share price over the past 3 months compared to the US market means glioblastoma headlines could drive sharp swings in either direction.

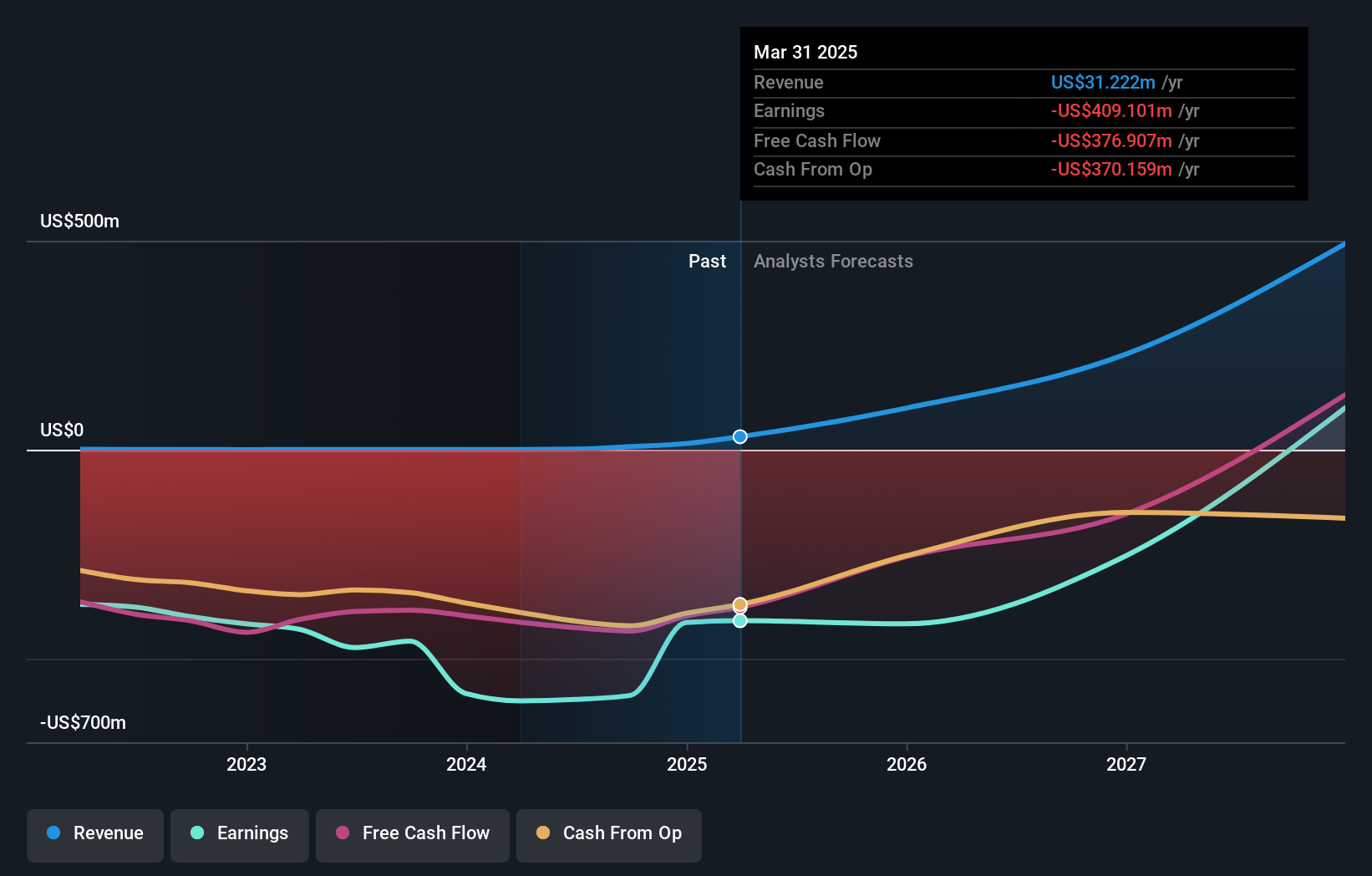

- ⚠️ Shareholders have been substantially diluted in the past year and the company has less than 1 year of cash runway, so further funding could be required to progress GBM and other trials.

- ⚠️ Negative shareholders’ equity highlights balance sheet pressure if development timelines extend or regulatory decisions are slower than expected.

- 🎁 A chemo-free regimen in recurrent GBM that maintains immune function, if supported in larger randomized trials, could broaden the addressable use of ANKTIVA and CAR NK across new indications.

What to watch from here

From here, investors can watch for enrollment updates in randomized GBM trials, further regulatory interactions on ANKTIVA across tumor types and any financing moves that affect dilution and cash runway. You can also keep tracking how the story evolves through this community narratives hub.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.