Please use a PC Browser to access Register-Tadawul

Improved Credit Quality and Earnings Might Change the Case for Investing in Valley National Bancorp (VLY)

Valley National Bancorp VLY | 11.92 | +0.59% |

- Valley National Bancorp recently announced its third-quarter 2025 results, reporting net interest income of US$446.22 million and net income of US$163.36 million, alongside a significant reduction in net loan charge-offs to US$14.6 million compared to earlier periods.

- This improvement in credit quality and earnings performance stands out against ongoing concerns in the broader regional banking sector and highlights Valley's operational resilience.

- We'll explore how Valley's improved loan charge-offs in the third quarter could reshape its investment narrative and analyst outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Valley National Bancorp Investment Narrative Recap

To be a shareholder in Valley National Bancorp, you need to believe that the company’s regional banking model and focus on operational resilience will position it to weather sector volatility while capturing growth in core markets. The recent sharp decline in net loan charge-offs and solid earnings certainly reinforce confidence in Valley’s management and asset quality, yet the biggest short term catalyst, continued credit improvement in commercial real estate, remains closely linked to the ongoing risk of geographic and sector concentration. These third-quarter results are encouraging, but the fundamental challenge of exposure to regional economic shifts still looms large for investors.

The company’s affirmation of its common and preferred dividend payouts is especially relevant, reassuring stakeholders that Valley remains committed to consistent capital returns. While the unchanged dividend signals a degree of financial stability, it also ties directly into how the company balances payout policies with its need for capital flexibility, an issue investors may want to monitor given the sector’s recent stresses.

By contrast, the question remains whether Valley National Bancorp’s asset quality gains will be enough to offset region-specific risks that investors should be aware of as...

Valley National Bancorp's outlook anticipates $2.5 billion in revenue and $807.5 million in earnings by 2028. This projection assumes a 16.6% annual revenue growth rate and an $381.8 million increase in earnings from the current $425.7 million.

Uncover how Valley National Bancorp's forecasts yield a $12.73 fair value, a 26% upside to its current price.

Exploring Other Perspectives

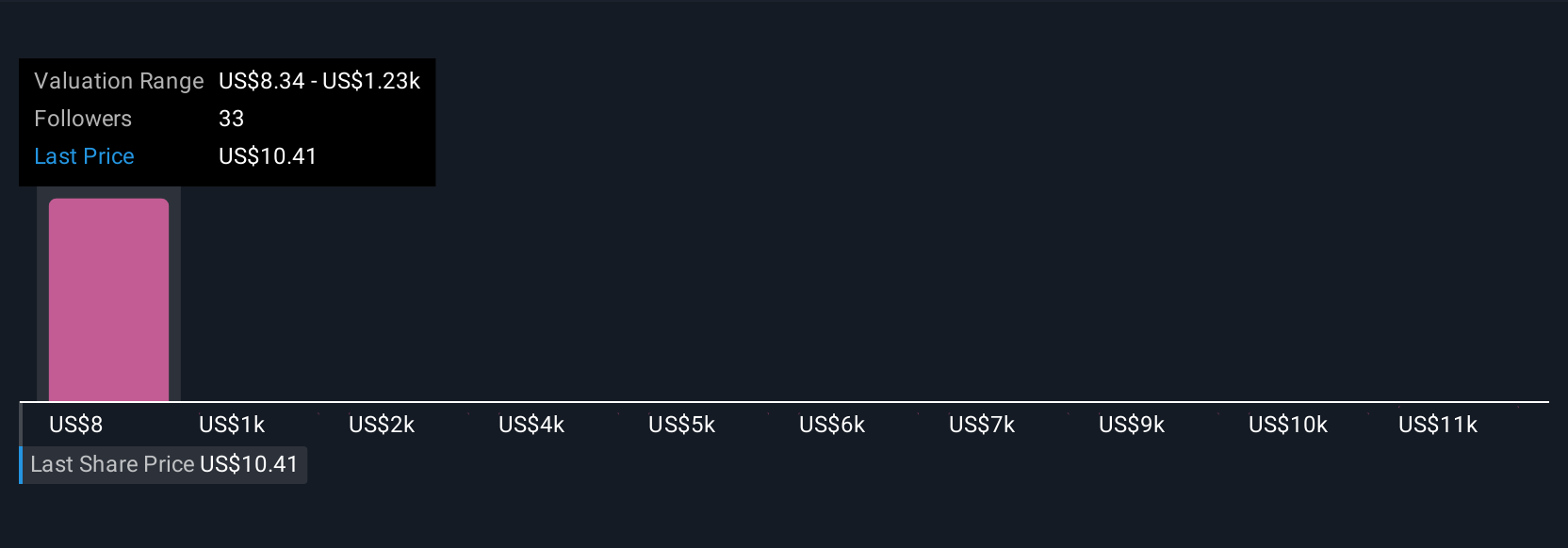

Four members of the Simply Wall St Community estimate Valley’s fair value anywhere from US$8.34 to a striking US$12,190.04. Against this wide range of valuations, consider how Valley’s ongoing exposure to local economic shifts could influence the future performance outlook, and explore several alternative viewpoints from fellow investors.

Explore 4 other fair value estimates on Valley National Bancorp - why the stock might be a potential multi-bagger!

Build Your Own Valley National Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valley National Bancorp research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Valley National Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valley National Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.