Please use a PC Browser to access Register-Tadawul

Improved Revenues Required Before LendingTree, Inc. (NASDAQ:TREE) Stock's 27% Jump Looks Justified

LendingTree, Inc. TREE | 38.95 | +1.46% |

LendingTree, Inc. (NASDAQ:TREE) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 67% in the last year.

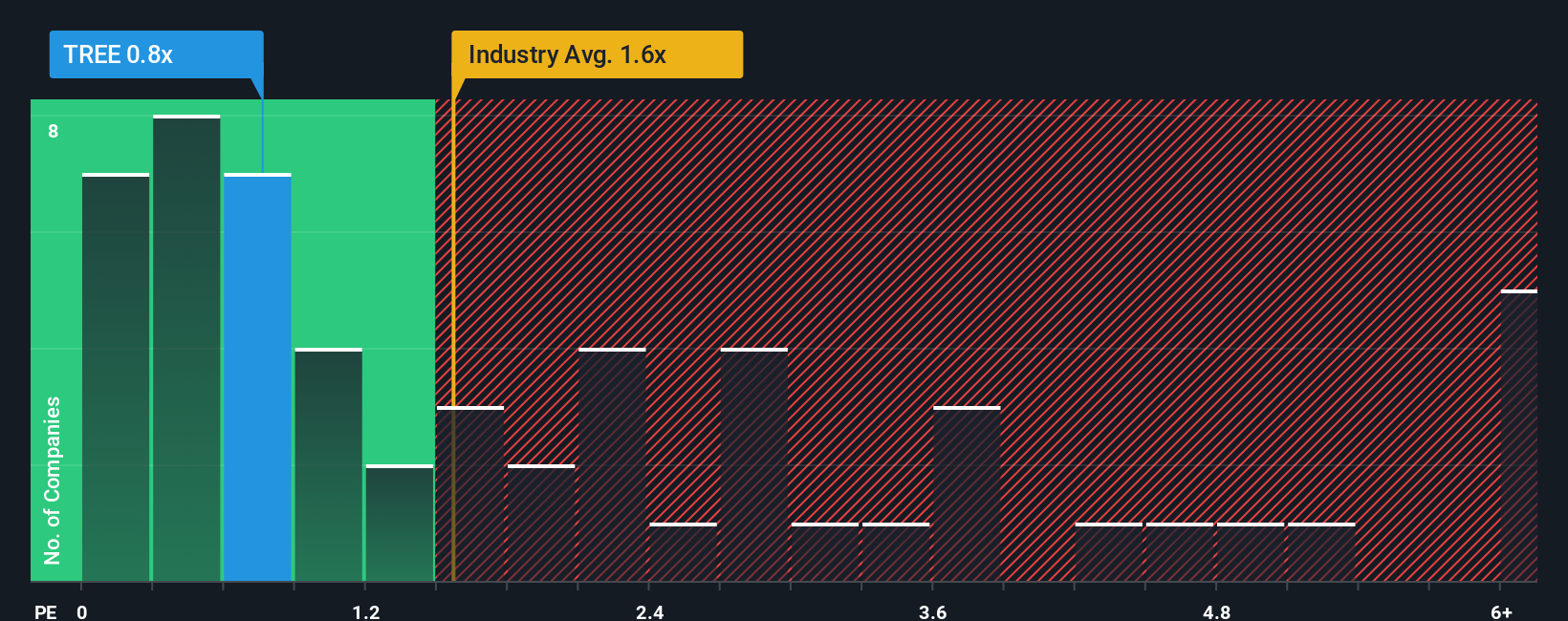

In spite of the firm bounce in price, considering around half the companies operating in the United States' Consumer Finance industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider LendingTree as an solid investment opportunity with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How LendingTree Has Been Performing

With revenue growth that's superior to most other companies of late, LendingTree has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on LendingTree will help you uncover what's on the horizon.How Is LendingTree's Revenue Growth Trending?

In order to justify its P/S ratio, LendingTree would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 5.5% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 20% each year, which is noticeably more attractive.

With this information, we can see why LendingTree is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On LendingTree's P/S

The latest share price surge wasn't enough to lift LendingTree's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of LendingTree's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

If these risks are making you reconsider your opinion on LendingTree, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.