In-Depth Examination Of 7 Analyst Recommendations For Altair Engineering

Altair Engineering ALTR | 103.00 | +8.22% |

Analysts' ratings for Altair Engineering (NASDAQ:ALTR) over the last quarter vary from bullish to bearish, as provided by 7 analysts.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 2 | 0 | 0 |

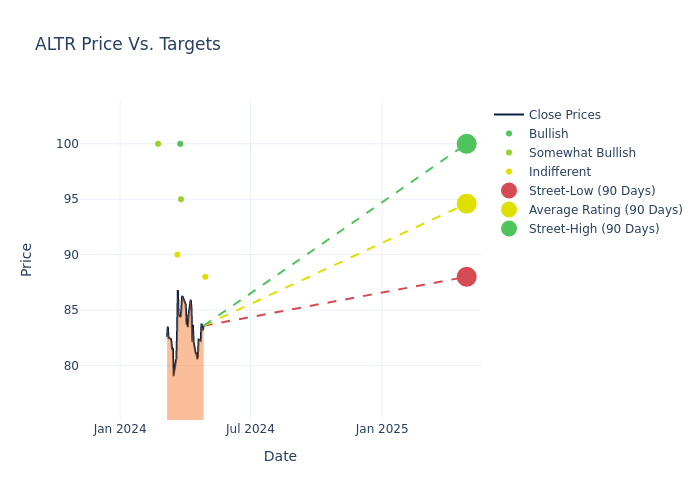

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $93.0, with a high estimate of $100.00 and a low estimate of $88.00. This current average reflects an increase of 8.45% from the previous average price target of $85.75.

Decoding Analyst Ratings: A Detailed Look

The standing of Altair Engineering among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Blair Abernethy | Rosenblatt | Maintains | Neutral | $88.00 | $88.00 |

| Stephen Tusa | JP Morgan | Raises | Overweight | $95.00 | $86.00 |

| Charles Shi | Needham | Maintains | Buy | $100.00 | - |

| Matthew Hedberg | RBC Capital | Maintains | Sector Perform | $90.00 | - |

| Matthew Hedberg | RBC Capital | Maintains | Sector Perform | $90.00 | - |

| Ken Wong | Oppenheimer | Raises | Outperform | $100.00 | $95.00 |

| Blair Abernethy | Rosenblatt | Raises | Neutral | $88.00 | $74.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Altair Engineering. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Altair Engineering compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Altair Engineering's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Altair Engineering's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Altair Engineering analyst ratings.

Unveiling the Story Behind Altair Engineering

Altair Engineering Inc is a provider of enterprise-class engineering software enabling origination of the entire product lifecycle from concept design to in-service operation. The integrated suite of software provided by the company optimizes design performance across multiple disciplines encompassing structures, motion, fluids, thermal management, system modeling, and embedded systems. It operates through two segments: Software which includes the portfolio of software products such as solvers and optimization technology products, modeling and visualization tools, industrial and concept design tools, and others; and Client Engineering Services which provides client engineering services to support customers. Majority of its revenue comes from the software segment.

Key Indicators: Altair Engineering's Financial Health

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Over the 3 months period, Altair Engineering showcased positive performance, achieving a revenue growth rate of 6.9% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Altair Engineering's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 11.47%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Altair Engineering's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.92% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Altair Engineering's ROA stands out, surpassing industry averages. With an impressive ROA of 1.5%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Altair Engineering's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.48, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.