Please use a PC Browser to access Register-Tadawul

In One Chart | 2025's Top Performing Sectors Revealed! US Stocks on Fire as SanDisk Explodes 589% & Bloom Energy Soars 391%

S&P 500 index SPX | 6896.24 | -0.14% |

Dow Jones Industrial Average DJI | 48367.06 | -0.20% |

Sandisk Corporation SNDK | 240.22 | -1.65% |

Western Digital Corporation WDC | 176.06 | -2.01% |

BitMine Immersion Technologies BMNR | 27.72 | -2.87% |

As 2025 draws to a close, reflecting on the past year reveals a robust recovery in the U.S. stock market. After hitting a low on April 7, the market has surged strongly despite various doubts, maintaining its overall bullish trend.

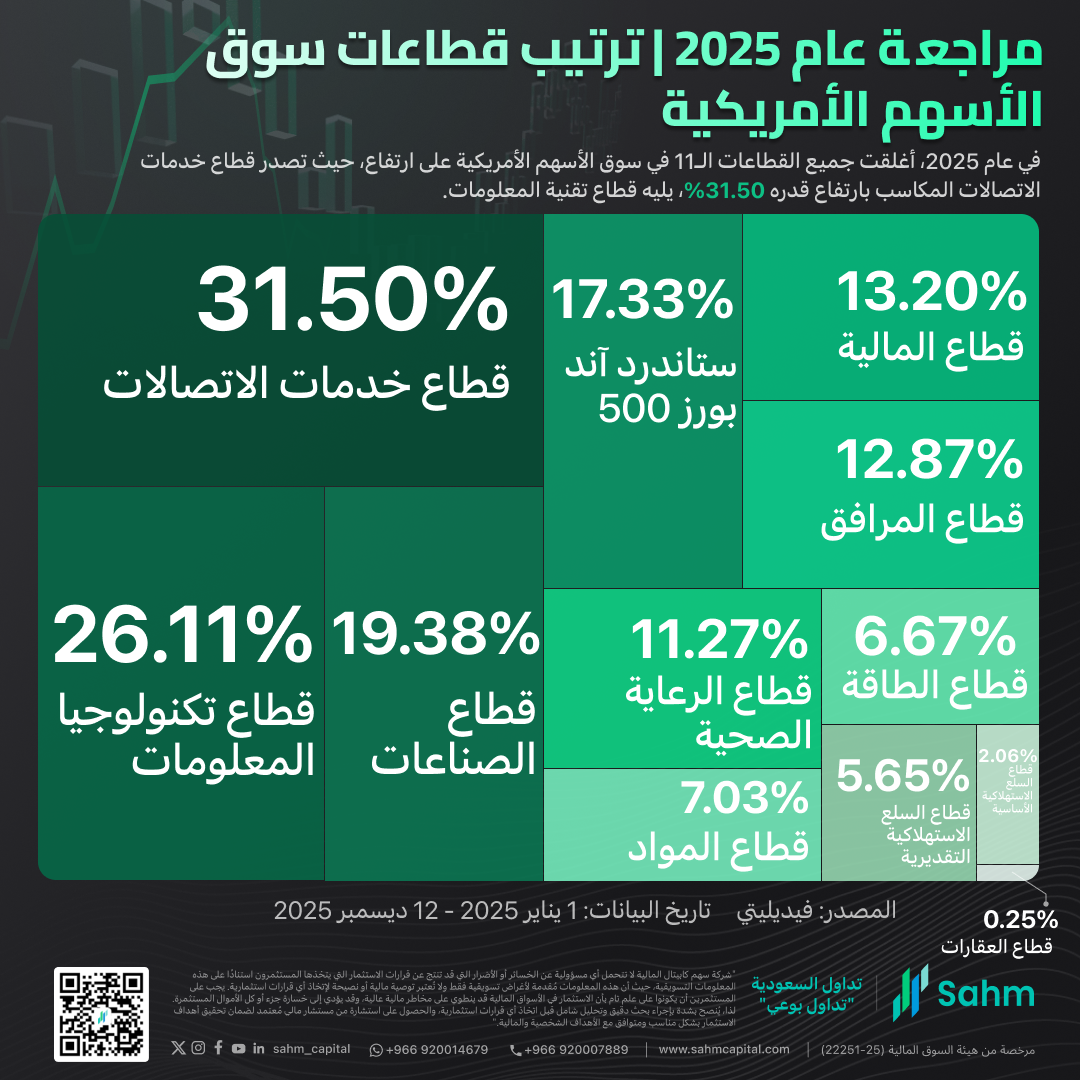

By the close of trading on December 11, both the S&P 500 index(SPX.US) and the Dow Jones Industrial Average(DJI.US) reached record highs. All 11 sectors of the U.S. market closed higher, with the communication services sector leading the charge with an impressive 31.50% increase, followed closely by the information technology sector.

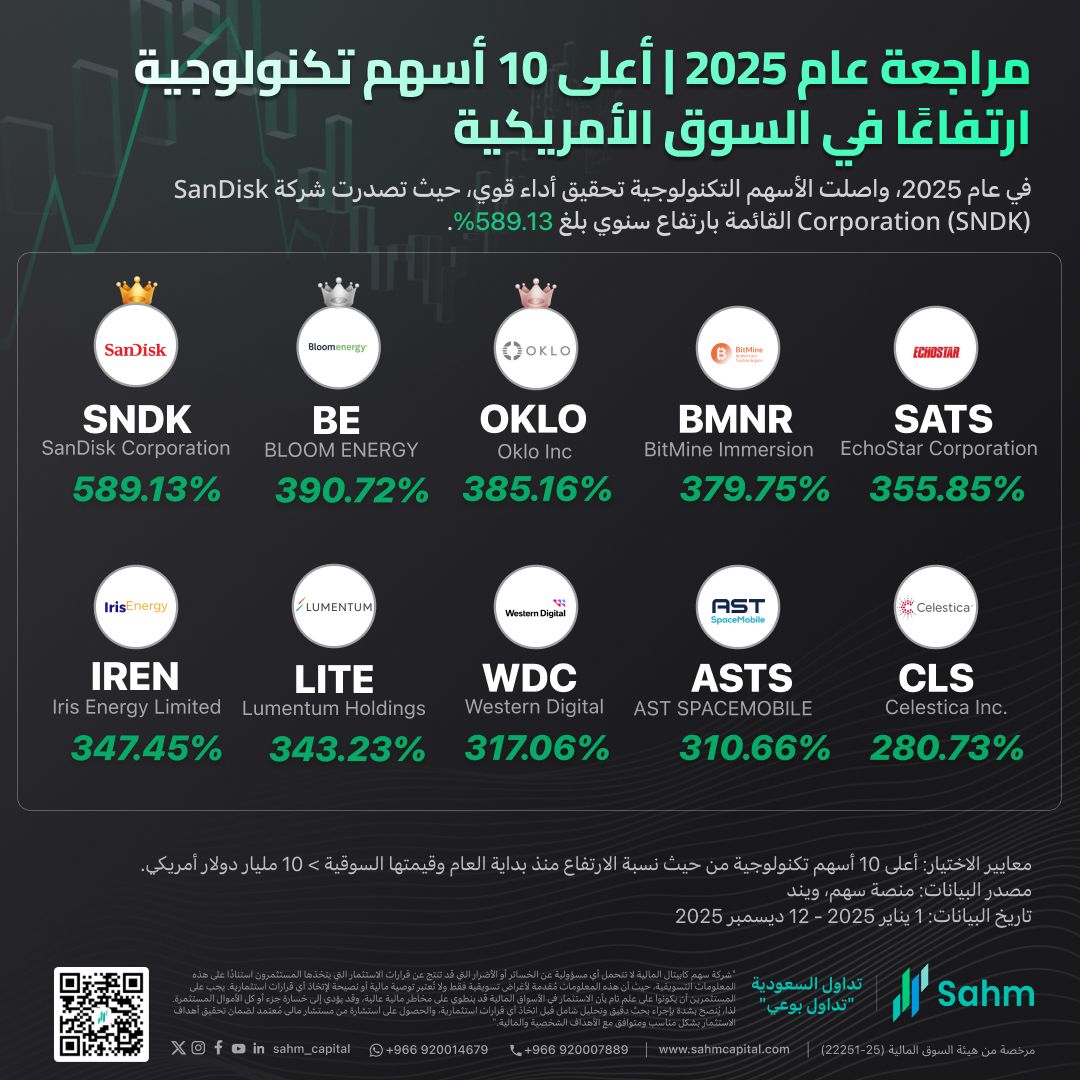

Top 10 Gainers in U.S. Tech Stocks for 2025

Screening criteria: Technology stocks with a market capitalization of over $10 billion and ranking in the top ten in year-to-date gains.

The AI boom continued to spread throughout 2025, driving growth in AI servers and data centers, which in turn led to a significant breakthrough in storage chips. SanDisk Corporation(SNDK.US) saw a staggering increase of over 589% this year, topping the list of companies with a market cap over $10 billion and among the top ten in terms of growth. Western Digital Corporation(WDC.US) also experienced significant gains, with a year-to-date increase of 317.06%.

Fuel cell company BLOOM ENERGY CORP(BE.US) experienced a 390.72% increase, ranking second, fueled by AI-driven demand for new power solutions amid electricity shortages. The company’s solid oxide fuel cell (SOFC) solutions precisely met this demand, further boosted by significant commercial orders, financial improvements, and market sentiment.

Oklo Inc(OKLO.US)'s stock rose by 385.16%, ranking third, due to the strengthening of small modular reactors (SMR) and nuclear energy concepts. The company achieved key regulatory and project advancements and became linked to trending topics like data centers and clean energy, positioning it as a "nuclear energy + AI + clean energy" play, driving stock price expectations and sentiment.

Despite recent corrections in the cryptocurrency market, BitMine Immersion Technologies(BMNR.US) recorded a 379.75% annual increase, ranking fourth. This was primarily due to its strategic shift to become an "Ethereum Vault Company." Under the leadership of renowned Wall Street analyst Tom Lee, the company raised funds through stock issuance to purchase and hold Ethereum (ETH), attracting institutional investors, including ARK Invest. This influx of market capital boosted the stock price. Additionally, Iris Energy Limited(IREN.US) saw a 347.45% increase, ranking sixth, driven by the Bitcoin bull market, enhancing mining revenues and the company’s shift to high-performance computing (HPC), making it a dual play on "cryptocurrency + AI computing power."

Space-related stocks also performed well in 2025. EchoStar Corporation Class A(SATS.US) surged 355.85%, ranking fifth, benefiting from the Starlink craze, which revalued the satellite sector, along with the release of spectrum resource value and policy expectations, leading to concentrated stock speculation. Additionally, AST SPACEMOBILE INC(ASTS.US), establishing dominance in the integrated space-ground sector, saw gains exceeding 310%.

Lumentum Holdings, Inc.(LITE.US) soared 343.23% due to the explosive demand for optical interconnects in AI data centers, with a surge in orders for its 800G/1.6T optical module components. As a leader in optical communications, deeply linked with giants like Nvidia, and with a recovery in its 3D sensing business, it is considered an essential "water seller" in AI infrastructure, boosting both performance and valuation.

Celestica Inc.(CLS.US) rose 280.73%, ranking tenth, primarily due to its role as a core ODM manufacturer for AI servers, benefiting from large-scale data center construction. The company successfully transitioned to high-margin connectivity and cloud solutions (CCS) business, securing numerous customized AI hardware orders, leading to sustained performance exceeding expectations and a market reevaluation as a key AI infrastructure manufacturing leader.