Please use a PC Browser to access Register-Tadawul

In One Chart | ASML Shares Soar, New Orders Double with AI Boost

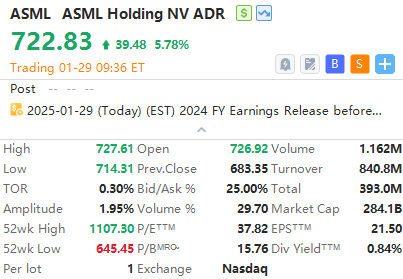

ASML Holding NV ADR ASML | 1069.86 | -0.21% |

As of 05:36 PM Riyadh time, ASML Holding NV ADR(ASML.US) shares are trading by 5.78% higher.

What's on the News?

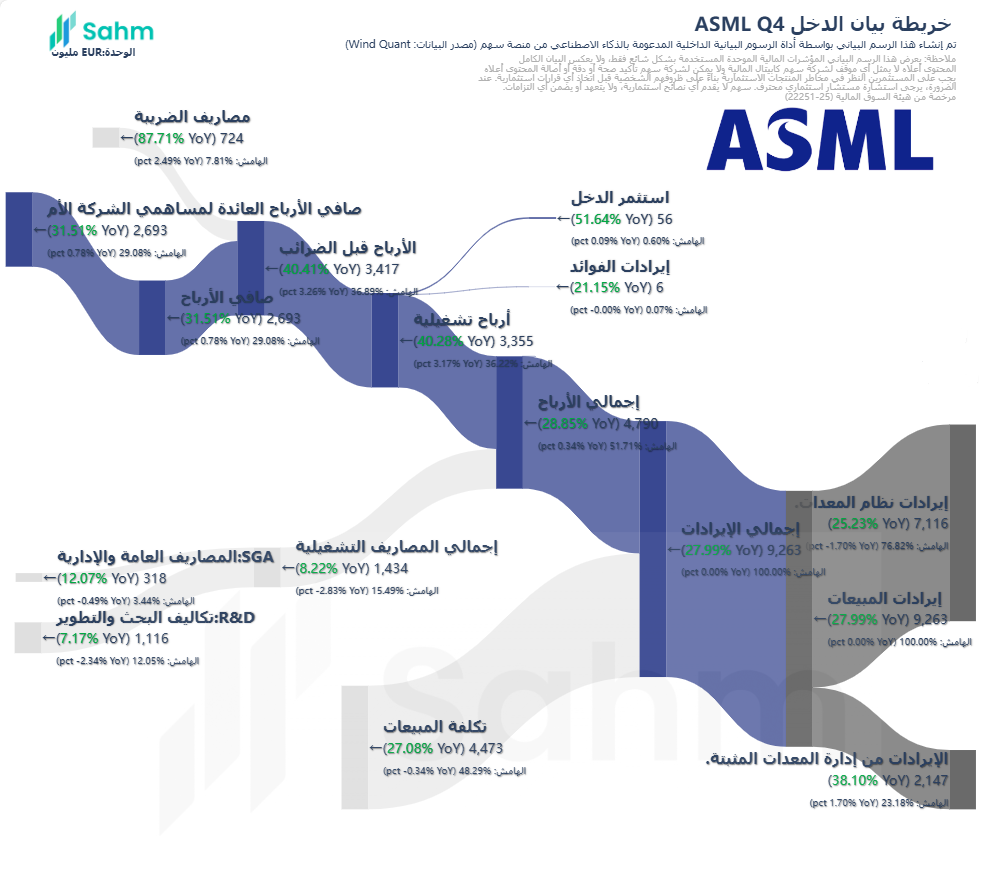

On January 29, European trading hours saw semiconductor equipment giant ASML Holding NV ADR(ASML.US) release its Q4 and full-year 2024 earnings report.

Key Highlights:

- Q4 Net Sales: €9.263 billion (above market expectations of €9.07 billion)

- Q4 Gross Margin: 51.7%

- Q4 Net Profit: €2.693 billion (above €2.64 billion expected)

- EPS: €6.85

A notable metric, the value of new orders, reached €7.088 billion, up 169% from €2.633 billion in Q3, significantly surpassing analyst forecasts of €3.99 billion. The last time new orders were this high was in Q4 2023, with €9.2 billion. The orders included €3 billion in EUV machine orders.

- Market Reaction: ASML’s stock surged over 10% in Dutch trading to €715 per share and over 9.3% in after-hours U.S. trading to $747 per share.

- CEO Commentary: Christophe Fouquet, ASML CEO, emphasized AI as a clear growth driver for the semiconductor industry. Several tech giants, including Meta, have committed to significant AI infrastructure investments, potentially benefiting ASML.

- Market Context: Despite recent pressures from Chinese startup DeepSeek’s R1 model, seen as highly cost-effective, Fouquet viewed it as positive for increased semiconductor demand over time.

- Analyst Insight: Morningstar's Chief Equity Strategist Michael Field stated ASML’s results support their investment thesis, suggesting the stock should be valued closer to €850, presenting a good opportunity considering recent pullbacks.