Please use a PC Browser to access Register-Tadawul

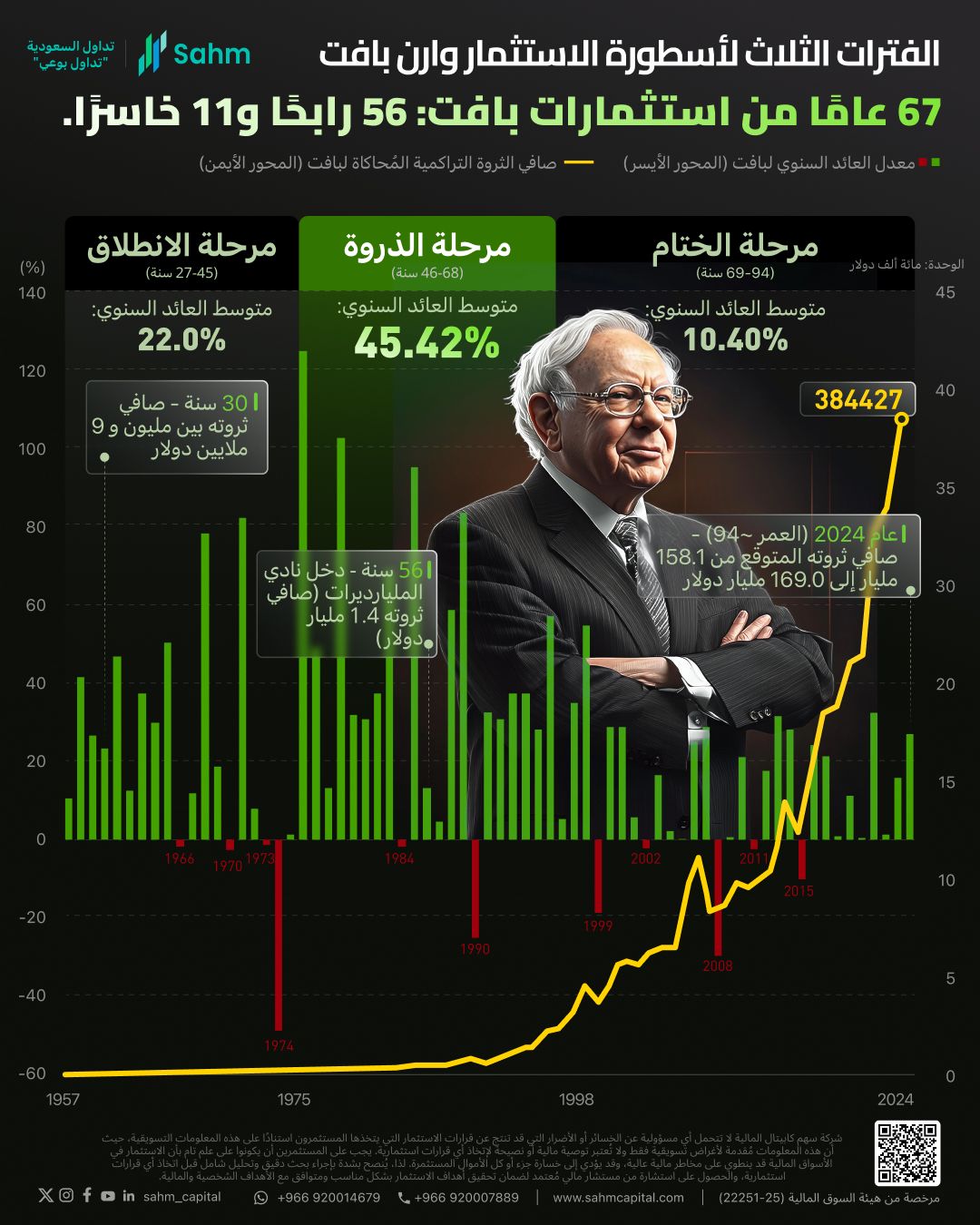

In One Chart | Buffett's 67-Year Investment Career

Berkshire Hathaway Inc. Class A BRK.A | 749120.00 | -1.29% |

Berkshire Hathaway Inc. Class B BRK.B | 499.84 | -1.29% |

Apple Inc. AAPL | 274.61 | +0.18% |

Coca-Cola Company KO | 70.37 | -0.85% |

Occidental Petroleum Corporation OXY | 38.92 | -3.16% |

Buffett's Wealth Accumulation: A Remarkable Journey

The accompanying chart vividly illustrates Warren Buffett's wealth accumulation at different ages.

Reflecting on Buffett's 67-year investment career, he achieved positive returns in 56 out of 67 years, with only 11 years of negative returns. His highest return reached an impressive 129.3%.

Assuming a $1 investment in 1957, by the end of 2024, this dollar would have grown to a staggering $384,427.

Buffett's financial journey reveals a striking fact: 99.4% of his wealth was accumulated after age 50, with 95% amassed after age 60. Statistics show that during his early career (ages 27-45), his average annual return was 22.0%; during his peak years (ages 46-68), it was 42.42%; and in his later years (ages 69-94), it averaged 10.40%. This compels us to reconsider the essence of wealth accumulation.

Percentage of approximate net worth for age in 2025 relative to peak net worth in 2025 (approximately $165 billion)

| Age | Approximate Net Worth (USD) | Percentage of Peak Assets in 2025 (Approx. $165 Billion) |

| 11 years old | Started investing in the stock market | - |

| 20 years old | Approximately $105,000 (adjusted for inflation) | <0.01% |

| 30 years old | 1 million - 9 million | 0.006%-0.055% |

| 40 years old | Approximately $265 million | 0.16% |

| 50 years old | Approximately $937 million | 0.57% |

| 53 years old | Approximately $620 million | 0.38% |

| 56 years old | Entered the billionaire club ($1.4 billion) | 0.85% |

| 60 years old | Approximately $8 billion | 4.85% |

| 90 years old | Approximately 83 billion - 96 billion | 50.3%-58.2% |

| 2024 (Approx. 94 years old) | 158.1 billion - 169.0 billion | 95.8%-102.4% (calculated using the midpoint value) |

These figures underscore a profound philosophy of wealth: it's never too late to start accumulating wealth, regardless of age. True wealth growth often follows an exponential trajectory, appearing slow initially but gaining momentum over time.

The Challenge of Patience:

Can people endure until the compounding curve steepens? Many abandon the journey due to the seemingly stagnant "low-return plateau." When a 30-year-old sees a $10,000 investment yield only $1,000, they may envy peers who strike it rich quickly. Similarly, a 40-year-old might feel discouraged by the long path ahead to reach a $1 million goal. This misunderstanding of time's value often leads to missed opportunities.

Buffett's near-200-fold return after age 50 serves as a powerful counterargument. Impatience in youth and conservatism in old age can both hinder wealth growth.

Buffett's Recent Performance and Market Realities:

Over the past two decades, Buffett's performance has barely matched the S&P 500 index, highlighting the difficulty of consistently outperforming the market in mature economies. Yet, the historic bull market in the U.S. has allowed Buffett to craft a legendary wealth story.

Many in their 30s and 40s wonder, "Is it too late to start now?" The key isn't regretting past delays but seizing current opportunities. The essence of youth lies in adopting a long-term mindset—whether in asset accumulation, learning, or gaining experience. Continuous effort can rejuvenate any stage of life.

Taking Action:

Rather than dwelling on "what if I had started earlier," act now. Waiting for wealth or the perfect time is a trap; anxiety and regret won't create wealth and waste precious time.

The best time to plant a tree was ten years ago; the second-best time is now. Don't let hesitation hinder your wealth-building journey. Cultivate the habit of consistent investment, regardless of the amount. Each day of action brings you closer to your financial goals.

Ask yourself: how old are you this year? Regardless of the answer, the important question is whether you're willing to start nurturing your wealth from this moment forward. In this era of opportunity, the true secret to wealth lies in daily perseverance.