Please use a PC Browser to access Register-Tadawul

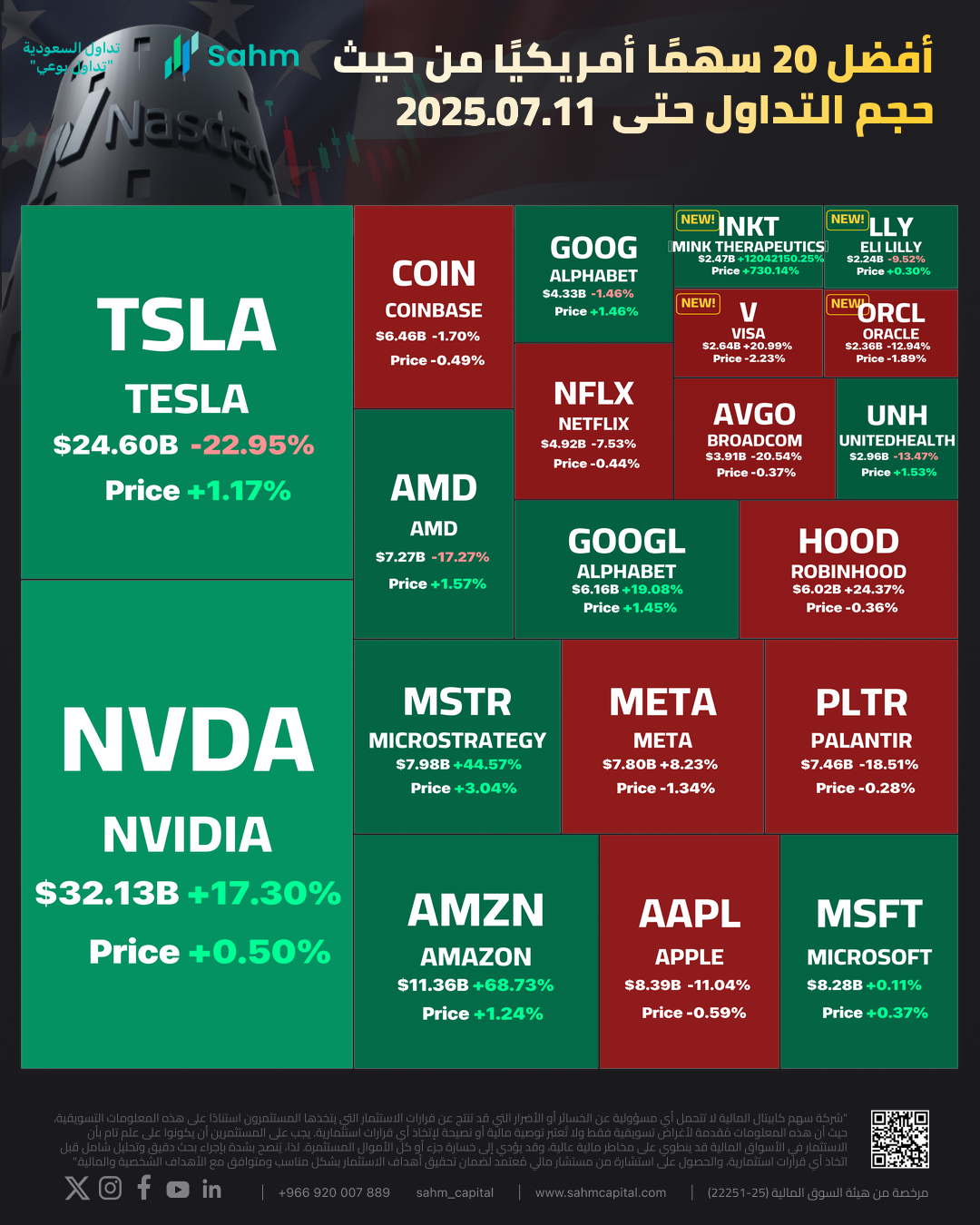

In One Chart | INKT Skyrockets 730% on Breakthrough Solid-Tumor Therapy; INKT, LLY, V And ORCL Joined Top 20 US Stocks by Turnover

NVIDIA Corporation NVDA | 177.72 177.14 | +0.81% -0.33% Pre |

Tesla Motors, Inc. TSLA | 489.88 487.01 | +3.07% -0.59% Pre |

Amazon.com, Inc. AMZN | 222.56 225.01 | +0.01% +1.10% Pre |

Apple Inc. AAPL | 274.61 275.05 | +0.18% +0.16% Pre |

Strategy MSTR | 167.50 167.40 | +3.34% -0.06% Pre |

What's on the News?

- On Friday, the top-ranked NVIDIA Corporation(NVDA.US) in US stock trading volume rose 0.50%, marking its fourth consecutive record high. Its market cap reached $4.02 trillion. CEO Jensen Huang is scheduled to visit China to reaffirm the company’s commitment to the Chinese market. NVIDIA plans to launch a new AI chip designed specifically for China as early as September this year.

- 2nd-ranked Tesla Motors, Inc.(TSLA.US) rose 1.17%. Sources indicate Tesla will open its first showroom in India next Tuesday, July 15, 2025, with deliveries expected to begin in August. The company aims to offset slowing sales in other markets by tapping into the potential of the world’s third-largest automotive market.

- 3rd-ranked Amazon.com, Inc.(AMZN.US) rose 1.24%. SEC filings show Jeff Bezos recently sold nearly 3 million Amazon shares, raising $665.8 million.

- 4th-ranked Apple Inc.(AAPL.US) fell 0.59%. Media reports on July 11 suggest Apple is developing a lower-cost MacBook. The new model is expected to use the A18 Pro chip instead of the traditional M-series, with a launch targeted for spring 2026.

- 6th-ranked MicroStrategy Incorporated Class A(MSTR.US) rose 3.04%. In an 8-K filing with the SEC, Strategy (formerly MicroStrategy) reported unrealized bitcoin gains of approximately $14.05 billion as of June 30, 2025, and recognized about $4.04 billion in deferred taxes. The company holds 597,325 bitcoins with a book value of $64.36 billion and an average cost of $70,982 per coin.

- 7th-ranked Meta Platforms(META.US) fell 1.34%. Meta may face new charges under the EU’s Digital Markets Act. It is unlikely to offer further changes to its “pay or consent” model. The EU could issue new allegations within weeks, followed by potential daily fines.

- 9th-ranked Advanced Micro Devices, Inc.(AMD.US) rose 1.57%. HSBC upgraded AMD from “Hold” to “Buy,” raising its target price from $100 to $200, citing optimism over AMD’s growing AI GPU portfolio.

- 11th-ranked Alphabet Inc. Class A(GOOGL.US) rose 1.45%. According to a senior official at the U.S. General Services Administration (GSA), Google will significantly reduce its cloud service prices for the U.S. government. The U.S. government is intensifying efforts to cut federal IT spending, particularly targeting long-term contracts with major tech providers. As a result, large tech firms including Google, Microsoft, Amazon, and Oracle are under pressure to offer steep discounts to enhance cloud adoption.

- 16th-ranked Circle(CRCL.US) Internet fell 7.67%. Mizuho analyst Dan Dolev initiated coverage on Circle with an “Underperform” rating and a $85 price target, implying a potential 60% decline from current levels.

- 19th-ranked MiNK Therapeutics, Inc.(INKT.US) surged 730.14%, with trading volume of 24.41 billion. Friday’s volume reached 20.2 million shares, far exceeding the previous average of 7.5 million.