Please use a PC Browser to access Register-Tadawul

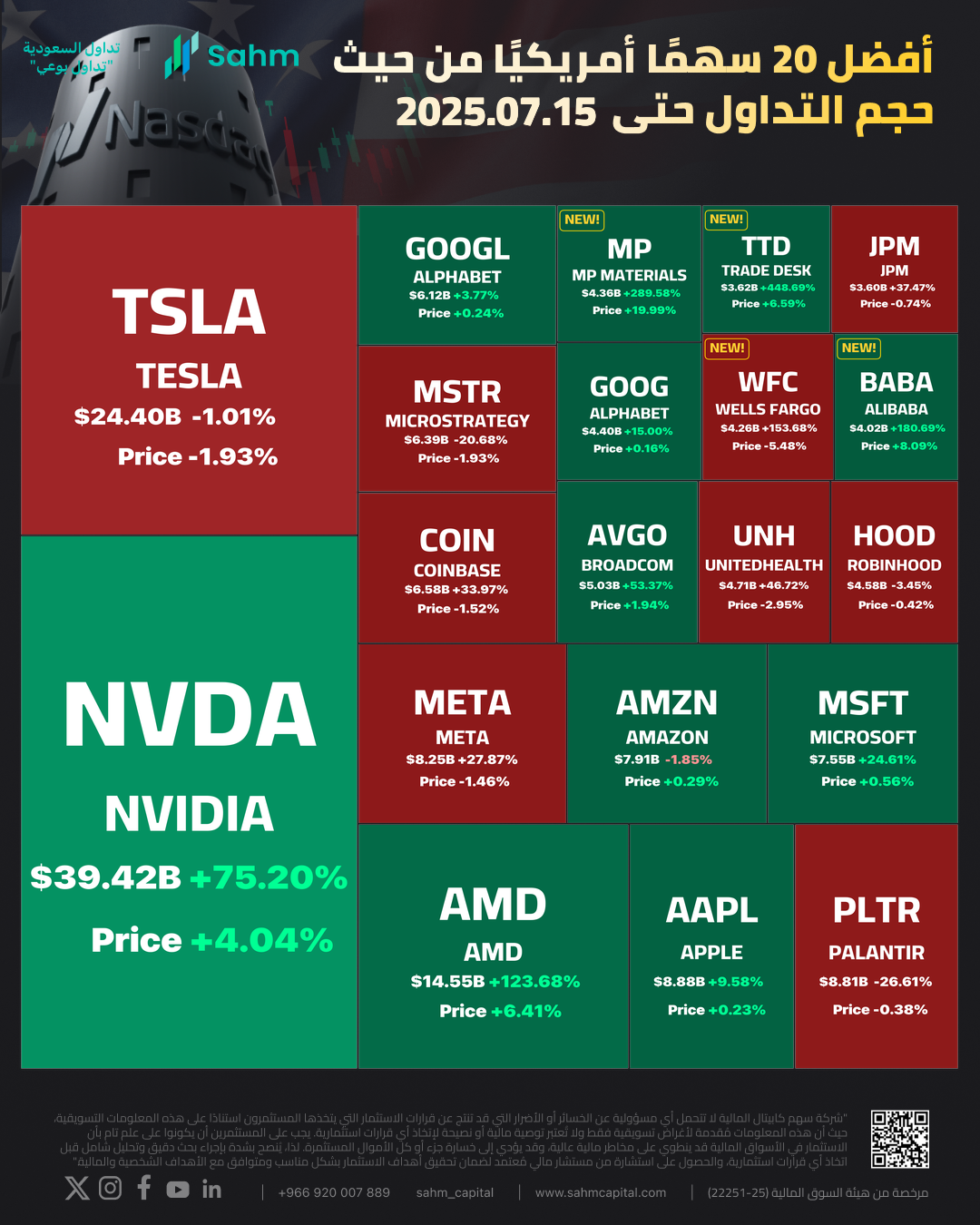

In One Chart | MP Materials Up 19.99% on Apple's $500M Investment Plan; MP, TTD, WFC And BABA Joined Top 20 US Stocks by Turnover

NVIDIA Corporation NVDA | 177.72 | +0.81% |

Tesla Motors, Inc. TSLA | 489.88 | +3.07% |

Advanced Micro Devices, Inc. AMD | 209.17 | +0.77% |

Meta Platforms META | 657.15 | +1.49% |

Coinbase COIN | 252.61 | +0.87% |

What's on the News?

- On Tuesday, the top-ranked NVIDIA Corporation(NVDA.US) in US stock trading volume rose 4.04%, hitting a new all-time high. Its trading volume reached $391.78 billion, and its market cap hit $4.165 trillion. NVIDIA CEO Jensen Huang announced that the US government has granted export licenses for the company’s H20 chips, with shipments set to begin shortly. This development, just three months after the US government’s sales ban in April, has drawn significant industry attention.

- 2nd-ranked Tesla Motors, Inc.(TSLA.US) fell 1.93%, with a trading volume of $241.17 billion. On Tuesday, media reported that Tesla’s North American sales executive had resigned, marking another high-level change amid a significant drop in sales.

- 3rd-ranked Advanced Micro Devices, Inc.(AMD.US) rose 6.41%, with a trading volume of $143.08 billion. Hours after NVIDIA’s announcement regarding the export approval of its H20 chips, AMD confirmed it would resume exports of its MI308 chips. AMD stated that its chip export license applications are entering the review stage and are expected to be approved.

- 6th-ranked Meta Platforms(META.US) fell 1.46%, with a trading volume of $82.12 billion. Meta Platforms may face another showdown with the EU, as the previous €200 million ($232 million) fine did not bring Facebook and Instagram in line with the EU’s strict new digital regulations.

- 9th-ranked Coinbase(COIN.US) Global fell 1.52%, with a trading volume of $65.26 billion. Argus recently initiated coverage on Coinbase with a “buy” rating, citing the cryptocurrency platform’s strong growth momentum and the potential of the recently passed GENIUS Act to fuel further business expansion.

- 10th-ranked MicroStrategy Incorporated Class A(MSTR.US) fell 1.93%, with a trading volume of $63.32 billion. Data shows that as of July 14, 2025, the total net inflow of Bitcoin held by global listed companies (excluding mining companies) reached $628 million in the previous week. Strategy (formerly MicroStrategy) resumed Bitcoin purchases last week, investing $472.5 million to acquire 4,225 Bitcoins at a price of $111,827 each, bringing its total holdings to 601,550 Bitcoins.

- 13th-ranked UnitedHealth Group Incorporated(UNH.US) fell 2.95%, with a trading volume of $46.06 billion. Reports indicate that the US Department of Justice is investigating UnitedHealth’s Medicare billing, focusing on diagnostic documentation. UnitedHealth responded that the special examiner concluded there was no evidence to support claims of overpayment or any wrongdoing.

- 16th-ranked MP Materials Corporation Ordinary Shares - Class A(MP.US) , a US rare earth producer, rose 19.99%, with a trading volume of $42.98 billion. Sources revealed that Apple plans to invest $500 million in MP Materials, the only operating rare earth company in the US.

- 17th-ranked Wells Fargo & Company(WFC.US) fell 5.48%, with a trading volume of $42.16 billion. Wells Fargo reported $11.7 billion in net interest income (NII) for Q2, slightly below the analyst consensus of $11.8 billion. Additionally, the bank lowered its full-year NII growth target to be flat compared to last year, below the previous expected range of 1% to 3%.

- 18th-ranked Alibaba Group Holding Ltd. Sponsored ADR(BABA.US) rose 8.09%, with a trading volume of $39.73 billion. Popular Chinese stocks generally performed well on Tuesday.

- 19th-ranked The Trade Desk(TTD.US) rose 6.59%, with a trading volume of $36.1 billion. On Monday, S&P Dow Jones Indices announced that Trade Desk will replace Ansys in the S&P 500 index before the market opens on Friday. This change is due to Synopsys’s acquisition of Ansys, which is expected to close on Thursday. Trade Desk’s inclusion surprised the market, given its market cap of only $37 billion.