Please use a PC Browser to access Register-Tadawul

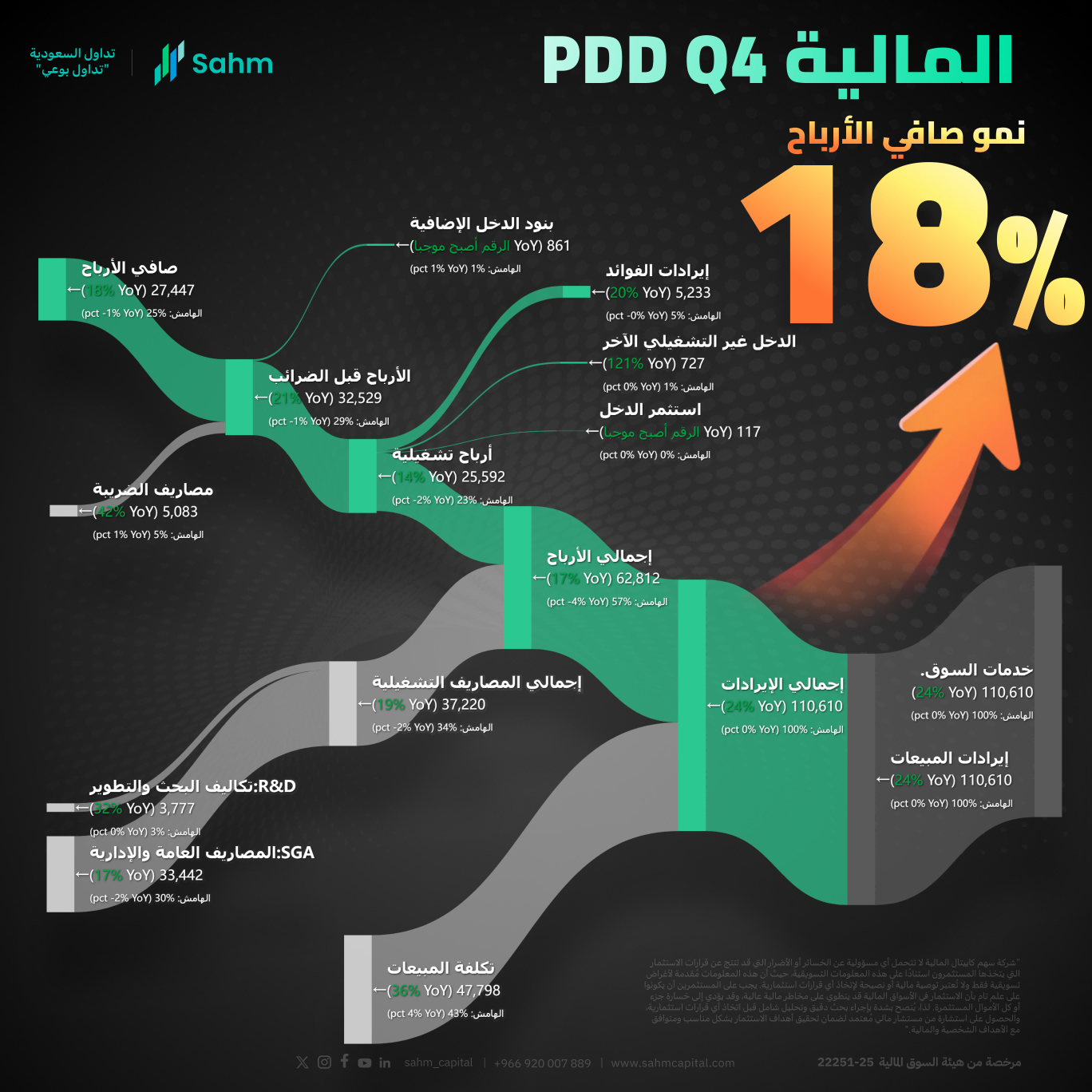

In One Chart | PDD Q4 Profit Grew Strong Despite Revenue Miss

PINDUODUO INC. PDD | 108.59 | -1.64% |

PINDUODUO INC.(PDD.US), Temu's parent company, up 2% on early trading.

Quarterly Financial Performance

- Pinduoduo released its fourth-quarter and full-year financial results on March 20, reporting a Q4 revenue of RMB 110.61 billion, which represents a 24% year-over-year increase but falls short of the market expectation of RMB 116.03 billion.

- Under non-GAAP measures, the net profit attributable to ordinary shareholders was RMB 29.851 billion, a 17% increase from the previous year, surpassing the estimated RMB 28.6 billion.

- Adjusted earnings per ADS were RMB 20.15, compared to RMB 17.32 in the same period last year.

- Net cash flow from operating activities was RMB 29.55 billion, down from RMB 36.89 billion in Q4 2023.

Full-Year Financial Overview

- For the full year, Pinduoduo reported total revenue of RMB 393.84 billion, a 59% increase year-over-year, and a non-GAAP net profit of RMB 122.34 billion, marking an 80% growth.

- The company’s R&D expenditure for the year reached RMB 12.7 billion, up 16%, primarily directed towards merchant operations, platform governance, and after-sales service technology upgrades.

During the earnings call, Pinduoduo's Executive Director and Co-CEO Zhao Jiazhen highlighted the establishment of the "Merchant Rights Protection Committee" in early January, aimed at coordinating various business teams to comprehensively research merchant needs and continually optimize the business environment.

Revenue Components and Market Reaction

Despite the strong profit figures, Pinduoduo's revenue fell short of expectations, and the growth rates of its online marketing services and other income, as well as transaction service income, continued to decelerate compared to the previous quarter. As of the latest report, Pinduoduo's pre-market stock price was USD 120.06 per share, a decline of 4.65%.

Data from Wind indicates that Pinduoduo's 52-week high was USD 164.69, with a low of USD 88.01. On August 26, 2024, Pinduoduo executives had indicated a future decline in profits during an earnings call, causing the stock price to drop from nearly USD 140 to below USD 90. Since the beginning of the year, Pinduoduo's stock has risen by 29.74%, closing at USD 125.92 per share on March 19.

Detailed Revenue Analysis

In Q4, Pinduoduo's online marketing services and other income totalled RMB 57.01 billion, a 17% year-over-year increase, down from a 24% growth rate in the previous quarter. Transaction service revenue was RMB 53.6 billion, up 33% year-over-year, but the growth rate slowed from 72% in the previous quarter. This indicates that while Pinduoduo continues to grow, its advertising and commission income saw a slowdown during the traditional peak season for e-commerce sales.

On the cost side, Pinduoduo's total cost of revenue for Q4 was RMB 47.8 billion, a 36% increase, primarily due to higher fulfilment and payment processing fees. Total operating expenses for the quarter rose 19% year-over-year to RMB 37.22 billion, driven by increased sales and marketing costs.

Strategic Initiatives and Global Challenges

Zhao Jiazhen noted the presence of homogenized competition in certain supply chains, which compresses merchant profits and stifles innovation.

Pinduoduo plans to implement supportive policies to enhance quality supply and reduce operational costs for merchants, leading the platform into a new phase of quality-oriented growth.

Regarding the overseas operations of Temu, Pinduoduo's Chairman and Co-CEO Chen Lei acknowledged the accelerating changes in the external environment and the intense competition. He mentioned that macro policies related to Temu might change, and Pinduoduo will ensure compliance while actively engaging with relevant stakeholders in various markets.