Please use a PC Browser to access Register-Tadawul

In One Chart | PIF Discloses First Quarter Holdings: What Are the Top 10 Investments?

Uber Technologies,Inc. UBER | 80.73 | -1.38% |

Lucid LCID | 11.37 | -3.77% |

Electronic Arts Inc. EA | 204.26 | +0.03% |

Take-Two Interactive TTWO | 243.92 | -0.26% |

Arm Holdings ARM | 120.61 | -3.02% |

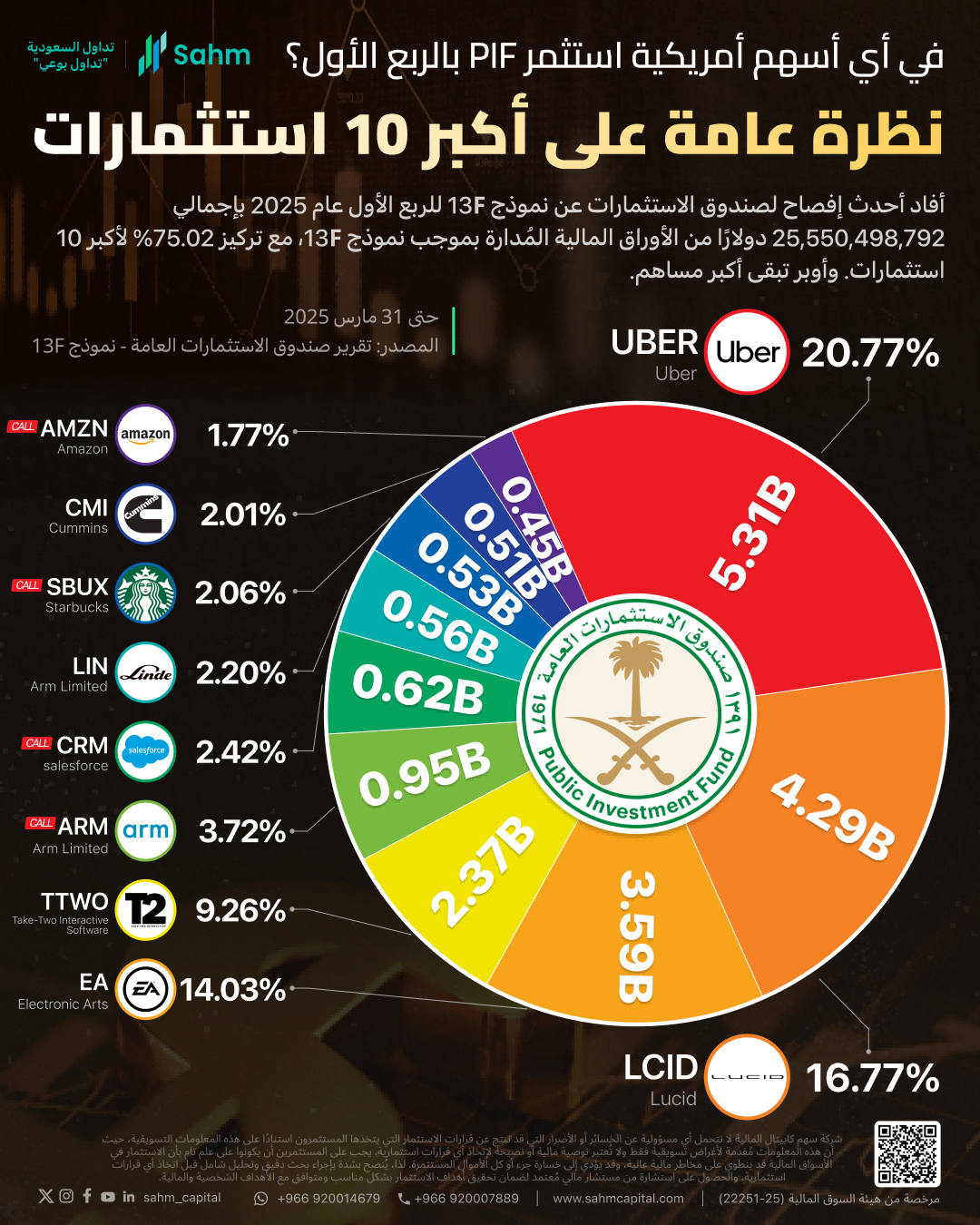

Based on disclosures from the U.S. Securities and Exchange Commission (SEC), Saudi Arabia's largest sovereign wealth fund, the Public Investment Fund (PIF), has submitted its Q1 2025 U.S. stock holdings report (13F) as of March 31, 2025.

According to the data, PIF's total U.S. stock holdings were valued at $25.6 billion in the first quarter, down nearly 5% from the previous quarter's $26.8 billion. The detailed data shows that PIF added 13 new stocks, increased holdings in 12 stocks, reduced holdings in 18, and fully exited 11 stocks. The top ten holdings accounted for 75.02% of the total U.S. stock portfolio, indicating a high concentration in these positions.

Specifically, Uber Technologies,Inc.(UBER.US) is the largest holding of the Saudi sovereign wealth fund PIF, with approximately 72.84 million shares valued at about $5.3 billion, representing 20.77% of the portfolio, unchanged from the previous quarter.

Lucid Group Inc Ordinary Shares(LCID.US) is the second-largest holding, with around 1.77 billion shares valued at approximately $4.286 billion, making up 16.77% of the portfolio, unchanged from the previous quarter. Lucid's largest shareholder, PIF holds nearly 60% of its shares.

Electronic Arts Inc.(EA.US), one of the world's largest gaming companies, ranks as the third-largest holding, with approximately 24.81 million shares valued at about $3.585 billion, comprising 14.03% of the portfolio, unchanged from the previous quarter.

Take-Two Interactive Software, Inc.(TTWO.US), the developer of the popular game "Grand Theft Auto" (GTA), is the fourth-largest holding, with about 11.41 million shares valued at $2.37 billion, representing 9.26% of the portfolio, unchanged from the previous quarter.

Bullish options on Arm Holdings Ltd.(ARM.US), a leader in chip design, rank fifth, with about 8.9 million shares valued at $950 million, making up 3.72% of the portfolio, with a 9.06% decrease in holdings from the previous quarter.

In terms of changes in holding proportions:

Top Buys (13F)

| Name | % Change |

|---|---|

| SYK Stryker Corp (CALL) | 0.46% |

| HCA HCA Healthcare Inc (CALL) | 0.41% |

| ZTS Zoetis, Inc (CALL) | 0.40% |

| ASML ASML Holding NV (CALL) | 0.31% |

| BAC Bank Of America Corp (CALL) | 0.30% |

Top Sells (13F)

| Name | % Change |

|---|---|

| BKNG Booking Holdings Inc (CALL) | -1.81% |

| SBUX Starbucks Corp (CALL) | -1.81% |

| PYPL PayPal Holdings Inc (CALL) | -1.41% |

| ARM Arm Holdings plc (CALL) | -0.79% |

| META Meta Platforms Inc (CALL) | -0.73% |

The Saudi sovereign wealth fund PIF's top five buys in the first quarter were Stryker Corporation(SYK.US), HCA Holdings, Inc.(HCA.US), Zoetis, Inc. Class A(ZTS.US), bullish options on ASML Holding NV ADR(ASML.US), and bullish options on Bank of America Corporation(BAC.US).

The top five sellers were bullish options on Booking Holdings Inc.(BKNG.US), Starbucks Corporation(SBUX.US), PayPal Holdings Inc(PYPL.US), Arm Holdings Ltd.(ARM.US), and Facebook and Instagram parent company Meta Platforms(META.US).