Please use a PC Browser to access Register-Tadawul

In One Chart | Tesla Earnings Breakdown 2024Q3 - Surprising Print Boosts 12% After-Hours Surge

Tesla Motors, Inc. TSLA | 458.96 | +2.70% |

Tesla Motors, Inc.(TSLA.US) reported a significant increase in earnings for the third quarter, leading to a more than 12% rise in after-hours trading. Key highlights include:

- Record Margins in Automotive and Energy Businesses

- EPS for Q3 Increased by 9%, Exceeding Market Expectations

- Strong Demand in China with Optimistic Future Delivery Projections

Despite facing ongoing market downturns and intensified competition in the electric vehicle (EV) sector, Tesla delivered a robust earnings report for Q3, driven by record profits in the energy sector, lower production and material costs.

Tesla reiterated plans to start producing new low-cost models next year and announced that the Cybertruck, which began deliveries last November, achieved its first positive gross margin. Although economic challenges persist, Tesla expects to surpass last year’s delivery numbers for this year slightly.

CEO Elon Musk indicated in the earnings call that, even accounting for potential external shocks, deliveries could increase by 20% to 30% next year, labelling this as an optimistic estimate. Musk also mentioned the Robotaxi prototype, Cybercab, from a recent event, targeting mass production in 2026 with an annual output of 2 million units.

Analysts suggest Tesla's delivery forecasts reflect a rebound in EV demand. Tesla highlighted strong demand in China, surpassing the US and Europe, and identified it as a significant market factor.

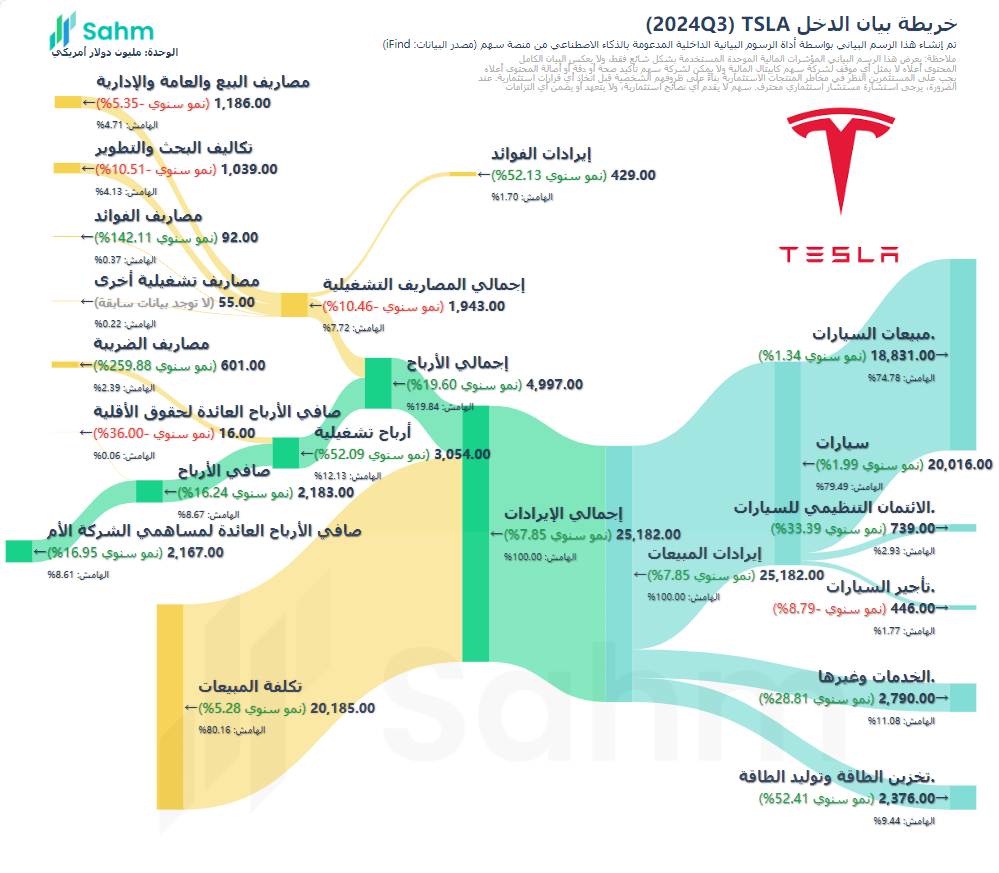

Main Financial Data:

- Revenue: Q3 total revenue reached US$25.182 billion, up 7.8% year-over-year.

- EPS: Non-GAAP diluted EPS for Q3 was US$0.72, up nearly 9.1% year-over-year, beating the forecast of US$0.60.

- Gross Profit: Q3 gross profit was US$4.997 billion, up 19.6% year-over-year, with a gross margin of 19.8%, exceeding predictions of 16.8%.

- Operating Profit: Q3 operating profit was US$2.717 billion, up 54% year-over-year, with an operating margin of 10.8%.

- Net Profit: Non-GAAP net profit for Q3 was US$2.505 billion, up 8.1% year-over-year.

- Free Cash Flow: Q3 FCF was US$2.742 billion, up 223%, surpassing the expected US$1.61 billion.

Segment Data:

- Automotive Revenue: Q3 automotive revenue reached US$20.016 billion, up approximately 2% year-over-year.

- Carbon Credit Sales: Revenue from selling carbon credits in Q3 was US$739 million, up 33.4% year-over-year.

- Energy: Q3 revenue from energy generation and storage was US$2.376 billion, up 52.4% year-over-year.

- Services and Others: Q3 revenue was US$2.79 billion, up 29% year-over-year.

Advancements in AI and Autonomous Driving:

- FSD Progress: Released the 12.5 version of the Full Self-Driving software in Q3, enhancing safety and comfort with greater training and parameter enhancements.

- AI Training: AI training computational volume grew over 75% in Q3, with significant deployments of Nvidia H100 GPUs, projected to reach 50,000 units by the end of October.