Please use a PC Browser to access Register-Tadawul

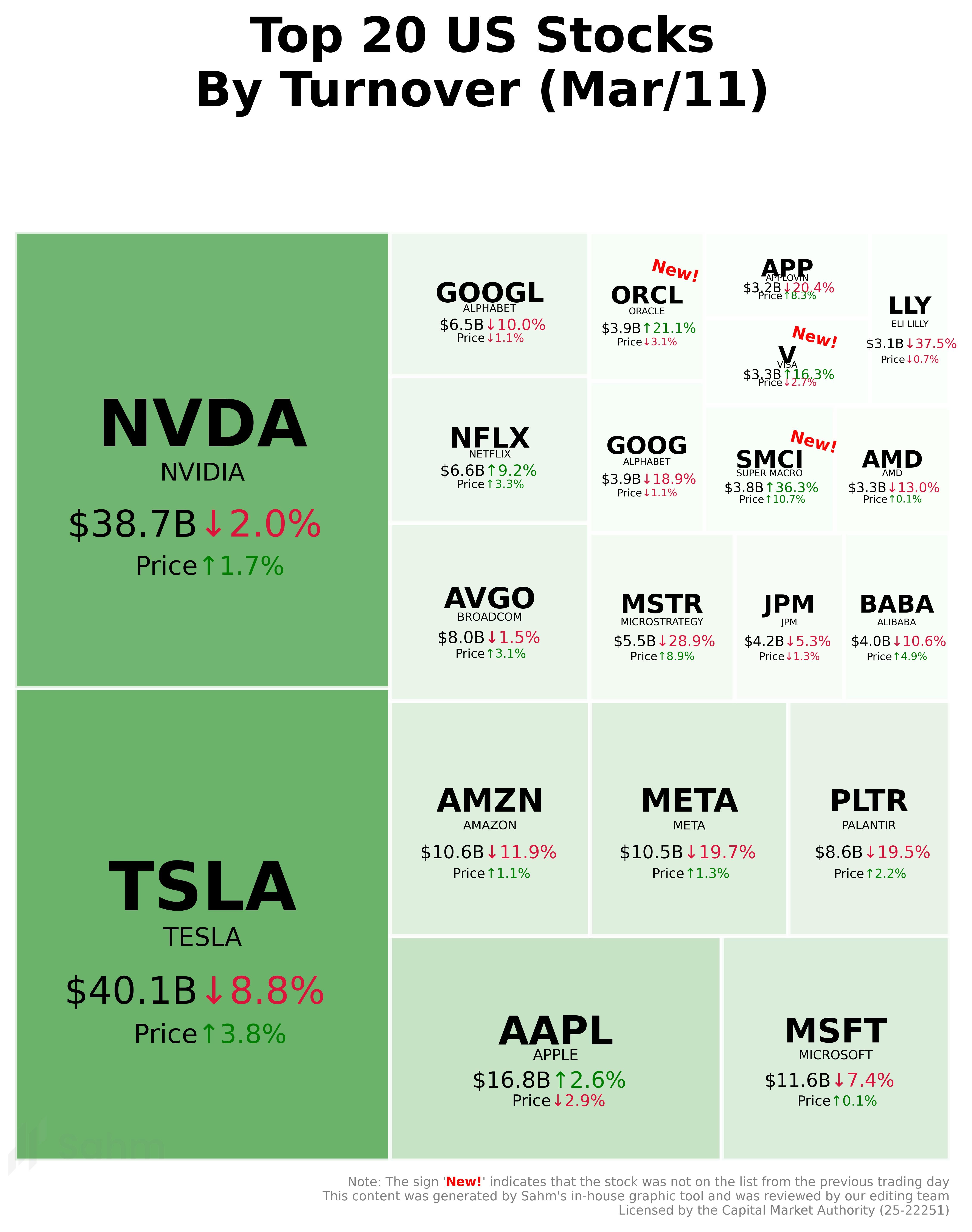

In One Chart | Trump Buys Tesla EV to Show Support; ORCL, SMCI Joined Top 20 US Stocks by Turnover on Mar/11

Tesla Motors, Inc. TSLA | 458.96 | +2.70% |

NVIDIA Corporation NVDA | 175.02 | -3.27% |

Apple Inc. AAPL | 278.28 | +0.09% |

Microsoft Corporation MSFT | 478.53 | -1.02% |

Broadcom Limited AVGO | 359.93 | -11.43% |

What's on the News?

- On March 11, Tesla Motors, Inc.(TSLA.US) led the US stock market in trading volume, closing up 3.79% at US$230.58, partially recovering from the previous day's 15.4% loss. Tesla CEO Elon Musk announced that the company plans to double its vehicle production in the US within the next two years.

US President Donald Trump publicly declared his support for Tesla on Tuesday, stating on Truth Social that he would purchase a new Tesla vehicle to show confidence in Elon Musk. Trump described Musk as a "truly great American" and criticized "radical left-wing lunatics" for "illegally conspiring" to boycott Tesla, calling it one of the best car manufacturers in the world. He also stated that he would classify violent actions against Tesla dealers as domestic terrorism, hoping his purchase would boost Tesla's sales.- NVIDIA Corporation(NVDA.US) ranked second, closing up 1.66%. Nvidia's annual GTC conference, set for March 17-21, will focus on next-generation AI chip architecture, multimodal large model optimization, and digital twin and robotics technology. Rosenblatt analyst Kevin Cassidy noted that market attention has shifted to GTC, expecting updates on Nvidia's technological developments and new AI inference applications.

- Apple Inc.(AAPL.US) ranked third, closing down 2.92%. Citibank lowered its iPhone sales forecast due to a delayed significant Siri update originally scheduled for April. The bank now expects iPhone shipments to reach 232 million units in 2025 and 244 million in 2026, below the previously anticipated 5% annual growth rate. Apple confirmed on March 7 that the Siri update, featuring screen awareness, personal context, and deep application integration, will be postponed to 2026.

- Microsoft Corporation(MSFT.US) ranked fourth, closing up 0.08%. Stifel lowered Microsoft's target price from US$515 to US$475. Reports indicate Microsoft is enhancing its Copilot AI assistant with two new interactive ad formats, aiming to find effective commercialization paths for AI assistants.

- Broadcom Limited(AVGO.US) ranked eighth, closing up 3.06%. Reports suggest Samsung and Broadcom are collaborating on silicon photonics technology, aiming for commercialization within two years. Although Samsung is also negotiating with other companies, including Nvidia, its partnership with Broadcom is progressing the fastest.

- Alphabet Inc. Class A(GOOGL.US) ranked tenth, closing down 1.10%. JPMorgan analyst Doug Anmuth noted that the revised proposed final judgment from the US Department of Justice offers little relief for Alphabet compared to the initial proposal submitted on November 20, 2024.

- MicroStrategy Incorporated Class A(MSTR.US) shares surged 8.91%, ranking eleventh. The cryptocurrency sector saw gains on Tuesday, with Coinbase Global closing up 6.95%.

- Alibaba Group Holding Ltd. Sponsored ADR(BABA.US) ranked fourteenth, closing up 4.89%. On March 6, Alibaba Cloud released and open-sourced the new inference model Tongyi Qianwen QwQ-32B, which matches DeepSeek-R1 in overall capabilities with fewer parameters. Upon release, it topped Hugging Face's trending list.

- Super Micro Computer, Inc.(SMCI.US) ranked sixteenth, closing up 10.68%.

- AppLovin Corporation(APP.US) ranked nineteenth, closing up 8.27%. Despite a 12% drop the previous day, Citibank remains optimistic, maintaining a "buy" rating and a target price of US$600, citing the stock's severe undervaluation. Citibank analysts, led by Jason Bazinet, argued that AppLovin's fair valuation should be US$550 per share, noting the unusually high implied probability of the company's equity value dropping to zero at 50%.