Please use a PC Browser to access Register-Tadawul

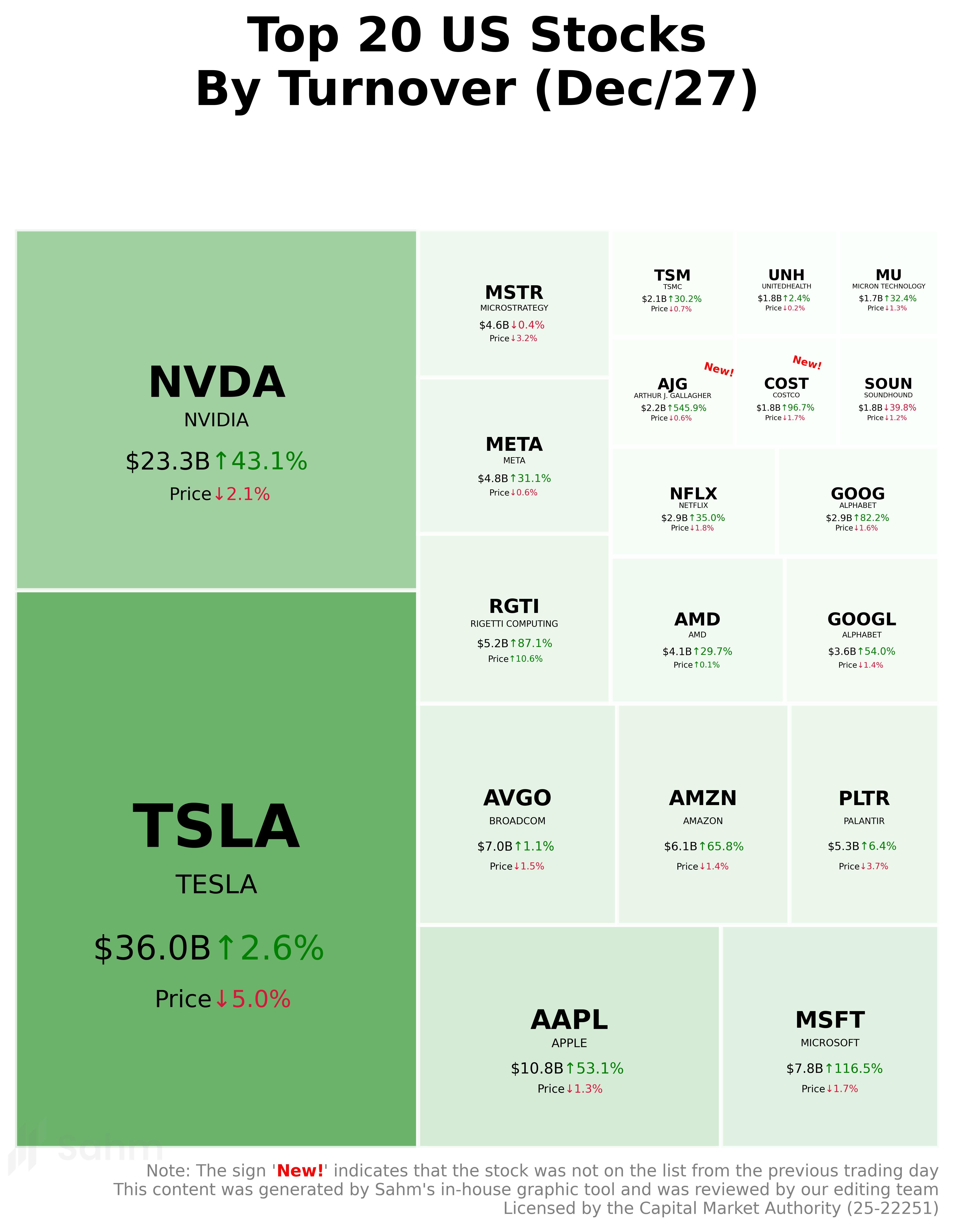

In One Chart | TSLA Down 5%, Turnover Little Changed; COST, AJG Joined Top 20 US Stocks by Turnover on Dec/27

Tesla Motors, Inc. TSLA | 430.41 | +3.32% |

NVIDIA Corporation NVDA | 191.13 | -0.72% |

Apple Inc. AAPL | 259.48 | +0.46% |

Microsoft Corporation MSFT | 430.29 | -0.74% |

Broadcom Limited AVGO | 331.30 | +0.17% |

What's on the News?

- Tesla Motors, Inc.(TSLA.US) closed down 4.95%. As the year-end approaches, several automakers have started discount promotions since late November to achieve their annual sales targets. On December 27, BYD COMPANY LIMITED(BYDDY.US) announced on its social media that from today until January 26, 2025, the Qin PLUS EV Glory Edition will have a limited-time discount of 10,000 yuan, with a starting price of 99,800 yuan. The second-generation Song Pro DM-i also has a discount of over 10,000 yuan, with a discounted starting price of 99,800 yuan. The maximum replacement subsidies for these two models are 25,000 yuan and 24,000 yuan, respectively.

Previously, Tesla China announced a discount policy from November 25 to December 31 for the Model Y Rear-Wheel Drive and Long-Range All-Wheel Drive versions, reducing the final price by 10,000 yuan, starting at 239,900 yuan, and allowing for a five-year interest-free finance option. This reduction sets the lowest price ever for the Tesla Model Y globally.- NVIDIA Corporation(NVDA.US) ranked second, closing down 2.09%.

- Apple Inc.(AAPL.US) came in fourth, closing down 1.32%. Apple released a series of mysterious teasers on social media, hinting at a surprise event related to Apple TV+ on January 4 and 5. The teaser image features the tagline "See it to believe it," but the details of the event remain undisclosed.

Users on social media platforms like Reddit have been speculating about the event, with some thinking Apple might announce a two-day free promotional period for Apple TV+, while others believe it could be a preview of new series or shows set to premiere on Apple TV+ in 2025.

Currently, an Apple TV+ subscription costs US$9.99 per month, with up to six family members sharing the subscription.- Microsoft Corporation(MSFT.US) ranked fifth, closing down 1.73%. A secret agreement between OpenAI and Microsoft was revealed. If OpenAI develops an AI system that generates at least US$100 billion in profit, it will mark the advent of Artificial General Intelligence (AGI). However, OpenAI may not become profitable until 2029, potentially losing billions in the meantime, indicating that AGI is still far off.

Technology media ProPublica recently reported that the US Federal Trade Commission (FTC) is conducting a broad antitrust investigation of Microsoft to determine whether its business practices violate antitrust laws.

The investigation includes assessing whether Microsoft's bundling of Office products with security and cloud computing services harms competitors, and whether its identity product, Entra ID (formerly Azure Active Directory), also engages in anti-competitive practices.- Broadcom Limited(AVGO.US) fell 1.47%. Recently, Netflix, Inc.(NFLX.US) sued Broadcom, accusing it of infringing several patents related to virtual machine operations. Netflix claimed VMware products such as vSphere and its cloud solutions infringe on up to five of its patents for managing and optimizing virtual machines.

- Netflix is seeking monetary damages from VMware's new owner, Broadcom. Broadcom completed its acquisition of VMware in 2023 for US$69 billion.

- Amazon.com, Inc.(AMZN.US) dropped 1.45%.

- Rigetti Computing Inc Ordinary Shares(RGTI.US) surged 10.62%. The market sentiment shifted rapidly after Alphabet Inc. Class A(GOOGL.US) announced a significant breakthrough in quantum computing earlier this month. The QTUM fund is now attracting significant capital inflows.

Bloomberg data shows that the QTUM fund, which tracks quantum computing-related stocks, received approximately US$250 million in inflows so far in December, targeting the largest monthly cash inflow since its launch in 2018.

The QTUM index includes stocks from D-Wave Quantum Inc. Common Shares(QBTS.US), Rigetti Computing Inc Ordinary Shares(RGTI.US), and IonQ, Inc. Common Stock(IONQ.US), as well as Alphabet Inc. Class C(GOOG.US) and NVIDIA Corporation(NVDA.US).- Meta Platforms(META.US) closed down 0.59%.

- MicroStrategy Incorporated Class A(MSTR.US) fell 3.24%. The Bitcoin market is facing multiple tests; on one hand, institutional investors like MicroStrategy continue to buy heavily, instilling confidence in the market; on the other hand, the imminent expiration of significant options might trigger short-term volatility.

- Advanced Micro Devices, Inc.(AMD.US) rose 0.1%. Recently, a CPU-Z screenshot of AMD's flagship Ryzen 9 9950X3D processor leaked, revealing its core parameters. The screenshot shows the processor features a 16-core, 32-thread design with version number GNR-B0, where GNR represents the codename Granite Ridge.

AMD is expected to officially unveil the Ryzen 9 9950X3D at the 2025 CES show, where more detailed information about the flagship processor will be released.- Alphabet Inc. Class A(GOOGL.US) closed down 1.45%. Due to product mistakes in the first half of the year, internal restructuring, and layoffs, many employees have questioned Google CEO Sundar Pichai's vision. Although the launch of several impressive AI products in the second half of the year boosted Pichai's position, some skepticism remains. A highly upvoted comment at the all-company meeting following the better-than-expected first-quarter financial report noted a significant drop in morale and an increase in distrust, highlighting the disconnect between leadership and employees.

- Netflix, Inc.(NFLX.US) fell 1.8%. On Thursday, December 26, Netflix released the second season of its global hit series "Squid Game." However, the premiere of the new season did not perform perfectly, leading to a significant drop in related South Korean companies' stock prices on Friday.