Please use a PC Browser to access Register-Tadawul

Ingles Markets (NASDAQ:IMKT.A) Is Paying Out A Dividend Of $0.165

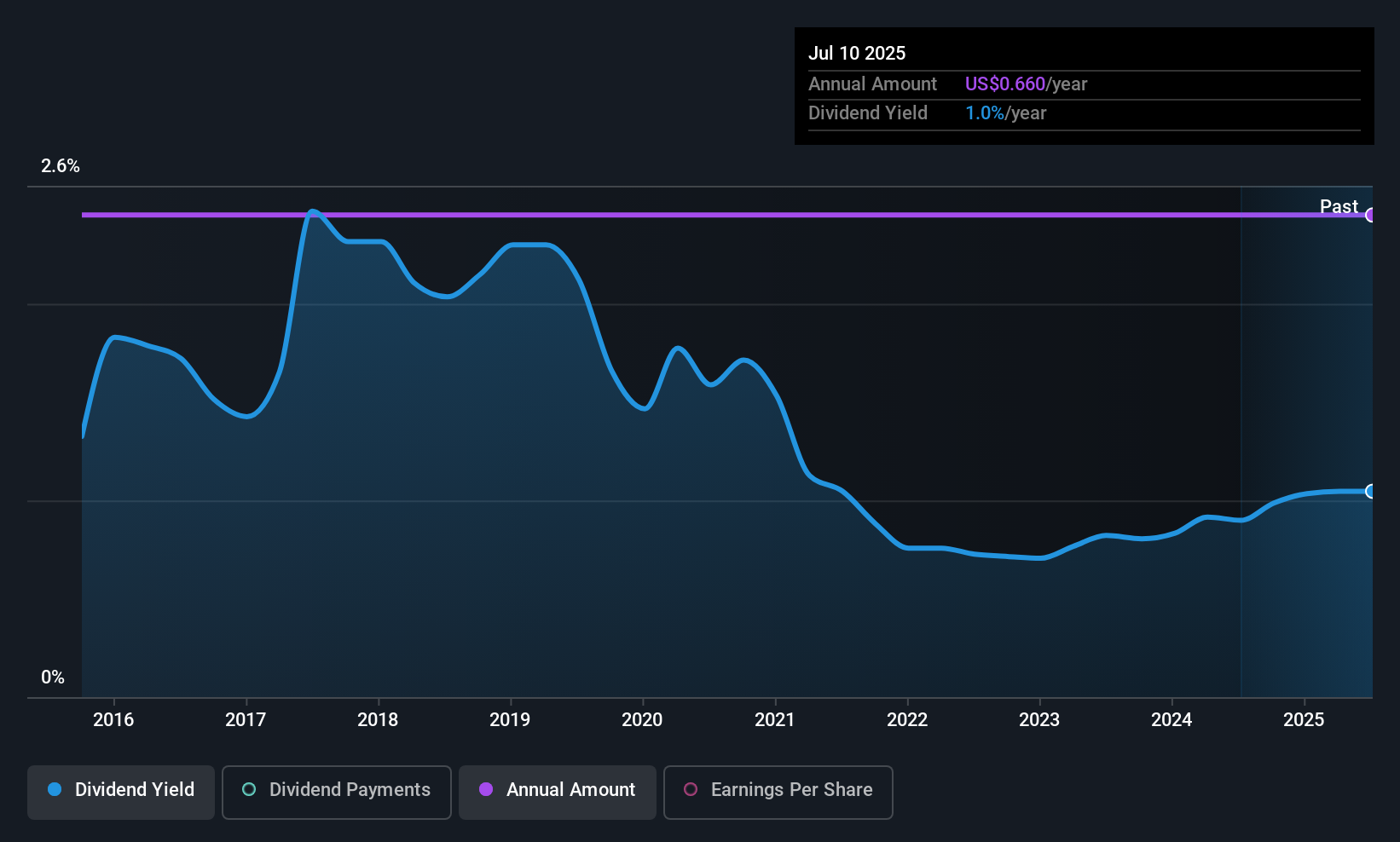

Ingles Markets, Incorporated's (NASDAQ:IMKT.A) investors are due to receive a payment of $0.165 per share on 16th of October. The dividend yield is 0.9% based on this payment, which is a little bit low compared to the other companies in the industry.

Ingles Markets' Future Dividend Projections Appear Well Covered By Earnings

If it is predictable over a long period, even low dividend yields can be attractive. Before making this announcement, Ingles Markets was paying a whopping 152% as a dividend, but this only made up 22% of its overall earnings. A cash payout ratio this high could put the dividend under pressure and force the company to reduce it in the future if it were to run into tough times.

EPS is set to fall by 15.7% over the next 12 months if recent trends continue. If the dividend continues along recent trends, we estimate the payout ratio could be 26%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Ingles Markets Has A Solid Track Record

The company has an extended history of paying stable dividends. The payments haven't really changed that much since 10 years ago. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. Earnings per share has been sinking by 16% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Our Thoughts On Ingles Markets' Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.