Please use a PC Browser to access Register-Tadawul

Innodata Palantir AI Deal Tests Valuation And Growth Expectations

Innodata Inc. INOD | 44.82 | -1.75% |

- Innodata (NasdaqGM:INOD) has entered into a partnership with Palantir to provide specialized data engineering and annotation for advanced AI projects.

- The collaboration focuses on complex, real world use cases, including video annotation and multimodal generative AI workflows for performance analytics in ride event analysis.

- The agreement positions Innodata as a key data partner for high stakes AI deployments where quality, security and domain specific workflows are central requirements.

The partnership with Palantir comes as Innodata trades at $43.52, following a 31.9% decline over the past week and a 33.1% decline over the past month. Even with those pullbacks, the stock has delivered a very large 3 year gain and a 546.7% return over 5 years, which illustrates how sensitive NasdaqGM:INOD can be to shifts in sentiment around AI and data infrastructure themes.

For investors following the AI supply chain, this new engagement with Palantir highlights how specialized data work, such as video annotation and multimodal pipelines, is becoming more central to enterprise AI deployments. As more companies look to deploy AI in complex, high stakes settings, the way Innodata executes on this type of partnership could be an important reference point for how its role within the broader AI ecosystem develops over time.

Stay updated on the most important news stories for Innodata by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Innodata.

Quick Assessment

- ✅ Price vs Analyst Target: At US$43.52 versus a US$93.75 consensus target, the price sits about 54% below where analysts have it pegged.

- ❌ Simply Wall St Valuation: Our model flags Innodata as overvalued, trading about 246.3% above its estimated fair value.

- ❌ Recent Momentum: The share price has seen a 33.1% decline over the last 30 days.

Check out Simply Wall St's in depth valuation analysis for Innodata.

Key Considerations

- 📊 The Palantir partnership reinforces Innodata's positioning in high stakes AI data work, which sits at the core of its business model.

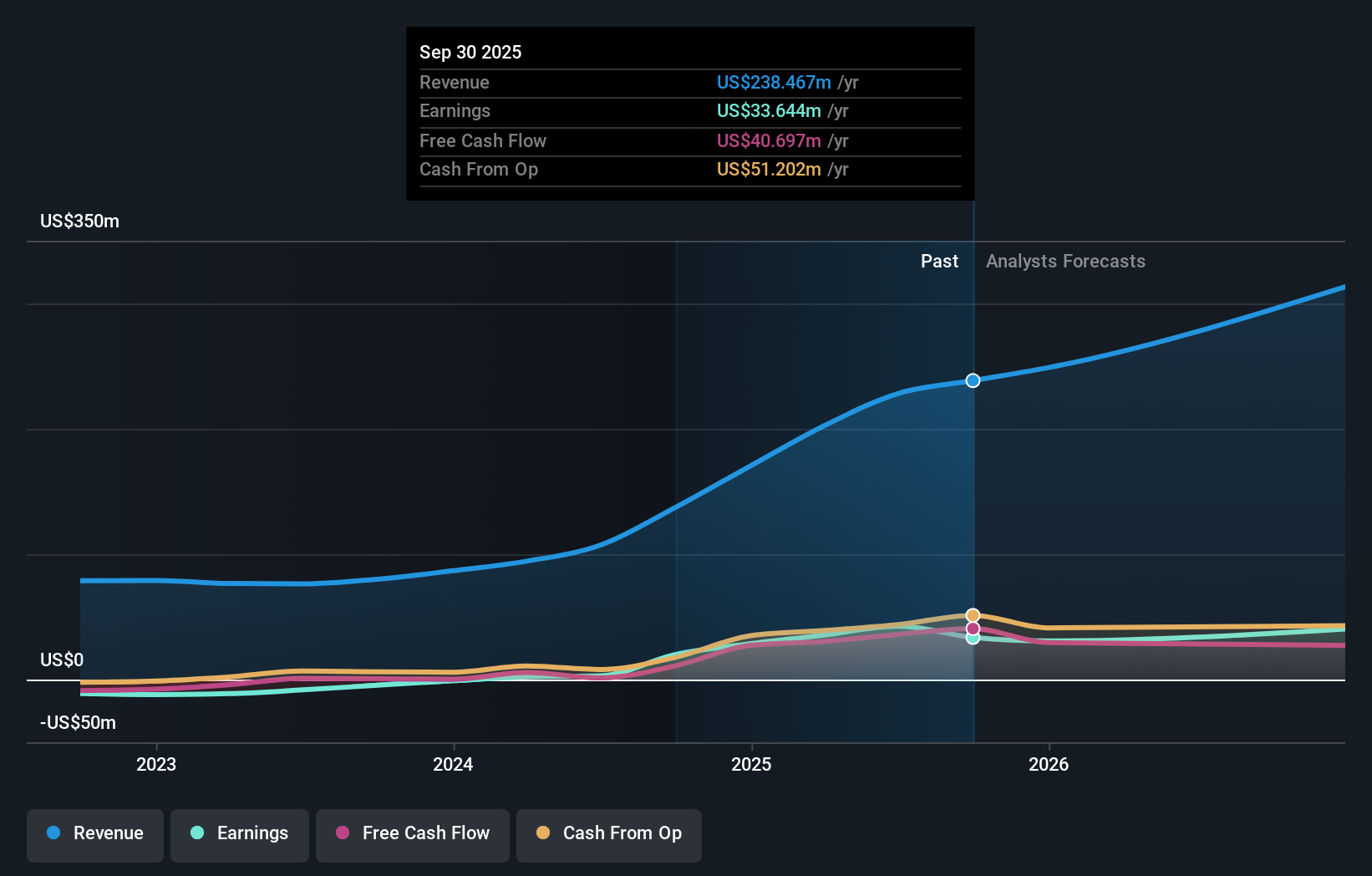

- 📊 Keep an eye on how this deal flows through to revenue and earnings, given the current P/E of 41.2 versus the Professional Services industry average of 21.5.

- ⚠️ The shares are flagged as materially overvalued by Simply Wall St's DCF model, alongside recent volatility and identified minor risks around share price stability.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Innodata analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.