Please use a PC Browser to access Register-Tadawul

Insider Buying and Analyst Upgrade Might Change the Case for Investing in MGE Energy (MGEE)

MGE Energy, Inc. MGEE | 80.19 | +1.12% |

- In recent days, MGE Energy saw a director purchase additional shares and an analyst at Ladenburg Thalmann upgrade its stock rating.

- This combination of insider buying and improved analyst sentiment highlights renewed confidence in MGE Energy's utility operations and earnings stability.

- We'll explore how increasing insider ownership may influence MGE Energy's investment story amid shifting sentiment in the utility sector.

These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is MGE Energy's Investment Narrative?

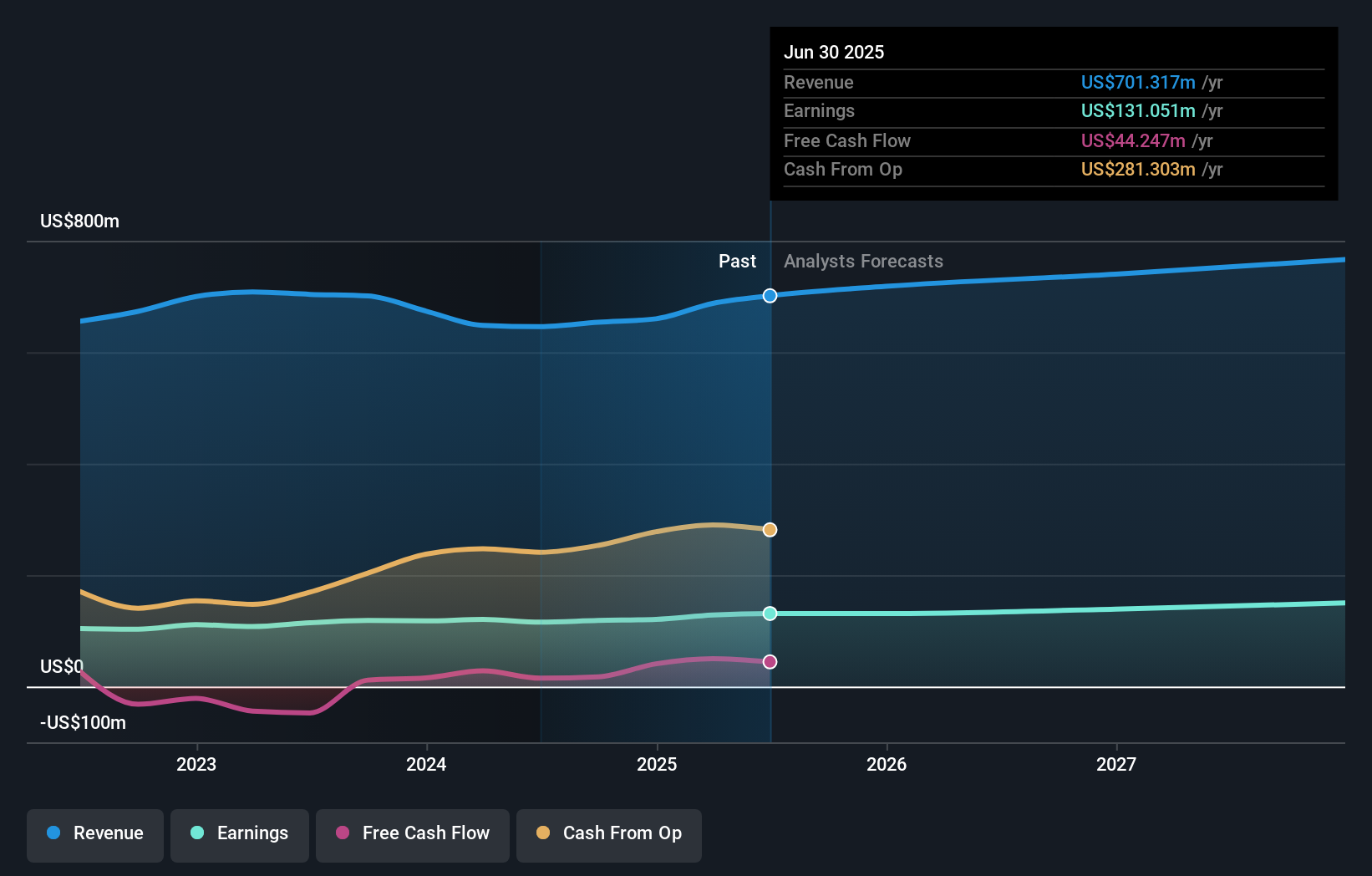

Anyone considering MGE Energy right now needs to believe in the resilience of regulated utilities and the appeal of stable dividends, despite modest growth expectations. The recent director share purchase and Ladenburg Thalmann rating upgrade, while positive, do not appear to be game changers for near-term earnings or dividend safety, especially since MGE Energy's pace of profit growth is forecast to be steady rather than rapid. Recent performance, including a small uptick after the news, hasn’t meaningfully shifted shares off the year’s lows or narrowed the valuation gap to consensus price targets. The key short-term catalysts remain consistent execution in core utility operations and ongoing cost management amid the transition from coal assets. Investors should still keep an eye on risks like relatively high debt levels, expensive valuation multiples, and slower expected profit growth than the broader market. These news events offer a sentiment boost but don’t remove those underlying business challenges. However, high debt still stands out as a risk worth monitoring.

MGE Energy's shares have been on the rise but are still potentially undervalued by 12%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on MGE Energy - why the stock might be a potential multi-bagger!

Build Your Own MGE Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MGE Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MGE Energy's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.