Please use a PC Browser to access Register-Tadawul

Insider-Favored Growth Stocks To Watch In April 2025

Upstart UPST | 49.35 | +0.45% |

As the U.S. market grapples with new restrictions on chip exports to China, causing notable declines in major indices like the S&P 500 and Nasdaq Composite, investors are increasingly looking for resilient opportunities amid this volatility. In such an environment, growth companies with high insider ownership can offer a unique appeal, as their significant internal backing often signals confidence in long-term potential despite short-term market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.2% |

| Hims & Hers Health (NYSE:HIMS) | 13.3% | 21.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.3% | 64.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Red Cat Holdings (NasdaqCM:RCAT) | 19.4% | 122.6% |

| Clene (NasdaqCM:CLNN) | 19.5% | 63.1% |

| Niu Technologies (NasdaqGM:NIU) | 36.2% | 82.8% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.2% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

Let's explore several standout options from the results in the screener.

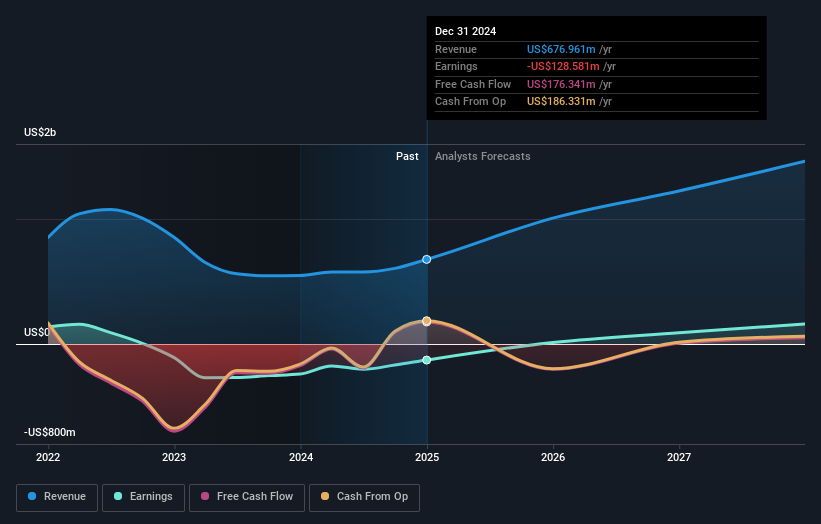

Upstart Holdings (NasdaqGS:UPST)

Simply Wall St Growth Rating: ★★★★★★

Overview: Upstart Holdings, Inc. operates a cloud-based AI lending platform in the United States and has a market capitalization of approximately $3.74 billion.

Operations: The company's revenue is primarily derived from its personal lending segment, which generated $625.31 million.

Insider Ownership: 12.7%

Revenue Growth Forecast: 21.8% p.a.

Upstart Holdings has demonstrated significant potential as a growth company with high insider ownership, despite recent volatility in its share price. The company's revenue is forecast to grow at 21.8% annually, outpacing the broader US market's growth rate of 8.3%. Recent partnerships with credit unions like First Commonwealth and Holyoke Credit Union expand Upstart's reach in personal loans. However, substantial insider selling occurred over the past three months, indicating mixed sentiment internally.

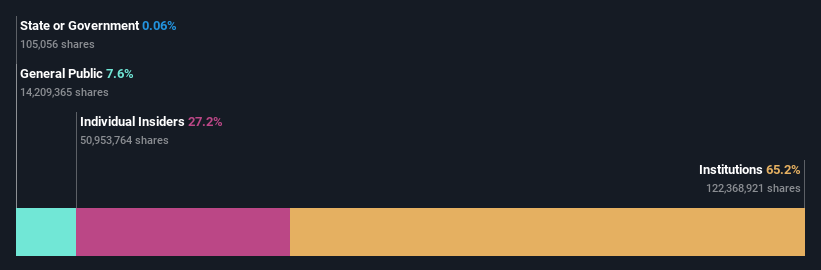

Doximity (NYSE:DOCS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doximity, Inc. operates a cloud-based digital platform for medical professionals in the United States and has a market cap of approximately $9.87 billion.

Operations: The company generates its revenue from healthcare software, amounting to $550.17 million.

Insider Ownership: 27.2%

Revenue Growth Forecast: 11.2% p.a.

Doximity, Inc. shows potential with its high insider ownership and earnings forecast to grow at 13.6% annually, surpassing the US market's growth rate of 13.5%. Despite recent share price volatility, insiders have not engaged in substantial selling over the past quarter. The company reported strong financial performance with Q3 sales of US$168.6 million and net income of US$75.2 million, reflecting robust year-over-year growth in earnings per share from continuing operations.

Workiva (NYSE:WK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workiva Inc. offers cloud-based reporting solutions globally and has a market cap of approximately $3.84 billion.

Operations: The company's revenue primarily comes from its data processing segment, which generated approximately $738.68 million.

Insider Ownership: 11%

Revenue Growth Forecast: 14.5% p.a.

Workiva demonstrates potential with substantial insider ownership and a forecasted revenue growth of 14.5% annually, outpacing the US market. Recent financials reveal a significant reduction in net loss from US$127.53 million to US$55.04 million year-over-year, alongside rising revenues of US$738.68 million for 2024. Despite no substantial insider buying recently, analysts expect profitability within three years and project the stock price to rise by 62.3%.

Taking Advantage

- Get an in-depth perspective on all 200 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Seeking Other Investments? Rare earth metals are the new gold rush. Find out which 22 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.