Please use a PC Browser to access Register-Tadawul

Insider Sales At CACI International Contrast With Bullish Analyst Outlook

CACI International Inc Class A CACI | 586.03 | -0.87% |

- CACI International Executive Vice President and General Counsel, William Koegel, sold 2,000 shares of NYSE:CACI.

- This was his latest transaction in a pattern of insider selling over the past year, with no insider purchases reported in that period.

- The activity comes with CACI International shares recently closing at $573.3.

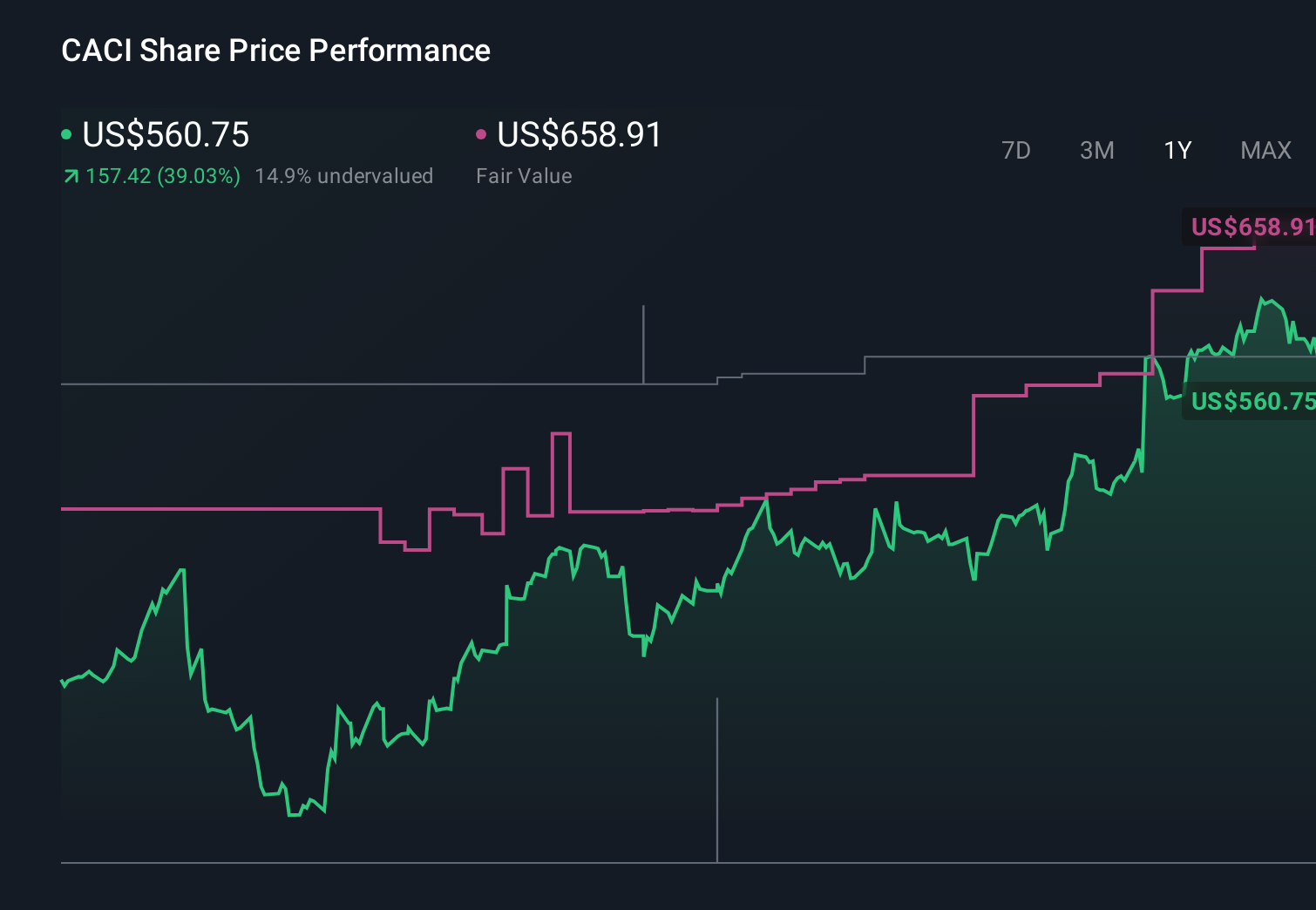

For investors watching NYSE:CACI, this cluster of insider sales is arriving after a strong longer term share move, with the stock up 69.4% over the past year and 144.7% over five years. Recent trading has been more mixed, with a 10.0% decline over the past week and a 9.8% decline over the past month, while year to date the shares are up 6.7% at a last close of $573.3.

Insider selling does not automatically signal trouble, but the absence of insider buying can prompt investors to look more closely at what might be driving executive decisions. As you assess this latest transaction, it can be useful to track whether this selling pattern continues, and how it lines up with future company disclosures, contract wins, or shifts in the broader government services and defense technology space.

Stay updated on the most important news stories for CACI International by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on CACI International.

Koegel’s 2,000 share sale fits into a year long pattern of insider selling with no reported insider buying, which raises questions about how management views the current share price after a strong multi year run. At the same time, external signals are quite different, with multiple banks lifting their price targets following what they describe as a strong quarter, raised guidance, and support from revenue growth, margin expansion, and robust free cash flow. For you as an investor, that gap between insiders trimming exposure and analysts turning more positive is the key tension to consider, rather than treating the sale as a simple bullish or bearish signal.

How This Fits Into The CACI International Narrative

- The insider activity is occurring while CACI continues to secure long term defense and IT contracts and grow its backlog. This aligns with the narrative that contract wins in areas such as cyber, electronic warfare, and software defined platforms can support higher earnings power.

- Repeated insider selling without offsetting buying can challenge the more optimistic parts of the narrative, especially around margin expansion and earnings durability, by suggesting executives may see the current risk reward as less compelling for adding personal exposure.

- The focus on insider sentiment is not a major feature of the existing narrative, which is more centered on contract pipelines, government funding, and technology adoption. This pattern of selling therefore adds an extra dimension that investors may want to factor in alongside the contract and funding story.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for CACI International to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ A series of insider sales with no insider purchases over the past year can point to caution from executives about valuation or concentration risk at current levels, even while external sentiment is constructive.

- ⚠️ Analysts have highlighted higher leverage after acquisitions and timing issues around government funding as existing headwinds. Any slowdown in contract awards or cash conversion could make continued insider selling feel more uncomfortable for shareholders.

- 🎁 Several banks have raised price targets after a strong quarter and higher guidance, citing sustained revenue growth, expanding margins, and solid free cash flow. This indicates that external observers see the underlying contract portfolio as supportive.

- 🎁 CACI’s growing backlog, tech heavy pipeline, and presence in areas such as defense IT and intelligence solutions place it alongside peers including Leidos, Booz Allen Hamilton, and CGI in markets where long term government demand can provide visibility when execution stays on track.

What To Watch Going Forward

From here, it may be useful to watch whether insider selling continues around upcoming catalysts, such as the company’s appearance at the TD Cowen aerospace and defense conference or future earnings updates. Tracking the mix of new contract wins, backlog growth, and cash flow alongside any additional selling can help you judge whether insiders are simply diversifying or systematically reducing exposure as the story matures. It is also worth watching how banks adjust their views if government funding timing, leverage, or execution issues become more prominent topics in future guidance.

To stay informed on how the latest news affects the investment narrative for CACI International, visit the community page for CACI International to keep up with the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.