Please use a PC Browser to access Register-Tadawul

Insperity Cost Cuts And HRScale Rollout Test Valuation Gap

Insperity, Inc. NSP | 23.30 | -7.50% |

- Insperity (NYSE:NSP) is rolling out major cost-cutting measures, including a reduction in non-sales staff and tighter expense controls, in response to profitability pressure.

- The company is targeting a $20 million cut in operating expenses while pushing ahead with HRScale, its new mid-market HR platform developed with Workday.

- HRScale is aimed at thousands of employees across small and mid-sized businesses, signaling a shift in how Insperity serves the mid-market HR segment.

For investors watching Insperity at a share price of $25.68, the backdrop is challenging. The stock has seen sharp declines, with returns of 34% over the past week, 43.6% over the past month, 33.5% year to date, 69.4% over 1 year, 77.6% over 3 years, and 62.5% over 5 years. That context makes the current margin recovery actions especially important to track.

Looking ahead, the key questions are whether the $20 million expense reduction and the push behind HRScale can help stabilize profitability and support a more durable business mix. For you as an investor, this news sets up a period in which execution on cost control and HRScale adoption will likely be central to any reassessment of Insperity’s risk and reward profile.

Stay updated on the most important news stories for Insperity by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Insperity.

Quick Assessment

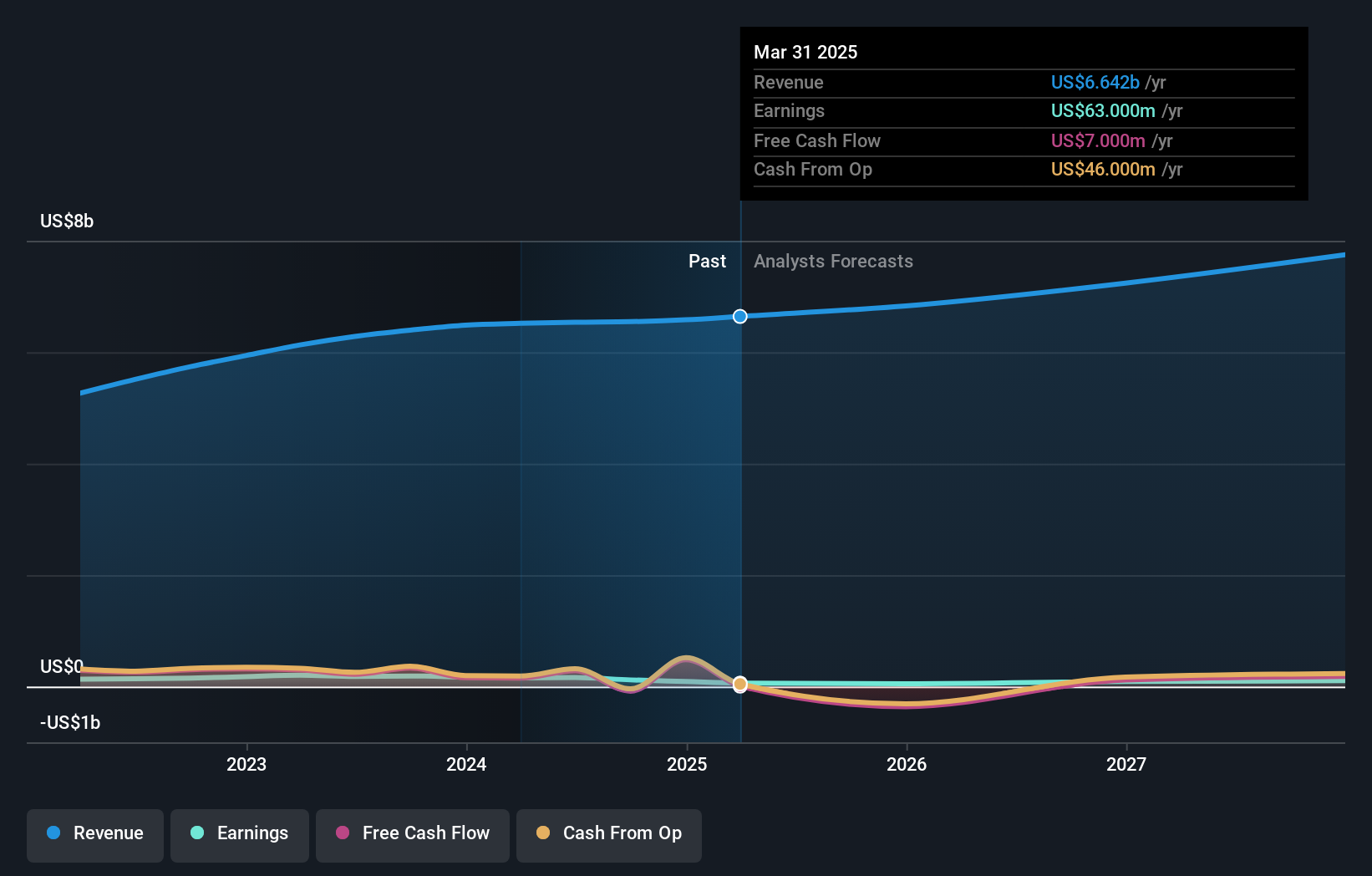

- ✅ Price vs Analyst Target: At US$25.68 vs a consensus target of US$40.50, the price sits about 37% below where analysts currently place it.

- ✅ Simply Wall St Valuation: The shares are flagged as trading roughly 86.9% below an estimated fair value.

- ❌ Recent Momentum: The 30 day return of 43.6% decline highlights weak short term sentiment.

There is only one way to know the right time to buy, sell or hold Insperity. Head to Simply Wall St's company report for the latest analysis of Insperity's fair value.

Key Considerations

- 📊 The cost cuts and HRScale rollout are management's current tools to address profitability pressure at a time when the share price and valuation signals are pointing in different directions.

- 📊 Watch how the US$20m expense reduction, HRScale client uptake and any shift in margins line up against the analyst target range of US$35 to US$56.

- ⚠️ The key flagged risk is a 9.35% dividend that is not well covered by earnings or free cash flows, which could matter more if profitability stays constrained.

Dig Deeper

For the full picture, including more risks and rewards, check out the complete Insperity analysis. Alternatively, you can visit the community page for Insperity to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.