Please use a PC Browser to access Register-Tadawul

Insteel Industries (IIIN) Net Margin Rebound Challenges Bearish Earnings Narratives

Insteel Industries, Inc. IIIN | 33.14 | +0.79% |

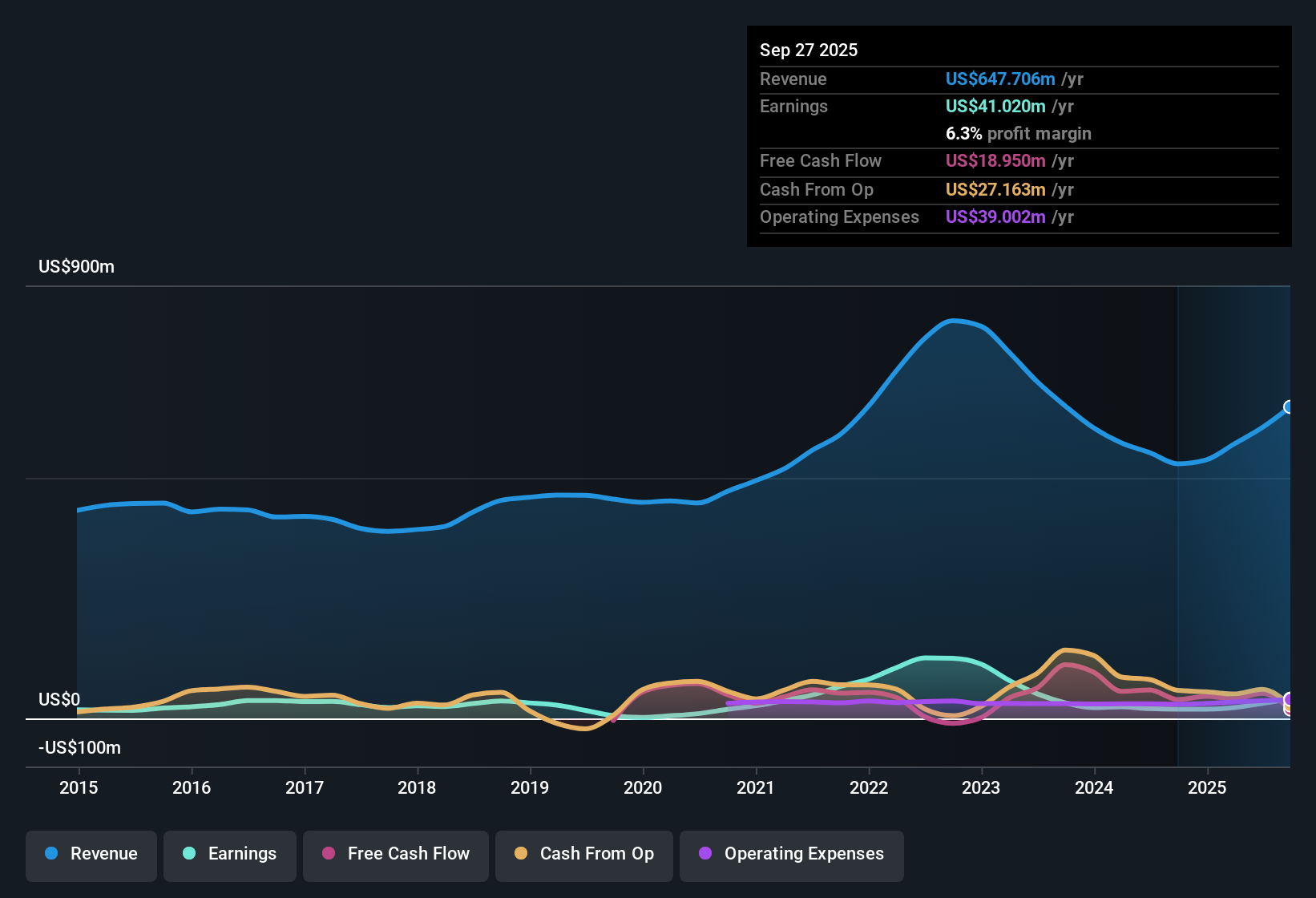

Insteel Industries (IIIN) opened its new fiscal year with Q1 2026 revenue of US$159.9 million and basic EPS of US$0.39, alongside net income of US$7.6 million. The company has seen revenue move from US$129.7 million and EPS of US$0.06 in Q1 2025 to a trailing twelve month revenue base of US$677.9 million and EPS of US$2.44. This gives investors a clearer sense of the earnings power behind the latest quarter and the improvement in net margin from 3.6% to 7% over the past year.

See our full analysis for Insteel Industries.With the headline numbers on the table, the next step is to weigh these results against the most common narratives around Insteel, highlighting where the data supports the story and where it starts to push back.

Margins Firm Up At 7% On Trailing Basis

- Over the last 12 months, Insteel earned US$47.5 million of net income on US$677.9 million of revenue, which equates to a 7% net margin compared with 3.6% a year earlier.

- Consensus narrative points to infrastructure funding and facility modernization as key margin supports, and the trailing move from a 3.6% to 7% net margin partly backs that up. However:

- Ongoing reliance on more expensive imports and mixed construction end markets in the consensus risks section show that higher margins still sit alongside cost and volume pressures.

- Staffing challenges and plant scheduling issues in the consensus risks also sit uncomfortably next to the higher margin, since any renewed disruption could push costs higher again.

EPS Swings: From US$0.06 To US$2.44 Trailing

- Basic EPS moved from US$0.06 in Q1 2025 to US$0.39 in Q1 2026, while trailing twelve month EPS now sits at US$2.44, alongside a 146.9% earnings gain over the past year.

- Bulls argue that federal infrastructure programs and acquisitions can support more durable earnings, and the jump in trailing EPS to US$2.44 helps that view. But:

- The five year record of earnings declining about 18.9% per year shows why some investors may still treat the recent 146.9% gain as volatile rather than firmly established.

- Forecast earnings growth of about 15.5% a year is solid, yet it is only slightly below the 16.2% US market forecast. As a result, the bullish story still leans heavily on those infrastructure and modernization catalysts playing out as expected.

Cheap On P/E, But Cash Flow Limits The 3.48% Yield

- The shares trade on a P/E of 13.1x, below both the US Building industry at 21.9x and peers at 18.8x, and below a DCF fair value of US$72.03 versus the current price of US$32.20, even though the 3.48% dividend yield is not well covered by free cash flow over the last 12 months.

- Bears focus on cash generation and end market fragility, and the fact that the 3.48% dividend is not covered by free cash flow, combined with reliance on costly imports and softer residential demand in the risks list, gives that cautious view some support. Specifically:

- Import dependence and tariff uncertainty in the risks section can add earnings and cash flow volatility, which matters when the dividend is not backed by strong free cash flow.

- The five year earnings decline of 18.9% per year also sits at odds with the current low P/E and DCF fair value gap, which is the kind of history bears point to when they question how much weight to put on one strong trailing year.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Insteel Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to test your own view against the data and shape the story yourself with Do it your way

A great starting point for your Insteel Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

For all the stronger recent earnings, Insteel still faces pressure from weak free cash flow coverage of its 3.48% dividend and a mixed construction backdrop.

If that combination makes you cautious about relying on its payout, use these 1804 dividend stocks with yields > 3% to zero in on companies offering yields that sit on sturdier cash flow foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.